Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 30 November 2020 00:10 - - {{hitsCtrl.values.hits}}

By ceylon association of shipping agents (CASA)

The Port of Colombo has always played a significant role in Sri Lanka’s growth trajectory. The strategic location of Sri Lanka in the Indian Ocean enables this growth and provides the country with the unique opportunity to emerge as a maritime and logistics hub in Asia.

A massive amount of maritime cargo, nearly 45% from the Indian sub-continent transfers through the Port of Colombo and enables the country to provide global and regional connectivity to transport freight to and from Asia to the rest of the world.

In 2018 the Port of Colombo was ranked as the world’s number one container growth port among the top 30 container ports and reached the 22nd position amongst global container ports, according to Alphaliner Monthly. It was a significant achievement as it is the first time in history that the Port of Colombo has topped a global maritime ranking.

However, retaining the leadership position is going to be a challenge for Sri Lanka due to the rapid growth in regional ports. India is rapidly investing in their port sector and particularly a Deep Water Terminal in Vizhinjam which will affect transshipment volumes from India. Plans to develop a big transshipment port on India’s Andaman and Nicobar Islands seems set to spur competition in the regional transshipment business. The islands consist of two groups of islands at the southeastern edge of the Bay of Bengal.

Port infrastructure and productivity

To remain competitive in the aforementioned competitive landscape, building port infrastructure and capacity is of paramount importance. Commencing operations of the partially built East Container Terminal in October was a progressive step towards the expansion. Further steps will have to be taken to expand the quay length from 450 m to 1,200 m and the government has also approved tax relief for a $ 90 million productivity expansion program for Colombo International Container Terminal. These steps will improve port capacity and productivity which is significant to remain competitive. Simultaneously Inter Terminal Trucking delays and yard congestion are two important factors that need attention to increase productivity within the Port. We saw few main shipping lines by passing Colombo recently due to berthing delays and this is detrimental to the reputation of Colombo as an efficient transshipment hub.

To attract services which are currently not calling Colombo and to retain the share in a growing regional transshipment market, we must have more capacity. If not, shipping lines and exporters would look for alternative ports to direct their transshipment volumes. Staying ahead of the demand curve is of paramount importance not just for growth but for survival of the port of Colombo as a transshipment port.

Improve ease of Improve Improve ease of doing business and digitalisation

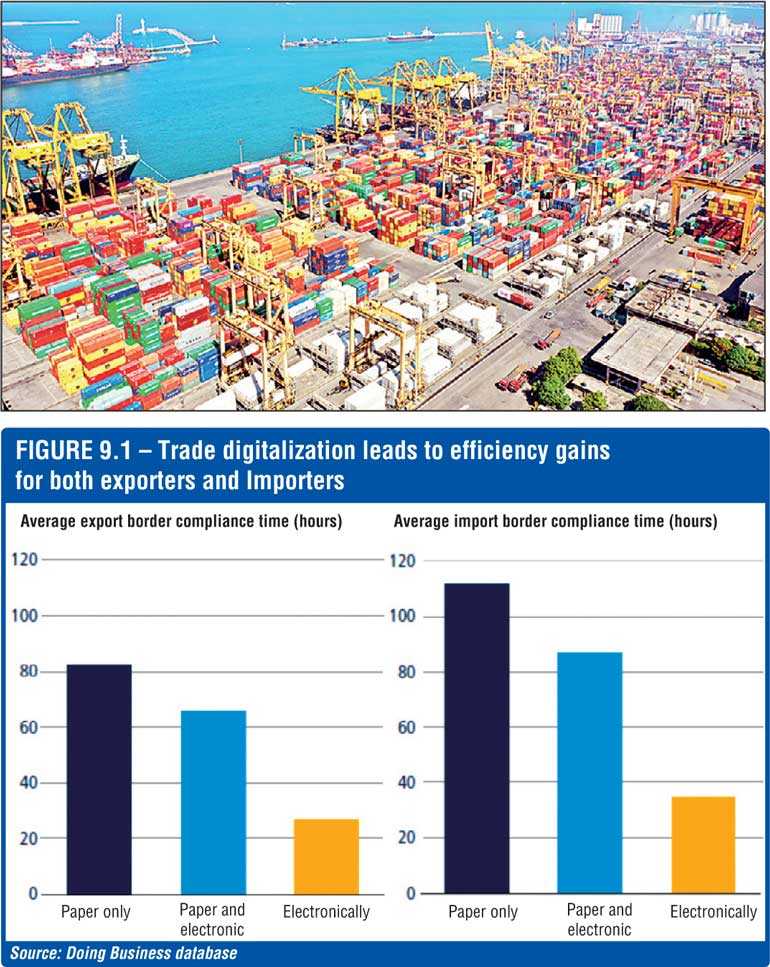

Trade is the engine of economic growth for any country. Therefore, countries around the world strive to improve cross border efficiencies and enable international trade to happen immaculately. The Government of Sri Lanka (GoSL) identified the need to reform its trade policies and practices to support a business-friendly environment, promote private sector growth and use the strategic position of Sri Lanka to benefit from Foreign Direct Investment (FDI), which will provide much needed support for better export performance. Digitalisation initiatives such as the Single Window and the Port Community System would undoubtedly drive growth in the maritime sector.

It is common to note that Customs administrations become the focus when the subject of trade facilitation is discussed. Although the functions and activities of Customs administration is an essential component towards facilitation, a view from a supply chain perspective helps to understand the various dependencies among other players, procedures and processes as well as linkages between these parties such as private sector traders, transport providers, service intermediaries and other regulatory bodies in the public sector. This has resulted in many countries making efforts to exploit digitalisation in order to drive efficiencies through automation, paperless trade, electronic data interchange, cashless transactions, etc.,

The fourth industrial revolution, through digitalisation and the leveraging of innovation, technology, data and the Internet of Things is set to revolutionise the service industry. This will shift established modes of production and consumption generating welfare and productivity gains and offering new opportunities. Therefore, it is imperative for us to consider whether we are ready as a nation to face this revolution and the demands that come with it.

Other ancillary services

Apart from port infrastructure there are many other areas which need attention to develop this eco system. Without these ancillary services, a concept of a hub is just a dream. A successful hub port requires the full range of ancillary port and marine services at competitive prices in order to be attractive to mainline and feeder operators, casual callers and attracting vessels specifically for services even without cargo operations. The government should promote maritime related ancillary services by creating a climate that would encourage investors by offering incentives and non-bureaucratic regulatory infrastructure for these services to be offered at world class standards and regionally competitive rates.

The ancillary services include the following; bunkering, marine lubricants and freshwater supply, off shore supplies and ship chandelling, slop disposal facility, salvage and towage, ship repair and ship building, ship layup, services to cruise ships and yachts, and maritime security services.

The bunkering industry provides the shipping industry with the fuel oil that the vessels consume. The quality of the fuel oil provided will ensure the safe operation of vessels. Ship bunkering is a key support service that a maritime hub can provide for the global shipping industry. If a ship can carry less bunker on a voyage it can accommodate more cargo, which means it can take in less bunker at turnaround ports and re fuel whilst on voyage at a strategic location.

Sri Lanka’s strategic location in the Indian Ocean offers tremendous opportunity for bunkering and other services to thousands of ships plying along the southern coast on the main East-West shipping route. Sri Lankan ports can provide both port-side and off-shore bunkering and ship services as a lucrative business. The Government and the private sector can work together to improve infrastructure, distribution and market development. The foreign revenue generated by this activity would contribute significantly to the Sri Lankan economy.

Policies that facilitate the seamless provision of bunkers and other services, attract foreign investment to increase capacity and create a fair and competitive environment with the adoption of the latest technology are key focus areas. For the bunkering industry to succeed, it is necessary that the industry has access to good supply vessels, storage facilities and a competitive product. At present in Colombo there is limited land-based storage capacity to store bunkers and supply from pipeline from JCT Oil bank. Enhancing this storage capacity is key in enabling bunker operators to buy larger volumes and leverage on lower prices to supply a competitive price in the region.

Attracting investments in new refineries that produce bunker fuels amongst other products would also save on significant freight costs and improve the availability of marine fuels. Benchmarking of port costs, storage costs, pipeline charges and all related costs with countries in the region is also imperative to remain competitive and grow volumes. Furthermore, improving the berthing congestion and facilities for oil tankers to discharge and load cargo is also important for efficient operations and avoid unnecessary costs such as demurrage.

Salvage operations is also an important aspect in the maritime industry, with high revenue potential, not only to the salvors, but also to the ports, transporters, insurance surveyors and everyone involved in the chain. Salvage services are also essential to ensure that maritime casualties in Sri Lankan waters do not cause damage to the environment, fauna and flora, as well as the coast.

The Government should encourage the development and promotion of ship chandelling and offshore supplies to ships. The present facilities available in bonded stores are only for liquor and cigarettes. As a result, a large range of ship supplies normally requisitioned by vessels have to be purchased by chandlers in the open market at rates which include import duties and other local levies. This makes supplies from Sri Lankan chandlers uncompetitive for ships calling at Sri Lankan ports. The existing bonding facilities need improvement and enhancement to accommodate all products.

Conclusion

It is important that the Government initiates discussion with all stakeholders and work on these main areas which is required to achieve Sri Lanka’s maritime aspirations. More importantly, an implementation body with legal mandate needs to be put in place to ensure that policy is executed without any delay. The main point to stress is that a maritime hub consists of several elements primarily capacity and physical infrastructure, quality ancillary services, and ease of doing business all which need to be addressed simultaneously to attract more vessels and more revenue and more investment to this country.