Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 9 October 2017 00:00 - - {{hitsCtrl.values.hits}}

By Ceylon Association of Shipping Agents (CASA)

Diplomatic ties between Bangladesh and Sri Lanka

President Maithripala Sirisena’s three day visit to Bangladesh in July 2017 was important and timely for strong bilateral ties between the two countries. Following bilateral discussions a few important agreements were signed between the two countries on increasing economic co-operation. The importance of Colombo as a transshipment hub for Bangladesh has been reiterated and naming Colombo as the preferred transshipment port of Bangladesh has also been discussed. Industry analysts state that this is a very commendable step taken by the government and should be followed up with further discussions.

The two South Asian nations have been historically tied since before the sub-continent’s colonisation by the British. The volume of trade between Bangladesh and Sri Lanka increased to over $ 115 million in 2014-15 from $ 24 million ten years ago. Although the growth of bilateral trade in the last few years is significant, the volume of trade is not commensurate with its potentials. The two countries are members of the South Asian Free Trade Area, also known as SAFTA, which is a multilateral free trade agreement committed to reducing tariffs and facilitating trade in the South Asian region.

Regional outlook

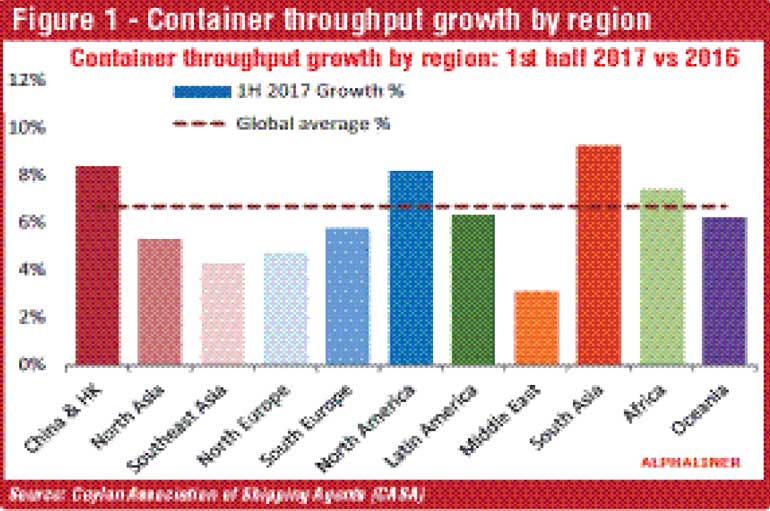

The container throughput globally grew by an estimated 6.7% in the first six months of 2017 and the momentum is expected to continue in the second half, based on a survey done by Alphaliner. Based on Figure 1, South Asian ports recorded the strongest growth rate of 9.3% whilst India, Sri Lanka and Bangladesh being significant contributors in this growth. In 2015 the container throughput of India was 12.31 million TEUs whereas Sri Lanka and Bangladesh recorded 5.2 million TEUs and 1.87 million TEUs respectively. The continuing growth of the Apparel Industry is one reason for this regional growth as Apparel exports in the region have grown by 10% annually from 2005 to 2014.

Strategic importance of Colombo Port for Bangladesh

The Bangladesh economy has recorded a steady growth of close to 6% and is expected to grow at 5.8% annually from 2015 to 2025. The main commodities imported are raw textile materials and consumables whereas the main commodities exported are finished articles of clothing and apparel to Europe and North America. The Government of Bangladesh has initiated several schemes such as liberalising trade, improving transport, supporting entrepreneurship by reducing the transaction costs of doing business, and strengthening the transparency and accountability of both the public and private sectors.

Exports of textiles and garments will be the principal source of foreign exchange earnings for Bangladesh. To be competitive in the apparel industry, Bangladesh will have to look for more cost effective and time efficient transportation methods. Transshipment efficiency and flexible supply chain solutions such as sea/air and air/sea would be vital to remaining competitive in this dynamic industry.

The Port of Colombo is ranked 33 among top 50 container ports according to the World Shipping Council rankings and has handled over 5.7 million TEUs in 2016 with over 75% being transshipment TEUs. Colombo has become South Asia’s topmost ‘container transshipment’ hub with transshipment volumes increasing from 3.2 million in 2013 to 4.35 million in 2016. This is one main reason why Colombo has become a must stop port for the top 20 lines.

Colombo and Hambantota would be preferred transshipment ports for Bangladesh exporters due to a few factors. As the Apparel Industry relies on speed-to-market, savings in transit time will have a significant impact on the supply chain. For example, shipping cargo westbound from Bangladesh via Singapore would involve at least four days of sailing from Bangladesh to Singapore and a further four days of sailing from Singapore to cross Sri Lanka. However, shipping the same cargo via Colombo would instantaneously reduce four days of sailing time since it only takes four days to get to Colombo from Bangladesh. This would also reduce the carbon footprint which can appeal to eco-friendly customers in the west. Both Colombo and Hambantota can provide flexible supply chain solutions such as sea/air and air/sea due to the proximity of the airport to the seaport. Bangladesh exporters will also have the opportunity of consolidating cargo in the South Asian region which will provide consolidation benefits to both the shipper and the consignee.

Way forward

It is important to take discussions that would make Colombo the preferred transshipment port for Bangladesh forward as this will benefit Sri Lanka Ports Authority in many ways. Throughput overall will increase and, in particular, will benefit JCT in terms of increased number of feeders calling Colombo. In the meantime, SLPA’s overall capacity is expected to increase with the operation the Colombo International Container Terminals (CICT), and the proposed East Container Terminal (ECT) and West Container Terminal (WCT) coming into operation subsequently. This will provide better sailing options and connections for Bangladesh exporters. Infrastructure investments of this nature are quite beneficial for the country and its economy. Going forward, SLPA will have to facilitate increased volumes from Bangladesh by reducing the waiting time for such feeders by way of dedicated berthing arrangements in shallower berths or allowing Bangladesh feeders to berth at any terminal with free or less costly Inter Terminal Trucking (ITT) charges. Such initiatives will result in savings on fuel and efficiency gains which will bring down the net cost of transshipments in Colombo.