Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 18 April 2019 00:00 - - {{hitsCtrl.values.hits}}

By Jayasri Priyalal

We are now in the era of acceleration termed as the Fourth Industrial Revolution (4IR). In the new era, the impact and relevance of good old theories of yesteryear have severe limitations to offer solutions to the complex problems unfolding in the 21st century.

Money and banking business is undergoing a complete overhaul with the introduction of the plastic money, and digital transactions on e-commerce platforms are spearheading towards cashless societies — the digital disruptions are accelerating the fourth industrial revolution era. Lord Mervyn King, former Governor of Bank of England, elaborates extensively about this change in his book ‘The End of Alchemy’.

The beauty of the English language is that a silent letter in a word can add a detonating meaning. To evoke some interest with little confusion, this article is titled with a newly-coined word, ‘Debterioration,’ which will undoubtedly add sense to the rest of the writing.

As we all know economics is a subject that predicts specific outcomes on probabilities and possibilities in an economy in addressing disequilibrium resulting in allocation and misallocation of primary factor inputs such as land, labour, capital and entrepreneurship. Unlike in natural sciences, no economics formulas or solutions can be tested in a laboratory before being introduced to the community. Many economic theories are based on trust and belief; as lessons learnt from past experiences, and the impact of such opinions on the economy discussed as historical narrations. One such approach is put forward by renowned Economist John Maynard Keynes, which is popularly known as Keynesian theories. His strategy worked well to overcome the economic crisis in the early 20th century when money supply was strictly in the hands of central bankers.

It is unfortunate that we still assess productivity and performances of businesses and institutions based on indicators designed for the First Industrial Revolution, when land, labour, entrepreneurship and capital factors were the productivity driving assets. Performances and productivity returns were measured in terms of returns on capital. This formula was necessary, as amongst the four-factor inputs, capital was the scarcest resource. How prudent are we to continue with the same performance and productivity measuring indicators in the current context? In this era, assets driving productivity and growth are our knowledge and human capital catalysed with digital and mobile technology. The capital what is now circulating is fake and impotent which is leveraged with debt as such investment capital has lost its vigour. There appears to be a need to challenge conventional thinking to initiate discussions to come up with new performance measuring indicators that are compatible with the 4IR, as many economies are on life support with debt-infused saline drip.

Economics is not a natural science. Natural science is a branch of knowledge that deals with the physical world. However, in Sri Lanka, economics in Sinhala is known as arthika vidyava, adding the scientific suffix to get a feeling of science for those students who opted to follow the subject.

Putting good money behind bad is not considered as good business sense. With regulatory tightening following the 2008 Global Financial Crisis (GFC), banks were subject to stress tests and forced to beef up their capital to cover the weighted risk assets and meet their liquidity requirements.

Regulatory tightening was considered as one option to resolve the global financial crisis which originated from the OECD countries. The unethical rent-seeking business culture of the top triple “B” bankers (Big Bonus Bankers) that contributed to the crisis were side-lined. Governments in a panic threw lifeboats to rescue the banks and bankers and life jackets were taken away from the real victims of the disaster and forced many to sink, losing assets, jobs and life savings.

Public-Private Partnership – Private debt and public debt; camouflaged as sovereign debt

Post GFC, commercial banks were subjected to tighter regulatory control, but the central banks could print money at will with the mythical belief to accelerate the growth stimulating the economy. A longstanding, time-tested Public-Private Partnership operation. Economists termed this policy option as Quantitative Easing (QE). Central banks were expected to arrest the deflationary trends and halt stagnation in the marketplace through QE. These unconventional monetary policies were termed as Modern Monetary Theory.

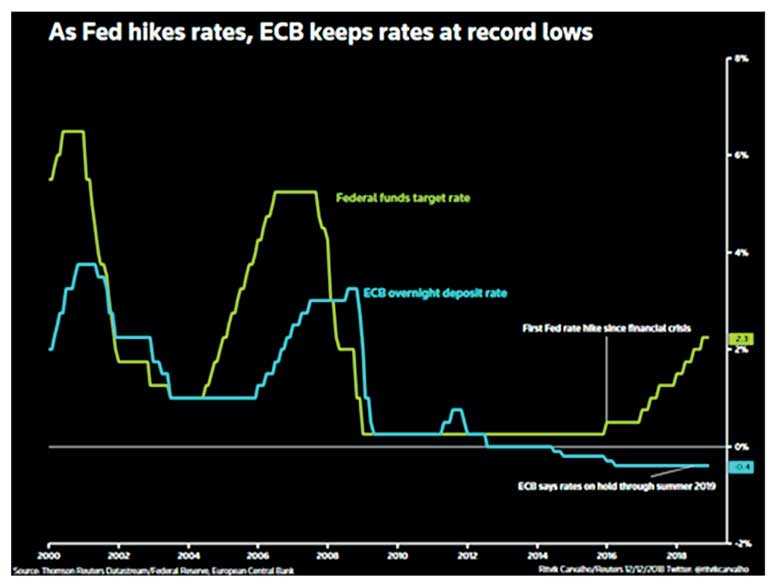

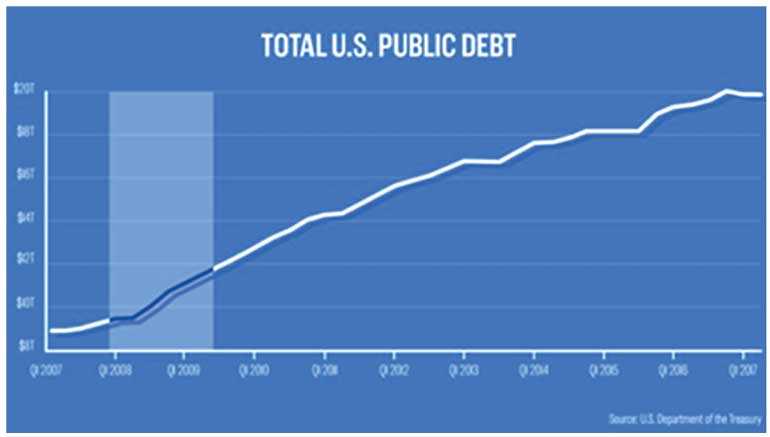

Based on this theory, it is reported that the US Federal Reserve Bank printed $ 2 trillion worth of paper money and released to jump-start the economy. The European Central Bank issued Euros 80 billion to stimulate economic growth post-2008 global financial crisis. As a result, the interest rates in the US and Eurozone remain at negative or near zero levels. We are printing paper money glorified with the term quantitative easing, the new jargon in economics. Since 2017 the Fed started interest rate hikes, resulting in many upheavals in global stock markets. There have been two rounds of Quantitative Easing, QE 1 and QE 2. During both rounds, stock prices rose sharply. The conventional perception is that higher stock prices make people more productive (so long as they remain high, at least); and when people are more prosperous, they spend more money, with a false belief that spending supports the economy, creates jobs, and generates tax revenues, which reduce the government budget deficit – a step towards the further widening of inequality of income and wealth in the community.

The perception of richness is what is expected to drive economic growth; what a fake feeling to foster future prosperity; this may not sound an intelligent way to overcome challenges. In the common man’s understanding, as one creates lies and believes in one’s lies and forces others also to think alike with statistics and complex mathematical models.

Economics and politics were two separate disciplines and practised differently in the post-colonisation era by many countries depending on the degree of development. Free market believers clubbed economics and politics together and espoused the neoliberal order since the late 1970s. The era of an ownership society, driven with the sole aim of increasing shareholder value, was unleashed, since then coining the new economic order popularly known as Reaganomics in the USA and Thatcherism in the UK. It never ended there and continued with fake beliefs till recently when Prime Minster Shinsho Abe tried Abenomics in Japan.

The free market believers under the neo-liberal order promoted and propagated liberalisation, privatisation and globalisation strategies to the rest of the world as the formula to accelerate growth yielding for prosperity. Growth measurements in terms of returns on investments and returns of assets are the outdated first industrial revolution indicator; returns on equity capital.

Share markets were the indicators measuring the prosperities of the nation and anything and everything was done to see the feelings of richness being kept alive in the capital markets. Development financial institutions like the World Bank and IMF, too, followed these principles and discouraged developing countries, offering subsidies to the producers in the real economy.

Grants and economic assistance to the marginalised needy can be considered as a market distortion force. All these policy directives made a U-turn with the advent of the Global Financial Crisis [GFC] causal factor that led to the global economic meltdown since 2008. Moreover, tariff reduction to promote trade and tax breaks for privileged aggravate the financial deficits in all major economies. Tax havens insulated with social hells populated.

As a way out of the GFC, the policymakers ventured out offer subsidies. This time they came up with the quantitative easing strategy – which is printing money – and offered grants to the capital markets to keep the stock markets alive and prevent them from collapse. The unconventional monetary policy is now allowed zero or negative interest rates in the economies reversing the championed formula of market distortions.

Negative interest rates – Confiscate capital and discourage savings

Nearly $ 10 trillion worth of bonds is trading currently at negative rates in Europe and Japan. The corporate borrowing is high in the USA at rock bottom interest rates. As reported in the Economist [16-22 March], Collateralised Loan Obligations (CLO) in the USA is rising steadily as the corporates are borrowing at near zero interest rates in the leveraged loan market.

Reports reveal the CLO volumes are almost equivalent the amounts of Collateralised Debt Obligations (CDO) of 2007, alarming the dangers of sub-prime debt. Banks and financial institutions are forced to hold bonds yielding negative returns to maintain liquidity as per the new regulatory norms.

President Donald Trump tweets and warns of the dangers of interest rate hikes to the Fed Reserve. IMF and WB are revising economic growth figures downward periodically. Artificially-managed interest rates are not the best option to overcome the current challenges; it is a step towards postponing the agony.

At these levels, without enough economic growth, no one generates enough wealth to repay debt obligations. When the next financial crisis hits, debt defaulters will wipe out a large portion of world savings. The economists and central bankers will run out of monetary policy tools beyond negative interest rates. Instead, the central bankers need to use negative interest rates to curb excessive debt, holding the risky borrowers to bear the burden, not allowing the erosion of wealth from savers, shaking future financial stability. The other option is to widen financial inclusion in society enabling the real economic actors, producers and consumers to drive organic growth blending social finance with digital finance.

The new ROE: Returns on Ethics

Facts above and figures point out the investment capital that is circulating in the economies is fake, distinctively different from the capital that rejuvenated economic growth in the First Industrial Revolution. Therefore, the economists need to define a new performance and productivity measuring indicators in tune with the new wave of 4IR.

Returns on Equity (ROE) does not sound ethical and scientific to estimate future prosperity. Returns On Ethics can be a qualitative measuring tool, as all the profits, dividends earned and retained in books will be of no use, when people do not have fresh water to drink and fresh air to breathe in the future.

The fake capital can smoothly integrate with Artificial Intelligence platforms driven with the algorithms and unfold double jeopardy, bridging a link between the Enron and GFC crisis that erupted at the beginning of the new millennium.

This author believes such a situation may shorten the lifespan of the prosperity indicators, the global stock and bond markets, inviting block chain technological linked distributive ledger system to restore trust between the producers and consumers in the real economy. Blockchain will become the alternative operating system substituting finance.

(The writer is the Regional Director responsible for the Finance Sector working with UNI Global Union Asia and Pacific Regional Organisation in Singapore.)