Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 8 April 2021 00:00 - - {{hitsCtrl.values.hits}}

By Institute of Policy Studies

The negative health effects of tobacco consumption are well established and confirmed by numerous sources. Tobacco has been found to increase the risk of many Non-Communicable Diseases (NCDs) including cancer, heart diseases and respiratory illnesses.

These tobacco-related illnesses are chronic illnesses with long term suffering and impose financial strains on governments and households due to increased health care costs. For instance, the direct and indirect costs of tobacco amounted to Rs. 89.4 billion for the Government of Sri Lanka, which is equivalent to 6.1% of Government revenue in 2015.1 Furthermore, tobacco-user households in Sri Lanka spend a greater share of their budget allocation on tobacco, rather than on critical items such as education, health and housing.2

Since signing the WHO Framework Convention for Tobacco Control (FCTC) treaty in 2003, Sri Lanka has introduced several tobacco control policies, which have over the years been successful in gradually reducing the smoking prevalence rate in the country. Nevertheless, pockets of smokers remain; for instance, 28% of men still smoke in Sri Lanka.3

However, tobacco control policies face significant resistance by the tobacco industry. Their arguments often revolve on the contribution of tobacco to the economy and assertions that stronger tobacco control will have negative economic impacts. To contribute to this debate, it is important to have empirically-backed evidence on the national income aspect of reduced tobacco consumption when considering efforts towards tobacco control.

Based on the output approach, the study on which this policy insight is based, reveals that reduced tobacco consumption will yield net positive gains on national income through increased consumption of non-tobacco goods and services.

Methodology

Following the Economics of Tobacco Toolkit developed by the World Bank,4 the impact of a reduction in tobacco consumption on the national economy is assessed by using National Input-Output (I-O) tables.

The analysis involves the following three main steps:

Household level tobacco use: ‘Crowding out effect’

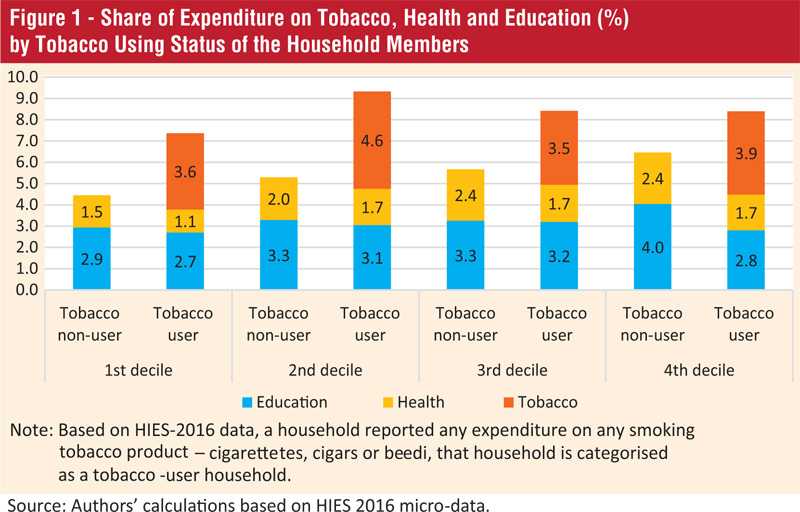

Tobacco consumption impacts the socio-economic well-being of households. A well-researched phenomenon that is observable in households where tobacco spending is present is the ‘crowding out effect’ where beneficial products such as education, food and clothing are neglected at the expense of tobacco. Household Income and Expenditure Survey (HIES) data reveal that on average, a tobacco-user household in Sri Lankan spends nearly Rs. 2,000 per month on tobacco, constituting 4% of the household budget, thus driving out other critical expenditures (see Figure 1). Moreover, tobacco-user households spend an even greater share of their budget allocation on tobacco, rather than on education (3.2%), health (2.7%) and housing (3.5%).

This ‘crowding out effect’ would be the greatest for poor families, affecting not only the smoker but the rest of the family as well. For instance, the poorest 40% of tobacco-user households, spend less on education (Rs. 788), health (Rs. 426) and housing (Rs. 1,124) than the same economic group of tobacco non-user households, whose respective spending are Rs. 834, Rs. 521, and Rs. 1,218. This suggests that if tobacco users were to stop smoking, they would spend more money on themselves and their family’s basic needs such as food, health, education and housing.

Impact of tobacco control policies on national output

The study assessed the impact of reduced tobacco consumption on the national economy. Tobacco control measures are designed to reduce consumer demand for tobacco products.

This shift in demand can lead to reduced spending on tobacco products and increased spending on other goods and services.

With the application of the World Bank developed economics of tobacco methodology, the study investigated the net impact of reduced tobacco consumption on the national economy. Taking to consideration the tobacco prevalence trends during the last decade, this study assumed a 20% tobacco consumption reduction to estimate the impact of reduced tobacco consumption on national income. Further, the study assumed that money released from tobacco purchases is spent on non-tobacco goods and services.

This simulation exercise offers empirical evidence that reduced tobacco consumption will yield net positive gains for Sri Lanka’s economy.

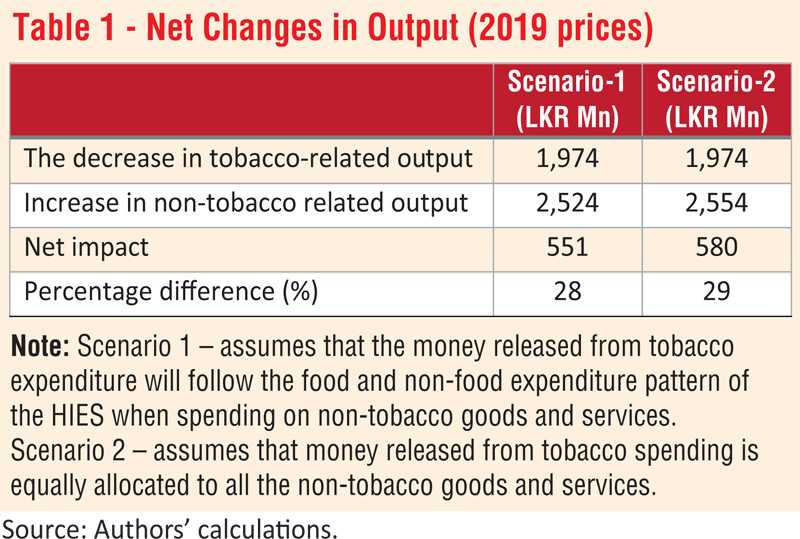

The total net impact on the economy due to a simulated decrease in smoking tobacco consumption is positive in terms of output produced by non-tobacco sectors. Decreasing smoking tobacco consumption by 20% will increase output by Rs. 550 million, which will result in a 30% net benefit to national income through spending of freed up money in other non-tobacco goods and services (see Table 1).

Conclusion

The study offers empirical evidence to support effective tobacco control policies in Sri Lanka. Based on the output approach, the study reveals that reduced tobacco consumption will yield net positive gains to national income through increased consumption of non-tobacco goods and services.

Further, the study findings indicate that reduced smoking tobacco consumption will lessen the household budget constraints for basic needs, particularly for the poor, as it would free up more resources for basic needs such as food and education.

Thus, the empirical findings show that implementing tobacco control policies to reduce smoking consumption will enhance household welfare as well as the national economy through the spending of released tobacco expenditures on non-tobacco goods and services. These findings offer important evidence for Sri Lankan policymakers, in support of stronger tobacco control measures including higher tobacco taxation.

(This Policy Insight is based on findings from an IPS study on ‘Talking Tobacco: How Reduced Consumption Benefits the Economy’ carried out by IPS researchers Priyanka Jayawardena and Harini Weerasekara. Contact on [email protected] and [email protected] for more information.)

Footnotes

1 World Health Organization. (2017). Economic and Social Cost of Tobacco and Alcohol in Sri Lanka – 2015. World Health Organization- Country office for Sri Lanka.

2 Calculations based on Household Income and Expenditure Survey micro data.

3 World Health Organization. (2019). WHO Global Report on Trends in Prevalence of Tobacco Use 2000-2025. Geneva: World Health Organization

4 World Bank. (2020). Economics of Tobacco Toolkit. Retrieved September 10, from: https://www.worldbank.org/en/topic/health/publication/economics-of-tobacco-toolkit