Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 2 February 2018 00:00 - - {{hitsCtrl.values.hits}}

By Sanjana Fernando

If there are no buyers for the airline, then why can’t it be shut down to prevent further losses? If the debt is the problem for potential buyers, then why can’t the Government takeover the debt? These are questions I hear too often these days. So I will use this article to explain why.

First of all, let’s try to understand the problem clearly. Misunderstanding the problem leads to “solutions” that may create even bigger problems.

The issue is not about finding a buyer or tidying up (balance sheet cleansing) the company to make it look attractive for a buyer. The issue is that the company does not generate enough cash to service its day today working capital requirements or have enough cash left over to service its debt obligations.

If you look at the profit and loss account (which is reported on an accrual basis) you will see that the company does not have enough revenue income left over to pay off even the operating expenses (thus the negative EBITDA margins). So from the point the revenue income runs out, the rest of the expenses have to be paid off by borrowing money (note also that there is not enough cash in company’s bank account). But given that the business is not even able to achieve a positive EBITDA margin, every year more and more money must be borrowed, to not only pay off operating expenses, but also to service the debt. This becomes a perpetual problem for the company but this itself is not the real problem that we are trying to solve.

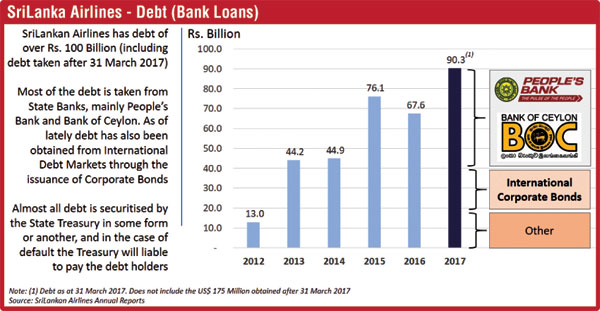

The problem (for the IMF) is that most of the money borrowed is obtained from State banks, mainly from the People’s Bank and The Bank of Ceylon, and the IMF wants an end to it. Christine Lagarde led IMF is no saint and the global lender has a sadistic approach to lending. It usually releases its agreed loans in tranches only after the satisfaction of seeing the government strangle and torture its own people through direct and indirect taxes. Even Shylock would be more merciful.

The problem (for the IMF) is that most of the money borrowed is obtained from State banks, mainly from the People’s Bank and The Bank of Ceylon, and the IMF wants an end to it. Christine Lagarde led IMF is no saint and the global lender has a sadistic approach to lending. It usually releases its agreed loans in tranches only after the satisfaction of seeing the government strangle and torture its own people through direct and indirect taxes. Even Shylock would be more merciful.

Unfortunately, it is not that simple to end State support. Cutting the flow of state debt capital will automatically push the company into bankruptcy. So the next best thing available for the Government (or at least they think) is to find an equity partner who will inject some equity funding (relieving the Government of its funding obligations) and also figure out how to bring the business to profitability. If you have read my previous article you will understand why SriLankan Airlines cannot attract a buyer. I also have summarised it below.

Reasons why the company is not attractive to a buyer:

1. Unprofitable business

2. Large debt levels

But a private equity company (like TPG Capital) may be able to turn the business around at the operating level. They will rip the costs out to the bare bone and juice every cent they spend to extract as much revenue as they can squeeze out. They will of course pay no more than a dollar for the entire equity stake and expect the Government to take out all the debt out of the business. I have heard some Government ministers even suggesting that this – taking the debt out – may be the way forward.

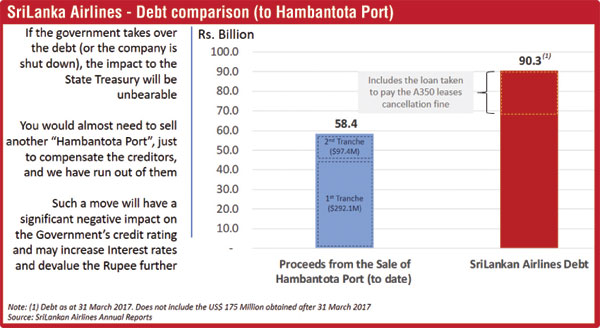

Taking the debt out of the company balance sheet to appease potential buyers is suicidal. The debt, once taken out of the company balance sheet, does not disappear into thin air. It eventually falls on the head of the general public. Given that the debt is borrowed from lenders on the understanding that in the case of default, the Government of Sri Lankan will pay up, that is exactly what it will have to do in such a scenario. The total debt is over Rs. 100 billion (Rs. 90 billion as at 31 March 2017 + $ 175 million taken after that) and the country will not be in a position to pay immediately as demanded by the creditors and thus may even trigger a country default and send the economy into a tailspin.

Just for comparison the total proceeds so far from the “fire” sale (99-year lease is effectively equivalent to an outright sale) of the country’s most strategic asset (Hambantota Port) to China, is only around Rs. 60 billion. So just to pay off this debt the country will have to sell another “Hambantota Port” – unfortunately we have run out of them. A similar situation will arise if the company is shut down.

Debt comparison

Therefore, taking the debt out of the company balance sheet or shutting the company down, cannot be done, as it will create a much bigger problem than the current one. Although the Indian Government had suggested to take the debt out of Air India to make it more attractive for a buyer, we must understand that the Indian State Treasury may have the capacity to absorb such a shock; Sri Lanka does not.

It must also be understood that SriLankan Airlines cannot be sold, shutdown or operated profitably. Any organic restructuring efforts (by Nyras) will be futile as the cost savings from operating efficiencies will be wiped out by the upward moving unhedged fuel prices. Revenue enhancements will be threatened by the uncontested low cost carriers (Mihin Air is no longer there to defend against LCCs).

Unfortunately, there is no “organic” solution to the problem.

(The writer is a former Investment Banker from London with Mergers & Acquisition and Corporate Strategy experience. He has worked for a number of International companies in London including HSBC Bank and Goldman Sachs. As an Investment Banker in London he was also involved in the team that advised Emirates when they were looking to sell their stake in SriLankan Airlines at the time. He holds an MSc in Engineering from Imperial College London.)