Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 21 August 2017 00:00 - - {{hitsCtrl.values.hits}}

The airport closure from January to April, floods in May, as well as the recent dengue outbreak are the primary factors that most stakeholders in the industry point to as the reasons for the slowdown in growth

By Chamindra Goonewardene

The growth of the tourism industry is visible on the surface across the country, with a number of new international chains opening up large scale properties across the country, along with an increase in room inventory through smaller projects across the country.

In order to meet up with this increased supply, tourist arrivals have been slated to increase rapidly in the next few years. However, after the completion of the first seven months of 2017, the official arrivals data from the SLTDA show statistics that should raise a few alarm bells for the industry.

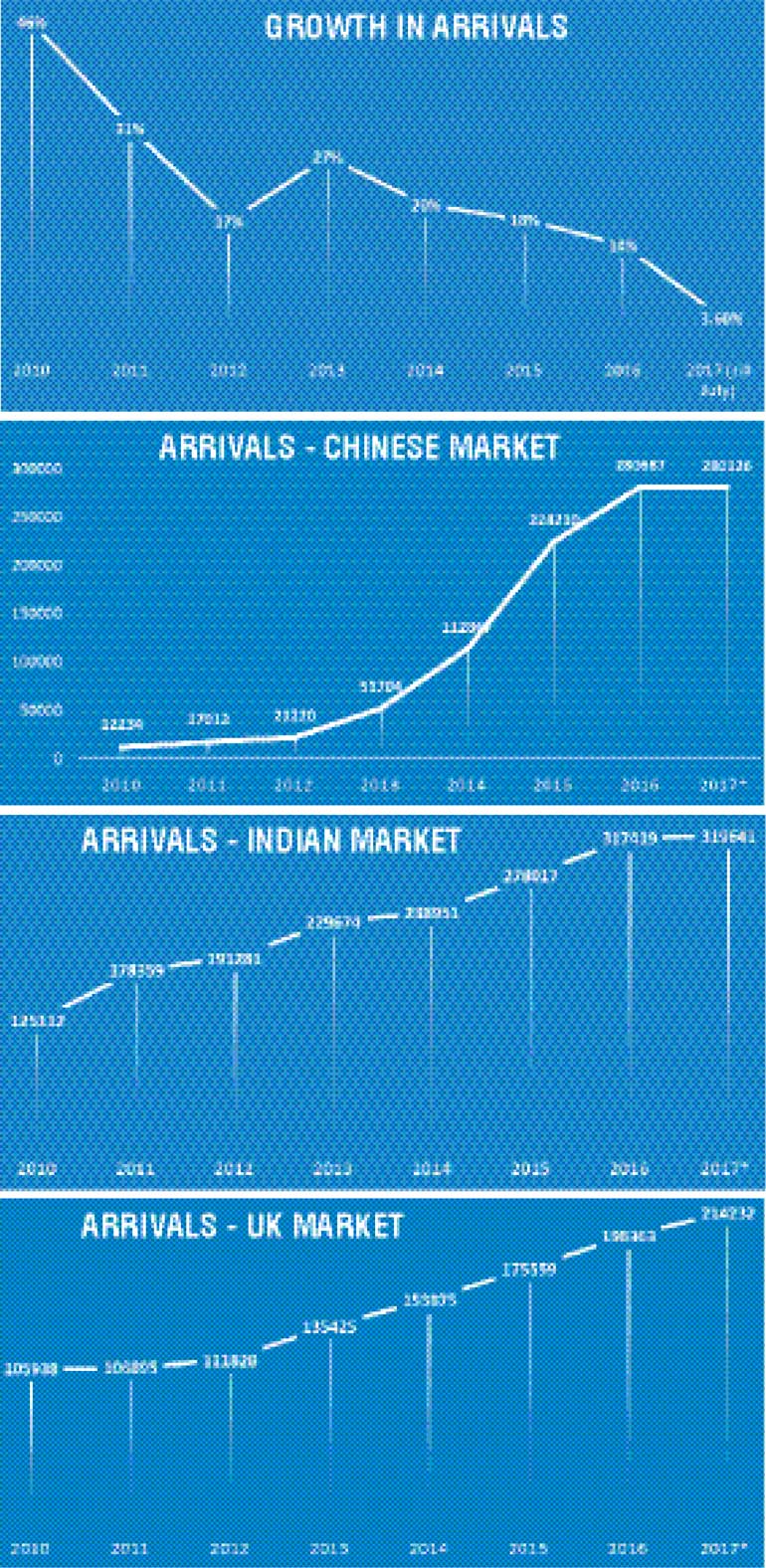

The airport closure from January to April, floods in May, as well as the recent dengue outbreak are the primary factors that most stakeholders in the industry point to as the reasons for the slowdown in growth. Four months of 2017 showed a YoY drop compared to 2016, but instead of just comparing the number to a previous year, it is important to look at overall trends from 2010, as well as how the main markets have been performing.

Immediately preceding the war in 2010, Sri Lanka saw a boom in arrivals with a 46% growth from the previous year. While this number was not a sustainable figure, up until 2015, arrivals grew at over 15% with the lowest level of growth being 14% in 2016. However, the growth in 2017 has been significantly lower with just a 3.8% YoY growth. As mentioned earlier, the airport closure has been the primary factor that experts point to, but when taking a look at arrivals in July, one sees a different picture.

The SLTDA data shows a 1.8% drop in arrivals in the month of July, which is extremely worrying as it has been one of the strongest months of the year with an increased flow of traffic in the summer periods. A lack of clear messaging following the dengue outbreak has led to potential visitors being turned off due to this fear. However, whether there is more at play is yet to be uncovered. What we do know is that summer markets tend to consist of family groups and a factor such as the dengue outbreak could have had a significant impact on such a demographic.

ANALYSIS OF MAIN MARKETS

Collapse of the Chinese market

The Chinese market played a critical role in the growth of Sri Lanka tourism in the last five years. Tourist arrivals from this key market grew from 12,234 in 2010, to 280,687 in 2016. During this growth period, the country was not positioned as a higher end product, and most operators were left scraping the bottom of the barrel and engaging in price wars in an extremely price-competitive market.

The Chinese market has decreased by 1.2% compared to some staggering levels of growth in previous years. The market grew at over 80% YoY annually from 2012-2015, and the previous year’s growth was marked at over 40%. Despite issues such as floods, dengue and airport closures, many point to the positioning of Sri Lanka and the kind of audience it attracted which has led to the downfall of this market.

It is also important to put this in a global context and look beyond merely Sri Lankan arrivals. The growth of the overall Chinese market has slowed down in 2016 to 4.3% compared to 9.3% in 2015, and 9.2% in 2014. Nevertheless, the total number of outbound travellers from China was 122 million in 2016.

Sri Lanka’s market share is still under 0.2%. The country is currently ranked at #17 amongst outbound travellers. Thailand, South Korea and Japan make up a majority of these numbers but other Asian counterparts such as Maldives at #8, Vietnam at #9, Cambodia at #11 also have a significant share of the Chinese market.

Stagnation of the Indian market

The role of India in Sri Lanka’s tourist arrivals cannot be underplayed with significant numbers being showcased from pre-war periods. The country’s growth from the previous year was non-existent with a dismal 0.2% pick-up from 2016.

In context, the Indian market registered 20.3 million outbound travellers in 2015, with a growth of 11% from the previous year. Sri Lanka’s market share in this context is 1.1%. Sri Lanka ranks first among the South Asian neighbours, but the sheer volume of the market shows us the significant untapped potential in this market. Other Asian countries such as Indonesia, Singapore, Malaysia, Thailand and Hong Kong all rank above us, which is disappointing given the close proximity of our island and the product on offer.

UK market still surging

Despite the slowdown in the two main markets, and the overall drop in growth in 2017, UK still continues to grow steadily from 2012 to date. While overall growth has slowed down to 8% this year, the growth to Sri Lanka is higher than the UK average.

Total outbound travels from the UK grew by 5.06% in 2015, and by 4.14% in 2016. This is a promising figure, as residents from the UK are also known to be repeat visitors. With 37.6 million outbound arrivals in 2016, Sri Lanka still makes up a very small market share of 0.5%. While we cannot expect significant market share, what we can look at is growing existing markets and attracting new markets, while expanding our higher-end luxury space.

Areas moving forward

More data: Too often we get caught up in numbers, and we don’t look at where the most profitable markets are. For too long, we have merely been in search of that elusive number. The latest goal announced was the four million mark by 2020, and in order to achieve such numbers or even understand whether these numbers are feasible, further analysis of the current data is essential. While the SLTDA does a commendable job in the collection of this data, too often a lot of this information fails to receive concrete analysis and distribution among key stakeholders. Information such as booking windows, decision influencers, overall experience, and specific feedback should also be collected and collated upon departure in order to fully understand and improve the Sri Lankan travel product.

A holistic marketing strategy: The marketing campaign for Sri Lanka Tourism has recently been put on hold yet again, and each time this happens, the country will lose revenue in the long term. According to earlier reports by the Daily FT, a campaign of Rs. 3 billion along with a Rs. 500 million digital campaign was to be kicked off in May, but was delayed for a few months. Delays of this nature will have a significant impact on the industry, as there is no cohesive message being marketed to potential travellers. For the longest time, Sri Lanka was ‘A land like no other’ and after a series of rebranding efforts, it is currently branded as the ‘Wonder of Asia’. Just recently, a 13-member task force was appointed with experts from the industry to engage with the Ministry of Tourism, and one hopes that this is a step in the right direction in order to improve the brand ‘Sri Lanka’.

Damage control during major PR events: Even current searches for items such as Sri Lanka floods and Sri Lanka dengue still bring up very negative articles. As shown in the data, these two events have adversely affected growth in Sri Lankan tourist arrivals, and that the response to events of this nature need to be quick in terms of a public relations approach. Communiques highlighting the areas affected by these disasters, and areas that are still in the clear, along with constant updates to major news broadcasters and relevant embassies is extremely important from the perspective of informing potential tourists to this island.

Improvement of product: Sri Lanka’s tourism started off with the hippies in search of soul in the 1970’s, and as a reason, the country will always be an attractive destination for the backpacker community, and this bodes well for the small and medium enterprises. But in order for the country to grow its foreign reserves, attracting higher-end clients is a must. Locally-grown properties such as Ceylon Tea Trails, and Uga Escapes, and most recently Santani, have helped put Sri Lanka on the global luxury travel map. For this market to succeed, infrastructure needs to be ramped up rapidly in order to facilitate this growth. The Central expressway, which will create linkages between the cultural triangle and the rest of the country, as well as a more robust internal air transport infrastructure will have a significant benefit in this regard. This higher end clientele will have a significant impact on the total revenue brought to the country.

Authentic products: With so much to offer on this little island, too often our own Sri Lankans value what is beyond the borders of our island and fail to showcase the rich culture, history, heritage and values that we have held dear for thousands of years. From architecture to cuisine to every single element of the experience, the Sri Lankan product should not be modelled after other Asian elements. Yes, there are points of inspiration that we can draw from but as an industry we should ensure to keep the product as authentic, genuine and as Sri Lankan as we can. It is up to the forward thinking hoteliers and other stakeholders of this country to ensure that these elements carry over in the total experience.

Bright spots: In the midst of disappointing data, there are quite a few glimmers of hope. Despite negative impact by the airport closure, the floods and the dengue outbreak, and a lack of clear information following this, arrivals still registered overall positive growth. European countries such as Netherlands, Spain and Sweden have shown significant promise with a higher YoY growth, while markets such as USA, Canada, Australia and more are still showing growth in the face of these adversities. Information from stakeholders also point out to August data showing much better promise than July, which one hopes will be a much needed boost for the industry.

The importance of the sector: Recent research by the World Travel and Tourism Council shows that the Tourism Industry is expected to have a total contribution of Rs. 2,686 billion by 2027, which amounts to 13.5% of the total GDP. This also translates to 1.2 million individuals being employed directly and indirectly through this industry. This highlights the importance of moving in the right direction at a crucial inflection point of this nature, and to make sure that the government and the private sector work together in order to ensure that this industry grows at the expected pace, in order to create revenue and jobs for our country.

Therefore, while the first seven months of 2017 have not been as promising as one would have hoped, it is vital for the situation in the country to stabilise and for steps to be taken in order to address our shortcomings and improve on our strengths in order for the growth of this industry to continue. With a variety of ambitious projects on the horizon for Sri Lanka, which will increase the country’s room inventory significantly, an equivalent increase in arrivals that go hand in hand with this product is vital to the success of this industry, and for the impact on the overall economy.

(The writer recently completed his MBA at the University of Leicester with a specialisation in Marketing and wrote his thesis on ‘The Impact of Online Marketing’ on the travel purchase decision. He received his undergraduate degree in Economics from Duke University and is currently the Group Head of Marketing and Brand Development at Santani Resort and Spa.)