Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 20 April 2020 00:26 - - {{hitsCtrl.values.hits}}

By Tilak Abeysinghe and Shen Yifan

No data yet, apart from distressing data on escalating infections and deaths caused by the COVID-19 outbreak. The economic shock is yet to be seen.

On 16 March, China reported that in the two months of January and February alone there was a record 13.5% drop in the factory output. The World Bank, in a study released on 30 March, projects the possibility of a massive increase in poverty levels in East Asian and Pacific countries. The International Labour Organization, in a study released on 7 April, projects massive increase in unemployment globally and call for swift policy actions and open trade regimes.

Opinion pieces are abound that warn of dire outcomes in the absence of early policy interventions. Some even think that containing the pandemic quickly does not necessarily lead to a rapid economic recovery. The economic fallout of the COVID-19 outbreak at a global scale is likely to be unprecedented. We thought of engaging in such a global assessment to provide early projections of growth trajectories across countries that can shed some light on what to expect in the absence of policy interventions. For this we use a large econometric model that we constructed. It connects the time series of GDP growth of 60 economies (with one more representing the rest of the world) through the time series of 3,660 bilateral export shares.

For the present analysis we have to modify the model to account for the COVID-19 impact. The COVID-19 shock generates negative growth effects through disturbances to demand and supply channels.

On the one hand, increasing healthcare and other related fiscal expenditures is a boost to economic growth. On the other hand, many restrictions such as lockdown, curfew and travel restrictions imposed to contain the contagion entail both demand and supply disruptions at an international level. At this stage required data to estimate the COVID-19 related parameters of the model are not yet available. We, therefore, adopt the framework of intervention analysis and calibrate these parameter values and combine them with the pre-crisis parameter values to run the full model. In the intervention framework COVID-19 is represented by a dummy variable that takes value 1 from 2020 quarter 1 onwards and 0 before that.

We make brave assumptions to calibrate the parameter values. We first assume that the more the COVID-19 infections in a country the severe the strain on the economy. Based on this we use the proportion of COVID-19 infections in each country in the first quarter of 2020 (number of cases in a country divided by the total number of cases in the world) to represent the impact effect of COVID-19 on GDP growth.

For the second quarter of 2020 we assume 80% reduction of the infections and for the third quarter 99% reduction. These represent the lagged effect. Note that these are only parameter estimates, the full impact of the COVID-19 global shock is generated by running the full model interactively. We generate a baseline growth scenario where the direct impact of COVID-19 on each country is proportional to the infection proportion mentioned above. The baseline numbers can be multiplied by any desired number for each country to magnify the impact. Although the magnitude of the fall in growth is important to assess the severity of the recession, at this stage we draw more attention to the growth trajectory and duration of the downturn.

An important advantage of our model is that it can generate the direct growth effect of the COVID-19 shock on a country and the indirect growth effect that results through the international transmission of the recessionary impact.

Results

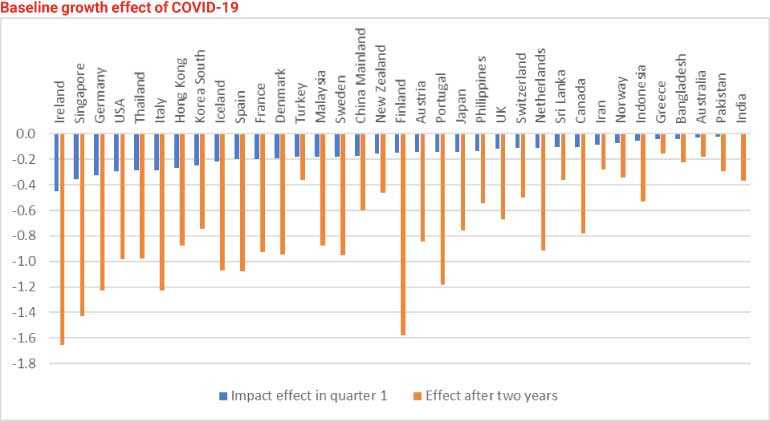

The chart shows by how much the GDP growth is going to drop over a two-year period for selected countries. The countries in the chart are ranked by the first quarter impact effect of COVID-19. It should be emphasized again that these numbers represent only a baseline case. Actual growth effect depends on the magnitude of demand and supply shocks each country is facing.

Overall, the exercise brings out the following general results.

First, although we assumed that the COVID-19 contagion withers away within three quarters, the economic contagion is going to continue in the absence of effective policy interventions. The baseline scenario projects mild recessionary conditions that may last two to four years in some countries. However, the duration depends on the severity of the downturn.

Second, with the exception of few countries, 80%-99% of the drop in growth results from the international transmission effect (indirect effect), not from the direct impact of COVID-19. The countries that are less prone to international transmission of recessionary effects are Germany (75%), China (50%), Iran (39%), and the USA (26%).

Third, although the impact growth effect of COVOD-19 is very low for some countries like India, as time goes by, they also suffer as a result of disruptions to international transactions. The Chart shows that the recessionary impact after two years changes the initial ranking pattern completely.

More specifically, highly open Singapore is more susceptible to the economic crisis caused by COVID-19 than Sri Lanka. However, during past crises Singapore rebounded very quickly because of effective and innovative policy interventions. Although Sri Lanka may be less affected relatively, Sr Lanka also needs innovative policy interventions to avoid a protracted downturn.

There is silver lining in the dark cloud. The global economic downturn, instead of just a few countries suffering, generates the need for collective actions. When conditions improve with policy interventions, the international transmission mechanism renders faster recovery to all the countries.

(Tilak Abeysinghe is the Research Director of the Gamani Corea Foundation, Sri Lanka and was a Professor of Economics at the National University of Singapore. Shen Yifan is an Assistant Professor at the Institute of Politics and Economics, Nanjing Audit University, China.)