Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 8 December 2017 00:00 - - {{hitsCtrl.values.hits}}

By Rehan Fernando

Following my article in the Daily FT which was published on 27 November under the same subject heading, I thought of sharing a few more thoughts about the road to becoming a maritime hub. This was mainly triggered by forums which I took part last week which not only supports my view but also addresses a few more grave areas that we need to attend to immediately.

Views expressed by the German Ambassador

Ideas expressed by the German Ambassador to Sri Lanka Jörn Rohde at the Annual General Meeting of the Sri Lanka Apparel Exporters Association led me to think how other trading partners of Sri Lanka view our economic policies.

In his speech he stated that Germany supports Sri Lanka’s aim to become the hub of South Asia and even World Bank economists say that this aim is achievable. However obtaining very low corruption indicators, efficient fiscal and legal infrastructure and competitive tax systems are immediate requirements to achieve this status.

Further looking at current benchmark indicators such as the ‘Ease of Doing Business’ and ‘World Competitiveness Report,’ Sri Lanka ranks 107(2016) and 71(2016/2017) respectively. He stated that it’s important that initiatives are taken to improve these rankings as they do not portrait a good picture about Sri Lanka.

Talking about German investments in Sri Lanka he said that only EUR 130 million was invested in Sri Lanka for the last five years and this can improve as long as the Government can improve the above indicators and maintain stable policies without zigzagging on announcements like it has often done in the past.

This statement highlights a few important areas from my earlier article. A single entity with the necessary legal mandate to take ownership and drive an industry wide digitalisation initiative and improving ‘Ease of Doing Business’ is very important. Some countries have been highly successful with a government agency driving the project directly under a minister whilst there are other cases where Public-Private Partnerships have proved to be successful. Ensuring active participation of all stakeholders to achieve a common objective with consistent monitoring at the highest level and continuous improvement will make this initiative successful.

Non-competitive pricing structure

A competitive pricing structure needs to be implemented across all sectors in the maritime industry. Statistics published by ‘Ship & Bunker’ shows that the average bunker price of the top 20 ports as at 22 November is $ 379.50/MT whereas the bunker price of Colombo was a staggering $ 420/MT. This makes bunkering, which is a very important element of a maritime hub, expensive and uncompetitive in Sri Lanka.

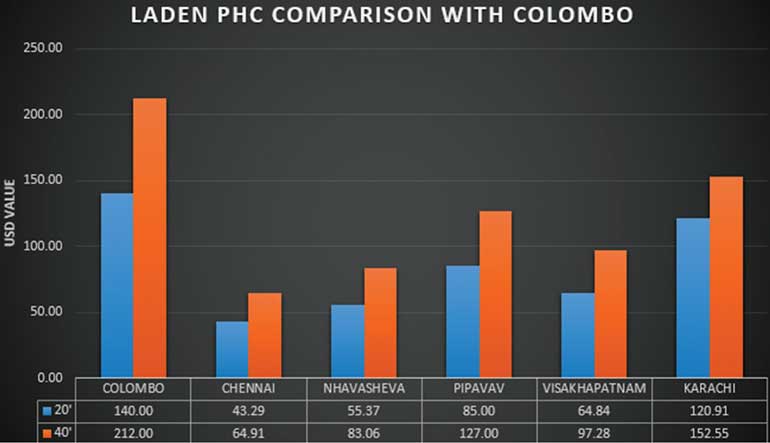

Among the other elements affecting price competitiveness is the Terminal Handling Charge. As per Diagram 1, Colombo PHC (Port Handling Cost) can be easily highlighted as highest amongst the main hubs in the Southeast Asia/West Asia regions. When segregated, Colombo PHC value is ranked the highest in the Indian sub-continent with a PHC amount of $ 140/20’, $ 212/40’ and $ 263/45’ container on laden basis.

With a variation of $ 96.71/20’, $147.09/40’ and $ 176.44/45’ per container compared to the lowest ranked Port Chennai which amounts for only $ 43.29/20’, $ 64.91 and $ 86.56 respectively reflecting on a variance of 223% in average.

We can see the same dilemma for empty containers and transshipment cargo. When compared to empty PHC charges, Colombo PHC value is ranked amongst the highest in the Indian sub-continent region with amounts of $ 102/20’, $ 158/40’ and $ 200/45’ per container. This reflects a difference of $ 69.19/20’, $ 108.8/40’ and $ 134.39/45’ per container which amounts to a total negative variation of 47% in average compared to the lowest ranked port – Chennai.

We can see the same dilemma for empty containers and transshipment cargo. When compared to empty PHC charges, Colombo PHC value is ranked amongst the highest in the Indian sub-continent region with amounts of $ 102/20’, $ 158/40’ and $ 200/45’ per container. This reflects a difference of $ 69.19/20’, $ 108.8/40’ and $ 134.39/45’ per container which amounts to a total negative variation of 47% in average compared to the lowest ranked port – Chennai.

When compared to PHC charges in main hubs located in Southeast and West Asia, Colombo again is ranked amongst the most expensive in terms of laden PHC charges, with amounts of $ 140/20’, $ 212/40’ and $ 263/45’ per container. This reflects a difference of $ 77.35/20’, $ 117.44/40’ and $ 148.82/45’ per container which amounts to a total negative variation of 125% in average compared to the lowest ranked Malaysian North/West ports. These exorbitant charges make the Sri Lankan ports uncompetitive in the region and makes the road to becoming a maritime hub even more difficult.

Earlier shipping lines were allowed to recover the Terminal Handling Charge from the shipper. However the recent change of policy to lift the THC component from the shipper’s invoice has affected many lines which has to bear this cost.

The decision to abolish THC has prompted vessel operators to display subdued interest in the Colombo Port resulting in the exploration of other options. Furthermore, this decision would also hamper Sri Lanka’s prospects of maintaining itself as a maritime hub. As such, if the country is to build on its maritime hub status, it cannot afford to lose the interest of the vessel operators who could potentially eye Colombo as the major regional hub as well.

The THCs and other surcharges are collected virtually in all major trade lanes in the world, including the Asian region. And by mandating how business partners structure their financial arrangements, Sri Lanka is isolating itself from major commercial centers that attract business by protecting freedom of contract.