Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 17 November 2017 00:00 - - {{hitsCtrl.values.hits}}

By Merrill J. Fernando

By Merrill J. Fernando

The TEA, in its response in the Daily FT of 9 November to my writing, ‘TEA brews toxic blend for its own survival,’ has resorted to vague generalities whilst accusing me of misrepresenting facts to suit my interests, without clarifying these facts.

In the absence of rational arguments to support its call for “liberalisation,” a transparent euphemism for the importation of cheap tea, it has also attacked me, personally and offensively. Therefore, though it is not in my nature, I am compelled to respond appropriately. Unlike the TEA, however, I shall confine myself to hard, verifiable facts.

My philosophy has always been not to be the “biggest” but the “best”. The 3% of the national export volume which Dilmah represents is exported at an average FOB value in excess of three times the national average. Dilmah is the exclusive serving brand in some of the best international airlines and in the most prestigious hotels around the world. That is the value of the “Pure Ceylon Tea” quality proposition and an accurate reflection of the quality of my purchases.

The Dilmah operation enables research and development of innovative products and international advertising and promotion; the latter alone costs over Rs. 1 billion annually, promoting “Pure Ceylon Tea” across the globe, to the advantage of other exporters who wish to benefit from that image in their marketing.

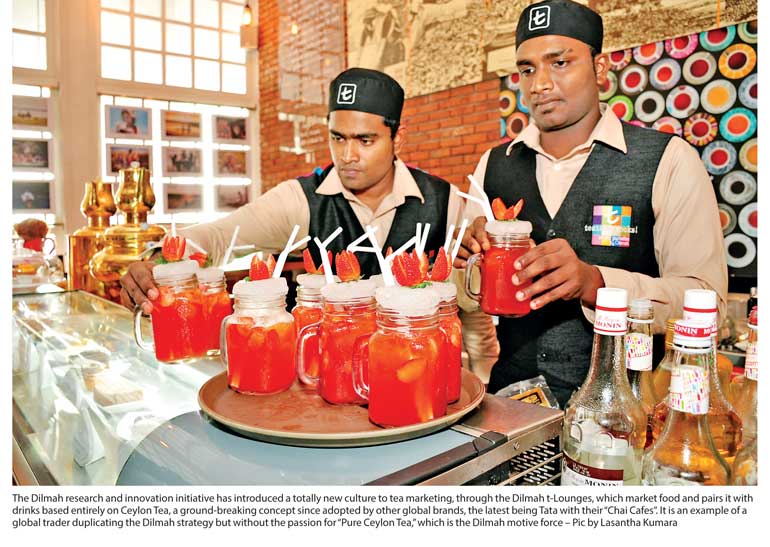

The Dilmah research and innovation initiative has introduced a totally new culture to tea marketing, through the Dilmah t-Lounges, which market food and pairs it with drinks based entirely on Ceylon Tea, a ground-breaking concept since adopted by other global brands, the latest being Tata with their “Chai Cafes”. It is an example of a global trader duplicating the Dilmah strategy but without the passion for “Pure Ceylon Tea,” which is the Dilmah motive force.

My business also enables me to provide a service to marginalised groups, wildlife, ecosystems and communities across Sri Lanka. These programmes are supported entirely on Group earnings, through the initiatives of the MJF Charitable Foundation and Dilmah Conservation.

Over the years my philosophy of being the “Best” as against the “Biggest” has produced unique benefits to my shareholders. An initial investment of Rs. 10,000 in my listed company has, today, grown to Rs. 11 million, of a net worth of around Rs. 18 million with dividend earnings. These are values created on the back of “Pure Ceylon Tea”.

HVA Foods, one of the strongest proponents of the liberalisation concept, ended both 2015 and 2016 with operational losses whilst its 2017 share value has vacillated between Rs. 9.50 and Rs. 3.80. Compared with the results of my company, the latter figures should educate the reader as to the more successful course to follow, for a Sri Lankan tea exporter. Further elaboration is unnecessary as the statistics speak for themselves.

The TEA has also made a snide reference to “…political support to get a large part of the tea promotional budget to build their own brands”. In a previous writing, “Dilmah and its Initial Struggle,” in the Sunday 14 October 2007 edition of the Times, I have comprehensively debunked this ridiculous canard. That article presents fact and reality as against rumour and innuendo. Suffice it to say that, had the then Sri Lanka Tea Board given me the generous and unstinted support they extended to every foreign brand, the Dilmah position would be even stronger today.

I have countered the TEA proposal for importation with verifiable facts and figures, which support my claim for the primacy of “Pure Ceylon Tea”. A paradigm shift in the industry trajectory cannot be permitted on the basis of extravagant statements of possible benefits. The TEA has yet to support its claim for the massive financial and other tangential benefits of importation, with a single, financially verifiable equation. In its latest writing, the TEA claims that the call for liberalisation was supported by a majority of the exporters it represents but deliberately omits to specify that majority, statistically.

The truth is that Sri Lanka’s largest tea exporters, such as Akbar Brothers, Stassens Exports, and Jafferjee Brothers who, along with Dilmah, collectively account for the greater proportion of value added tea exported from Sri Lanka, do not subscribe to the call for liberalisation. What is more relevant is that the so-called majority of exporters, is still a small minority in relation to the totality of the industry stakeholders who would be adversely affected by liberalisation. The major players in the value added tea business are opposed to the liberalisation proposal in view of the possible adverse consequences to the industry and the national economy.

It is agreed that importation was permitted up to 1981. However, it was subsequently withdrawn when the then Minister of Plantations, on a visit to Egypt with a trade delegation, ascertained for himself that exporters had been blending cheap Chinese tea with Ceylon Tea, to reduce the blend cost and exporting as Ceylon Tea, providing the Egyptian market with a very low quality product whilst totally devaluing the image of Ceylon Tea. That is an accurate pointer to the possible outcomes from liberalisation of imports.

There is no argument against the limited liberalisation available for the serious exporter, for the importation of specialty tea such as Darjeelings and select Assams, and other non-traditional varieties not produced in the country. They are used by genuine marketers as a strategy to widen their range of offerings for supermarket buyers. Such teas are invariably more costly on an average than Ceylon Tea and the Government permits imports without restriction.

As the TEA itself has pointed out, the annual volume of such imports amounts to approximately five million kg, equivalent to less than 2% of the national black tea production, a quantity that has no impact on the local industry. If the global demand for such tea increases, there is absolutely no barrier to proportionately increasing the quantities to be imported for blending and re-export.

In the same breath, identifying the high cost of Ceylon Tea as a barrier to servicing international markets, the TEA suggests that the opponents of liberalisation assume – wrongly – that liberalisation means the importation of cheap tea. If the TEA is actually calling for importation of speciality tea varieties which are more costly than the local product, then the facility for the importation of such tea already exists. In that case what, specifically, is the TEA driving at?

The TEA says “…some companies always talk of cheap teas when the subject of liberalisation of tea imports comes up…” It is a very valid apprehension. Our 2016 national NSA was Rs. 468.61 and to end October 2017 it is Rs. 617.22, whilst the national export average for all varieties in 2016 was Rs. 639.88. Would the TEA confirm, beyond doubt, with clearly defined numbers and projections, how the liberalisation would improve those statistics, bearing in mind that a devaluing of the current positions through importation would be detrimental to the Sri Lankan tea industry economy in its totality?

For example, a 75% component of cheap, imported tea in a blend – which would require a sizeable foreign exchange outgoing – would have its value enhanced by the Ceylon Tea component, whilst the value of the Ceylon Tea itself would diminish. The cheap blend would then be marketed as “Packed in Ceylon” and, in the eyes of the consumer, perceived as genuine Ceylon Tea. Historically, that has been the strategy of the trader, the promotion of a brand on the quality image of Ceylon Tea and then gradually reducing the latter component, thus exploiting the local farmer and deluding the customer; that is exactly what the TEA is driving at and, clearly, why the TEA is seeking to delink itself from the rest of the industry.

In actual fact, foreign exchange earnings from Ceylon Tea will drop below present levels as every kilo of imported tea will devalue Ceylon Tea.

The comment by the TEA “…most international brands reduce the Ceylon Tea component in their blends due to the high prices which would be detrimental to the local tea industry” is a clear pointer to their agenda. How can a high price paid for Ceylon Tea be detrimental to the country’s tea industry?

Notwithstanding all the other arguments that the TEA has offered in defence of its call for liberalisation, it eventually circles back to this issue – the high price of Ceylon Tea – and their obvious need to devalue it so that it will fit in comfortably with their cheaper blend proposals, thus ensuring the survival of the trader.

The TEA argues, irrationally, that the diminution of the Ceylon Tea component in the global market can be countered by a liberalisation process. The proportionate decline of the Ceylon Tea volume in the international market corresponds with increased exports from other traditional producer countries, and from new entrants to tea production. However, those factors have not had a depressive effect on the national auction average, or the national FOB, of which the benefits flow back to the producer and the many millions of its dependents. Since 95% of what we produce is exported, the only means of increasing our share in the global market is to increase plantation production.

If the TEA proposal for importation, blending and re-export is permitted, the global price average is bound to decline with the injection of cheaper blends into the market, unless there is a corresponding increase in the global consumption of tea.

Stagnant production is a completely different problem and cannot be resolved by liberalising imports. If our global market share is improved through increased production, our production costs will decline and prices will stabilise. That is the only sustainable means of growing our foreign exchange earnings. One of the immediate impacts of blending with cheap varieties at source of production would be to further dilute the image of Ceylon tea and exacerbate an existing situation.

In the tea export trade, there are two obvious ways of competing: either make the product cheaper or make it more exclusive. Which is the route that the TEA proposes to take? The exporter comes in two forms, the timid, unimaginative supplier and the bold, innovative marketer; in the context of meeting competition internationally and promoting a national product, which is more preferable?

The TEA constantly cites this mythical target of $ 5 billion in annual export earnings as a certain outcome of liberalisation. Currently, we earn $ 1.5 billion by exporting 300 million kg annually. Assuming that the current national export average will remain steady even with massive imports, does the TEA propose to eventually import a quantity more than double the local production in order to arrive at this grand target?

I understand, perfectly, the nature of the Tea Hub, proposed by the TEA. However, establishing Sri Lanka as a hub for logistics, financial services, tourism and IT cannot be equated with the concept of a “Tea Hub,” supported by the importation of cheap tea. The former involve the improved provision of services, infrastructure and knowledge and does not envisage the importation of a home-grown agricultural product.

For example, would the major wine-growing countries permit the importation of spirits from other countries for establishing a “Wine Hub” in the home country? When Chile and Australia entered the wine market with cheaper, more competitively-priced products, French wine producers simply improved the image of their product and made it more exclusive. UK distillers of Scotch Whisky followed the same route, when challenged by new Asian entrants to the whisky market. Neither of those countries considered establishing blending hubs in order to compete at the low end of the market.

The old adage of “bringing coal to Newcastle” seems appropriate at this point. As for Dubai becoming a tea hub, there was always an overpowering logic in its choice; Dubai is in a centrally-located country which does not grow tea, within its borders. If the hub proponents wish to purchase cheap tea for blending, they should seek incentives to enable themselves to re-locate to Dubai – or any other appropriate destination – though I am certain that they will not do so, for the simple reason that they need the “Packed in Ceylon” label, which to unsuspecting consumers means “Ceylon Tea”.

A total of 65% of the “Ceylon Tea” which is exported in bulk form is blended outside the country. The TEA suggests, vaguely and hopefully, but with no great conviction, that with a local Tea Hub, “…international tea brands that hardly use Ceylon Tea in their blends now may start using more Ceylon Tea in their blends…” The TEA has frequently spoken glibly, and confidently, of the benefits from liberalisation that would accrue to the packer, the freight forwarder, the shipper, the banker and the printer but is absolutely silent on the possible benefits to the producer sector and its dependents.

My concern is for the industry in its totality and not the ancillary service providers. Multi-national packers who would like to use Sri Lanka as a centre for their operations using cheap, imported teas in their blends would only be doing themselves a favour, and not the country. Value addition, branding and marketing are weak features of our exports and a blending hub with imported tea would only worsen that situation.

The TEA speaks of the shift from the consumption of loose tea to tea bags, even in traditional markets. But what is the market share in weight that we have lost as a result? Once again I will point out that despite the TEA argument that international brands have reduced the component of Ceylon Tea in their blends, our auction average is the world’s highest by a considerable margin. We have not been compelled to “dump” our tea. In fact, from the standpoint of a globally active marketer of “Pure Ceylon Tea”, I would advise that the top end of the market is now gradually moving towards leaf tea. Again an unpleasant reality is that in some key foreign markets such as Russia, Sri Lanka’s exporters helped local brands to establish themselves on the strength of Ceylon Tea. The result is that they have now become our biggest competitors in key markets.

The TEA claims, that it is “fully aware that, tea industry consists of a number of stakeholders and its strong impact on the social and economic aspects of the country…,” and that “…it has organised workshops and had meetings with other stakeholders to discuss the liberalisation of imports”. Has the TEA ever presented the proposal on importation to representatives of the 400,000 smallholder producers, worker representatives of the 1,000,000 plus residents of the plantations or even the plantation trade unions? The seminars conducted appear to be seemingly one-sided to already-biased audiences.

Unarguably, “Single Origin” is a niche product, which the cheap brands dominate. That is exactly my point, that converting Sri Lanka to a Tea Hub by importing and blending cheap tea would be to sacrifice the entire tea industry of Sri Lanka to the principle of mass-marketing of discounted, characterless, multi-origin products, instead of leveraging the advantages of “Pure Ceylon Tea” with its great variety of appearance, liquoring properties and multi-regional distribution within the country. To subordinate all it stands for to a cheap, blended, homogenous product would be to dilute our most unique selling point.

There are now a number of exporters who are contributing to the branding of Pure Ceylon Tea globally, with highly-focused marketing thrusts. Liberalisation would marginalise all such exporters who, in actual fact, should be encouraged to expand their businesses on the same premise. The need of the hour are not traders but marketers, who can sell the image of “Pure Ceylon Tea”, on the strength of its intrinsic value. There are suppliers and marketers and I belong in the latter category.

I made the statement that the export sector is not the most important segment of the industry, with intent; and I reiterate it although an exporter myself. It is in acknowledgement of the millions whose daily toil brings the product to the market; it is in awareness of the exploitative nature of multinational initiatives operating in third world countries, all over the globe in the name of profit alone. In all the numerous arguments that the TEA has offered in support of its proposal, the TEA has studiously ignored the major segment of the industry.

The importance of an enterprise, particularly in a developing country like Sri Lanka, with a largely rural economy, lies in the number of people it sustains. In that context, the fraction at the export end becomes insignificant when weighed against the millions in the producer segment. No government would support a far-reaching revision in an industry policy that would have the potential to impact on the livelihood of such a large proportion of the population.

At a Tea Council meeting held in 2012 I challenged the liberalisation lobby with six questions, in regard to their purpose. To this day those questions remain unanswered.

The TEA’s defence of their request to isolate themselves from the rest of the industry, is to cite, as examples, the Sri Lanka Tea Factory Owners’ Association and The Federation of Small Holder Tea Growers. The fact is that those bodies were formed to meet new developments in the industry which emerged only a couple of decades ago, whilst the CTTA, in my firm view, has always been more than adequate to represent the industry.

As for the call by the TEA for a public debate on the liberalisation proposal, I would welcome the opportunity.