Thursday Feb 26, 2026

Thursday Feb 26, 2026

Tuesday, 17 October 2017 00:00 - - {{hitsCtrl.values.hits}}

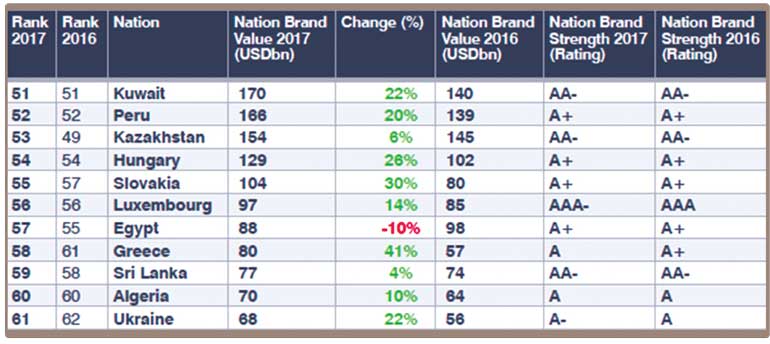

The 2017 nation brand report released by Brand Finance in London last week, shows that Sri Lanka has dropped one place in its rankings from 58 to 59, with just a 4% increase in Brand Value to $ 77.0 billion.

The global report which is available on the Brand Finance website (http://brandfinance.com/knowledge-centre/reports/brand-finance-nation-brands-2017/) provides a comprehensive analysis on the world’s leading nation brands and the impact that a country’s reputation and image has on stakeholders and investors. The analysis combines a wide range of measurable economic, demographic, and political factors, and is based on in-depth research.

The BrandFinance Nation Brands measures the value and strength of the nation brands of 100 leading countries using a method based on the royalty relief mechanism that Brand Finance uses to value brands.

Each nation brand has also been accorded a brand rating, which is a benchmarking study of the strength, risk and future value creating potential of the brand, much like a credit rating. Sri Lanka’s brand rating is AA-with a score of 67.2 which is just fractionally down from last year’s score of 67.5.

Brand Finance Lanka Managing Director Ruchi Gunewardene stated that, “based on the last 2 years trend we observe a stagnation of the country’s brand performance. Whilst we saw a jump in the indicators in 2015 following the change in Government and the commitment to reforms and governance that was shown at that time, we have not seen this translate into a strong and compelling reason for investors to commit themselves to the country”.

The Brand Finance nation brand study measures the country’s performance across indicators such as society (people and skills, corruption, judicial system, security, quality of life, etc), investment (governance, taxation, infrastructure, ease of doing business, talent, etc) and goods and services (trade rules, government policy, tourism, etc).

Because of the scale of its economy, brand USA dominated the list at the top of the value table, followed by China, Germany, Japan and UK in that order. However on the brand strength indicator Singapore emerges as the strongest nation brand.

An understanding of what drives strong nation brand value is worth noting in this context. The intolerance of corruption in Singapore combined with a highly efficient public service that has comparative wages with the private sector discouraging graft, makes it the ‘cleanest’ country in Asia according to the Corruption Perceptions Index.

In addition, Singapore’s reputation for investing in its citizens has particularly boosted its ‘People and Skills’ indicator, factored in the calculation. The ‘SkillsFuture’ movement initiated by the Government, which allows every Singaporean aged 25 and above to secure S$500 for professional development, helps to maximise the nation’s potential. More than 400,000 people undertook training in 2016, an increase from 379,000 in 2015. The state’s willingness to invest in the development of its people demonstrates a nurturing element that many other nations have yet to adopt.

Another country which Sri Lanka should take note of is Ireland, which is one of the fastest growing national brands in the world, with its brand value rising 24 per cent to $427 billion. One of the major factors attributed to the success in part is its ability to attract foreign direct investment and the manner in which it has bounced back since the recession. Ireland is now seen as a bridge between the US, the UK and the EU, and is somewhat of an island of calm in a sea of macro and micro economic troubles across both sides of the Atlantic, with the Trump and Brexit factors having a negative impact.

Gunewardene continuing says “the key lesson here is that we have to provide a strong and stable environment with a long term view, which provides confidence to investors to come and place their money here. When they see protests on the street and vehement opposition to current major investors for the purpose of short term political gain, it does not provide an environment of stability which is so vital, since there are so many more options for them to choose from.”

Brand Finance CEO David Haigh commented, “A strong brand has become a defining feature of success in the current economic climate. Worldwide hyper competition for business, combined with an increasingly cluttered media environment, means that a clear message carried by a properly managed brand can provide the crucial leverage needed to thrive. Nations can adopt similar techniques to capitalise on the economic growth that comes with proper positioning of a nation brand. Brand Finance estimates that strong nation branding can add between 1% and 3% to GNP. In the current economic environment no sensible government can afford to ignore branding as an instrument of economic policy.

Brand Finance plc, the world’s leading brand valuation consultancy, advises strongly branded organisations on maximising their brand value through effective management of their brands and intangible assets. Founded in 1996, Brand Finance has performed thousands of branded business, brand and intangible asset valuations worth trillions of dollars. Brand Finance is headquartered in London and has a network of international offices including Colombo.