Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 2 December 2020 00:41 - - {{hitsCtrl.values.hits}}

|

Stuart Rogers, Head of Wholesale Banking, HSBC Sri Lanka and Maldives

|

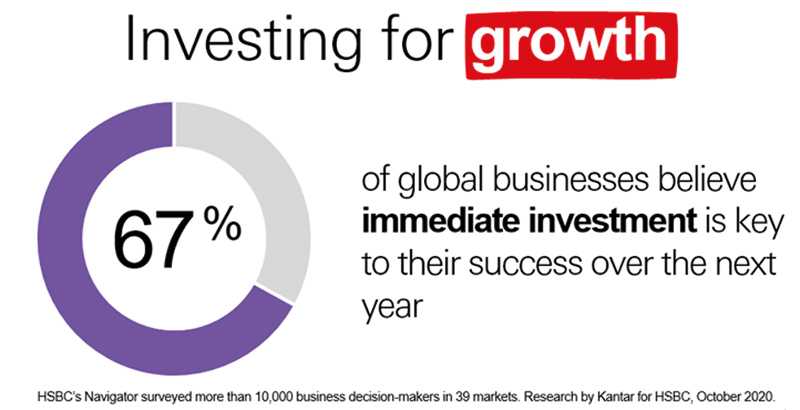

As the world awaits widespread access to Covid-19 vaccines, a new report from HSBC Commercial Banking signals a two-speed economic recovery spanning several years as the pandemic redefines business success.

Drawing on the views of over 10,000 companies in 39 countries and territories including Sri Lanka, HSBC’s annual Navigator survey finds that 8% are more profitable than they were before the COVID-19 outbreak and 45% expect to return to pre-COVID profitability by the end of 2021. However, 28% and 11% of businesses expect it will take until the end of 2022 and of 2023 respectively just to claw back ground lost during the pandemic, while 6% are looking at 2024 or beyond.

Amongst the Sri Lankan companies surveyed, increasing domestic demand, favourable government policies, regulatory and taxation environment, gaining technology-driven efficiencies, and expansion to new digital platforms and channels are the top growth drivers cited.

Digital is key

Stuart Rogers, Head of Wholesale Banking Sri Lanka and Maldives, said: “It’s been an extraordinary year but you can sense a more forward looking energy in the market as companies strategise to build back stronger. They see successful businesses of the future as being innovative, collaborative and socially responsible. Investment in technology will play a significant role in achieving those ambitions to target new customers, facilitate product and service innovation and to enhance the customer experience.”

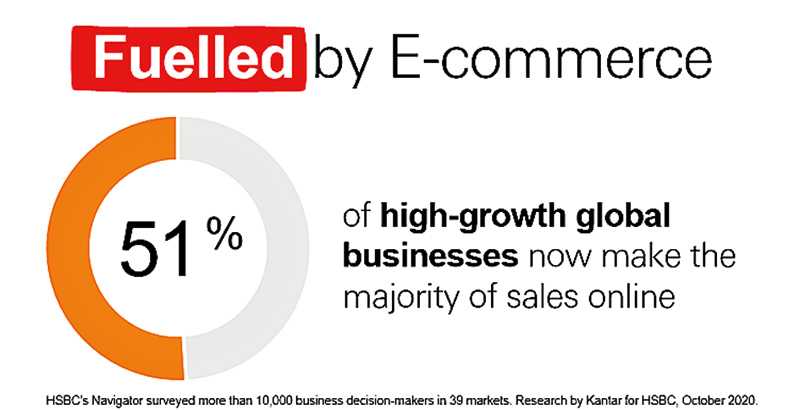

Digital is key to success during the pandemic, with ‘high growth’ companies now making most sales online. Globally, 32% of high growth firms expect technology-driven efficiencies to be a key driver for their recovery, more so than businesses with lower or no growth. As a result, 88% plan to invest in digital tools and platforms in the future, while a third have already innovated new products and services. In Sri Lanka, nearly all of the companies surveyed plan to increase or maintain investment in technologies.

Need for supply chain security feeding intra-regional trade

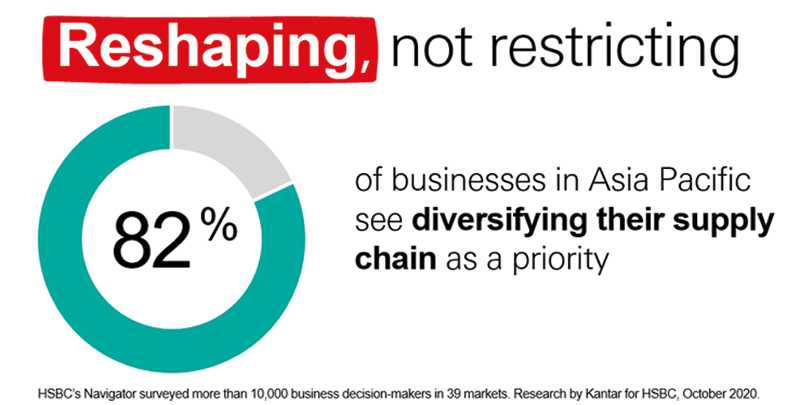

Supply chains are a universal concern for companies globally and in Sri Lanka, the most concerning factors being distance of suppliers from target customers or from their business, increasing costs and supply chain stability.

In Asia-Pacific, companies have diversified their supply chain so that they work with more suppliers; selected their suppliers based on the country’s handling of the pandemic; and ramped up the use of technology (all 34%).

And buffeted by the pandemic and other headwinds, companies in Asia-Pacific are doubling down on intra-regional trade to grow in the post-COVID world: 71% of APAC businesses that participated in the latest HSBC Navigator survey are trading within Asia-Pacific, up from 67% in 2019, with mainland China now cited as their most important trading market.

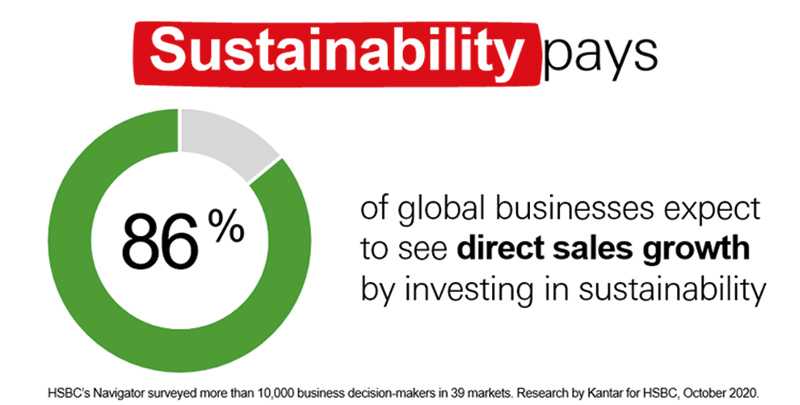

Barry O’Byrne, Chief Executive Officer, Global Commercial Banking at HSBC, said: “Companies have proven remarkably resilient in weathering the turmoil brought by COVID-19. They face the same storm, but they are not in the same boat. Different sectors face unique challenges, and we see this shaping decisions to invest, to embrace technology, and to target future growth. What they all recognise is that responsibility, resilience and reputation underpin long-term success. Getting this right is challenging, but the potential commercial and societal benefits are vast.”

More than three fifths of businesses (63%) expect cross-border trade to become more difficult than it was pre-pandemic, their commitment to pursuing international opportunities appears undiminished. Almost three quarters of businesses are positive on their international trade over the next two years. Two in five see broader horizons and new sources of insight (37%) as a benefit, while businesses believe international trade promotes positive social outcomes through boosting local economies (30%) and supporting the development of local infrastructure (24%).