Thursday Feb 26, 2026

Thursday Feb 26, 2026

Tuesday, 2 April 2019 00:00 - - {{hitsCtrl.values.hits}}

The smart use of total rewards in attracting, engaging and retaining an employee cannot be over-emphasised. Total rewards are a concept that is much larger than just monetary aspects of compensation.

In a truly holistic definition, total rewards cover non-compensation elements such as career and growth opportunity, work life balance and work environment, recognition and learning. On the monetary side too, there is a whole portfolio of tools in the armoury, including pay, benefits, short-term incentives and long-term rewards.

Long-term rewards could be share or non-share based (e.g. deferred bonus), though the former is more often used and hence more popular. Share based incentive plans can be designed to meet multiple objectives – they can be used to attract top talent on a risk-reward model without the organisation having to bear the burden of a high fixed compensation, they can be used to share wealth amongst those who have been significant in contributing to an organisation’s wealth creation, they can be used to ensure goal alignment, motivation and performance at the highest level by linking money to net worth appreciation of an organisation and they can be used to enable sustained growth and retention of key talent.

EY research study in India

An EY research study in India has found that organisations that have a defined reward strategy attain better financial results than those that choose not to have one. Each organisation needs a reward strategy that reflects the culture of the organisation and enables it to follow organisational strategy and achieve objectives.

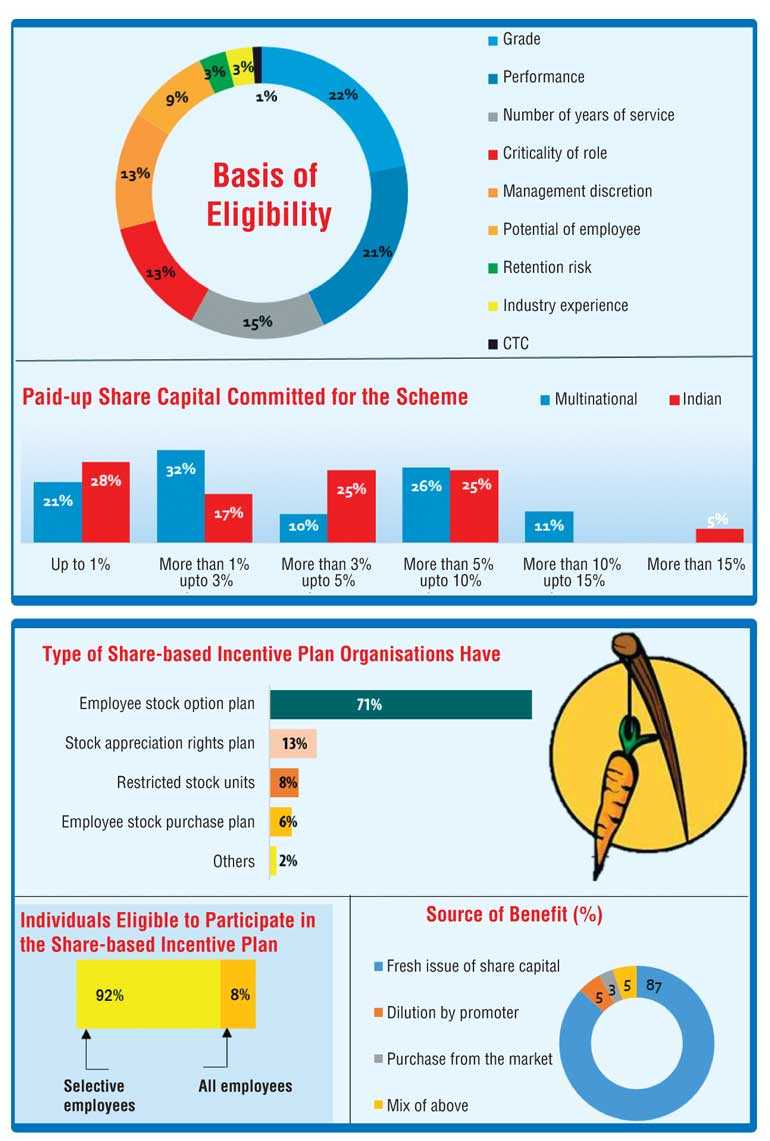

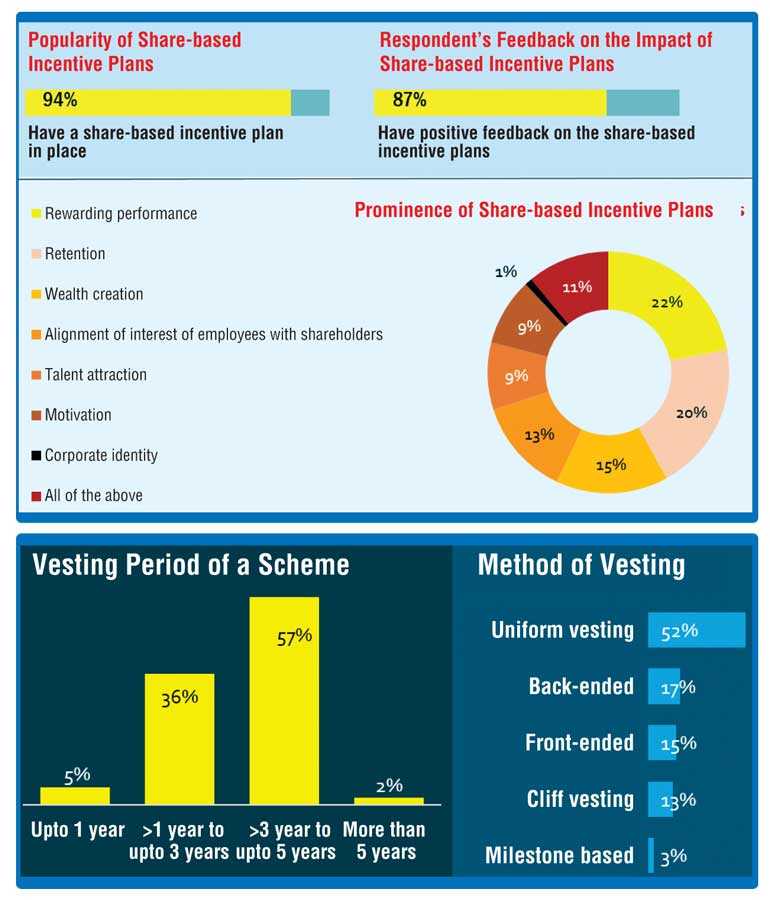

Therefore, the importance of constantly evaluating and innovating the rewards proposition is critical to an organisation. Almost 50% of the organisations in India feel that share-based incentive plans have shown immediate desired results such as retention and enhanced performance of employees.

Relevance of Share Based Incentive Plans

In Sri Lanka, like in most countries, typically share based incentive plans are either equity settled or cash settled schemes. Equity settled schemes could take the form of Employee Stock Option Schemes (ESOS) or Employee Stock Purchase Schemes (ESPS). ESOS is where stock options are granted and ESPS is where shares are issued to the employees. Cash-settled schemes can take the form of Stock Appreciation Rights (SAR) where cash awards are made linked to the appreciation in share price.

Several organisations that have introduced share based incentives plans have even initiated several successive rounds to continue on the growth momentum, and leverage on the performance culture that it has created. Whilst rapidly gaining popularity amongst other variable compensation arrangements that are in offer, and the growing awareness and interest, share based incentive plans are gradually shaping the mid to long-term compensation philosophy in the local context.

Sri Lanka and Maldives Senior Partner and Advisory Head Arjuna Herath, who also specialises in Equity Linked and Share Based Compensation Plans and Rewards, stated: “Shared based payments are essential part of compensation and align employees’ interests with the organisation’s interests. Share based payments ensure employees remain focused on the long-term goals and commitments of the company rather than thinking about short term gains. They are directly linked to value creation. It reinforces thinking and acting like an owner of the company as the opportunity is created for employees to become shareholders. While deciding on the employees who need to be given stock based payments, companies need to factor the impact on performance metrics like profitability, cashflow etc.”

Share based or Equity-linked incentive plans are an important component of the overall reward framework of the organisation. They help in aligning the interests of the employees with that of the shareholders thereby contributing to the growth and success of the organisation. The right and impactful design of such incentive plans is very critical for the success of the plan. It is therefore important for an organisation to invest time in getting the design right.

Equity based plans continue to be well perceived and well received when they are simple to understand, with transparent performance measures and a clear line of sight to results they can influence. The communication of the objectives of the incentive plans, transparency about performance against targets and ease of implementation of the operational elements of the plans helps create a high level of engagement from the participants for the success of the plan.

Mechanics of Share based Incentive Plans

Herath stated: “We use a proven EY methodology to help achieve the client’s objectives and have developed this unique service offering to be responsive to and flexible in addressing each organisation’s unique business situation: We help companies to effectively design, implement, communicate and administer share based compensation benefits. We use a multi-disciplined approach, focusing on a wide range of business dimensions cutting across different functional areas including HR, tax, accounting and compliance in structuring share based payments ensuring organisations are in compliance with all applicable laws and regulations.”

While share based incentive plans are a powerful tool in the rewards portfolio, there are clear areas that need to be carefully attended to, for an organisation to reap full benefits. There are challenges that needs to be carefully addressed.

Challenges

If the design of the share based incentive plan is not right, it may fail to meet the objectives. The design must be robust and impactful. Organisations need to spend maximum time in deciding the design features taking into consideration the objectives, market trends, regulatory requirements, current and future business projections within the overall employee reward and retention framework.

It is important for organisations to maintain a fair balance between the interests of the employer and employees. A fine balancing act between the organisation and employee.

Regulations governing share based incentive plans are more complex than other types of retirement and rewards plans. Compliance function need to be familiar with these. Organisations need to ensure compliance with all the regulations such as company law, SEC/CSE regulations, income-tax regulations and exchange control regulations which impact the share based incentive plans.

Very often share based incentive plans fail if the employee’s question of ‘what’s in store for me’ remains unaddressed. Organisations need to ensure that the value proposition of share based incentive plans is appropriately communicated to employees so that employees value the plan and remain committed to the organisation. To the extent possible, organisations should also maintain transparency with the employees on critical design features since it helps in building trust between them.

If there are unexpected and unforeseen challenges/changes in the future, share based incentive plans may not remain relevant both for the organisation and the employees. Ongoing relevance of the plan is very important. Employers need to review the share based incentive plan periodically to ensure appropriate changes are made to keep the plan attractive for employees and to meet objectives of the organisation.

The Art and the Science

Herath in conclusion stated: “Companies have immense potential to attract and retain key talent. To unleash this potential, organisations need to balance short term reward tools that provide for timely recognition; and longer-term armour that provides the unique opportunity for wealth creation linked to an organisation’s net worth appreciation. Stock option plans are a powerful means for serving the long-term reward agenda. One can craft from a variety of constructs and scheme design options, to create something that’s most fit-for-purpose. Designing the stock option scheme is like a fine blend of art and science, which then creates a solid foundation for success.”