Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 19 May 2020 00:00 - - {{hitsCtrl.values.hits}}

The pandemic

The article ‘Twelve deadliest viruses on Earth’ by Anne Harding and Nicoletta Lanese (4 March 2020) identifies SARS-Cov, SARS-Cov 2, MERS-Cov and Influenza in its list. It was said that during a typical flu season, up to 500,000 people worldwide will die from the illness, according to the World Health Organisation (WHO). But occasionally, when a new flu strain emerges, a pandemic results with a faster spread of disease and, often, higher mortality rates. The ‘not so typical flu’ became recognised as a pandemic and yet, the impact on the financial performance became unconceivable.

However, as Governments in countries around the world started to take swift measures to reduce the spread of the virus with social distancing and varying degrees of lockdown, the reality of the situation began to materialise. The grinding halt of regular activities in every sphere of life dawned on everyone after the lockdown. But, we aim to review in this article whether the entire world has actually come to a complete standstill or not.

At the time this article was being written, the Asian Development Bank (ADB) research had declared global losses from COVID-19 to range from $ 2.0 trillion to $ 4.1 trillion, equal to 2.3% to 4.8% of global GDP. Reality is to be worst hit as the estimate does not take into account such factors as supply disruptions, interrupted remittances, urgent healthcare costs, and potential financial disruptions, as well as long-term effects on education and the economy.

Overview

The new ‘normal’ has begun to sink into our lives and the new ‘normal’ of performing regular business saw radical changes within the last few months, locally as well as globally. Many businesses would need to respond to evolving consumer behaviours by reinventing their business models or be left behind in the recovery process from this pandemic. The reliance and complete control via digitalisation became paramount to business leaders at a time Sri Lanka is trying to completely place power and control on virtual reality.

Amid the aftermath of the drain of the spread of the virus – COVID-19, ever-changing consumer expectations and behaviours have cemented the need for adopting technology as the backbone of the success of a business. We can foresee a radical growth on the digital transformation journey, a trend that will undoubtedly continue at a robust pace – but, for a very short period of time. However, increasing uncertainty in the global economic and geopolitical environment and weaker global growth prospects reduces prospects for global business expansion.

Parallel to the declaration by WHO of coronavirus as a global health emergency, the International Monetary Fund (IMF) in January 2020 revised its 2020 global GDP growth forecast to 3.3%, a downward revision of 10 basis points.

The transformation of business activity is expected to continue in 2020 as global businesses proactively respond to evolving consumer behaviours. There is an indication of that consolidations and diversification mergers and acquisitions (M&A) would continue driving the majority of sector-related M&A in the year ahead. This is based on simple principle of achieving more together than what is possible individually.

Prospects of organic growth is restricted but there lies an indication of M&A among distressed businesses. But, prior experience from post-recession signals towards M&A which would be heavily influenced by sustainability agenda as investors target assets with sustainability features offering value in the longer run. Overall, we anticipate a ‘relaxed’ battlefield where the giants would strive to bridge the loopholes in their business models.

E.g. Strong delivery chain for consumer goods.

Future M&A would instigate synergy via long-term growth. The global economic and geopolitical uncertainty and weaker global growth prospects will impact investor activity for the benefit of the stronger players.

Intermission in business setback

The outbreak diverted the trend of thought of all corporate finance teams by shifting the priorities from a long term perspective to operational aspects encompassing working capital management, obtaining debt moratorium, redefining business models and shifting focus from core areas to support services. As a global organisation with operations in most countries, BDO has witnessed that COVID-19 has affected regions differently in terms of the response to it. The troubles are only the tip of the iceberg where many areas which would take a hit are yet to be identified – the gravity of the virus becoming more pronounced in many parts of the world from March onwards, it is natural that we would expect levels of activity to plummet further in the second quarter, with many live deal processes put on hold.

The world witnessed the credit crunch of 2008-2009. Yet, it was a structural issue to markets and the supply of credit and the impact on M&A was short-lived, where deal activity eventually recovered. The current situation is more of an external shock to the global system, prompting Governments around the world to severely restrict human activity in many ways at varying degrees as a response to a medical crisis.

The two sides of the coin is that the medical crisis would instigate an economic crisis with a more prolonged impact on M&A activity. In a geographical perspective, every region experienced a double-digit decline in deal activity in Q1 2020, which was near 40% or more. However, as the pandemic was slow to spread in some of the areas identified as least affected, this may change over the next few weeks as the death toll rises. It is surprising to note that China held 15% of the M&A handled by BDO at number two, seconded to only North America at 26% with Southern Europe nosing in at third place with only 8% of the total deal value.

The tragic loss of lives to the virus and also the number of livelihoods at risk, is only the lowest level of the problem. Yet, downturns can be excellent times for M&A, especially for bold and experienced dealmakers. Financial analysts may never have thought that there would be a day where all assumptions become centred on the Government of each country, which is not purely governed by selfish political mandates.

Epic centre of all drawbacks stem from Government restrictions on movement. The time required for businesses to recover and restore trading is influenced by the legislations. At a time of tremendous pressure on the bottom-line, it is possible that some owner-managed businesses who have seen the impact of different types of recessions and external shocks over the years may wish to de-risk and/or share risk by realising all or part of their business. Thus, M&A have not had a natural death.

Where is the market headed?

Difficult times coupled with no historical guidance for markets to draw upon, has led to a stalling of global M&A activity. Yet, markets can never come to a complete closure even at the face of such a global crisis, purely because M&A may become the only way out for business continutity for some businesses. Thus, significant distressed M&A opportunities will arise sooner or later this year, following a period of unrivalled State support.

A huge weight of global capital remains to be deployed and interest rates remain low. Eventhough, Governments are re-writing their investment policies hoping to inject capital and confidence into their economies, most companies have been forced to shut down services and are focussed on cutting costs and preserving cashflow to help them face the uncertainty of what lies ahead. Corporates which depended heavily on increased leverage, lower earnings and the need for working capital, will need urgent capital infusion.This will require understanding of local insolvency regimes and techniques.

Trade and Private Equity (PE) backed trade may have significant consolidation advantages over standalone PE. It’s reasonable to assume that it could be some time before mainstream M&A activity resumes. As a result, the reallocation of capital is likely to move to distressed investing immediately. Withstanding the unprecedented social and economic paralysis, many global companies continue to plan major transformation programs.

The big picture

The future for distressed M&A in North America seems bleek as the lenders have shown an almost unmatched flexibility in supporting their clients in providing solutions to avoid restructuring or insolvency. Lenders have demonstrated a commitment in many cases to honour term sheets, albeit slowly, while they prioritise existing clients.There are many other deals on hold due to concerns around business performance with attentions focused elsewhere during the crisis,such as working capital management for the target entities, specifically.

Companies in United Kingdom and Ireland are using M&A to drive transformation in an uncertain global economic environment. There is also increased M&A activity across the Energy, Mining and Utilities sector as renewable energy support schemes are rolled out across the region, attracting long-term investors and international energy groups. Both technology, media, and telecom (TMT) and Business Services will remain active in the next quarter and while the level of M&A activity will drop post-COVID-19, these two sectors will continue to underpin transactional activity among those resilient and scalable companies.

The forecast of the World Bank indicate that the Sub-Sahara African economies would lose between $ 37 billion – $ 79 billion in output losses in 2020 due to COVID-19. The impact on food security is likely to be particularly severe and some of the countries’ GDP might see contractions ranging between 2.6% to 7%. The growth forecast for 2020 is -5.1% compared to 2.4% in 2019. The pandemic is also likely to result in rising levels of public debt as well as huge losses in output and trade in 2020 in the continent. Donations from the Government, South African businesses, organisations and individuals, and members of the international community were utilised to set up a Solidarity Fund to assist the vulnerable segments of the society.

India is among the 15 most affected economies due to supply chain disruption in China. The possibility of acceleration of M&A activities as leaders consolidate their market share/positioning and diversification is a definite opportunity as business moguls often yield vast amounts of assets in India. M&A activities may find favour as firms become more opportunistic, finding value in assets at lower or distressed valuations, seeking supply chain economies and opportunities for consolidation within sectors.

On the extreme end, an indepth study into the Chinese economy gives an insight to the post-pandemic period. It provides hope for any economy fearing the worst that the virus has not wiped out all avenues for mid-market deals. M&A activities in China and other Asian countries and outbound investments from China are expected to resume as the outbreak ceases. The disruptions to global supply chains experienced in Q1 2020 by businesses (in particular those with trade connections with China) are expected to result in many businesses considering whether to diversify or shift their operations away from China and other Asian countries.

In SouthEast Asia, the quarter’s top three deals in terms of value were in Business Services, Consumer and Energy, Mining and Utilities. Even with Government intervention, it may take a while for the situation to settle down due to the unpredictable business environment and the likely increased scrutiny of deal terms. The global business environment and the pace of economy recovery will ultimately dictate the volume, value, rationale and type of M&A activities in this region.

Deal flow is expected to continue cautiously given the current economic backdrop in Austral Asia. A noteworthy change in exposure to COVID-19 in this region is the increased deal volume in the Leisure sector as compared to the prior corresponding quarter, with an increae of 67%. On the othe hand, there have been inquiries in relation to the small companies which had weathred the storm but may not survie or thrive in the long term.

Innovative revival in Asia post-pandemic

During this extraordinarily challenging time where normalcy has reduced to nothing, the impact is disrupting people’s lives, interrupting business and other economic activities around the world. However, Asia can said to be worst affected from the world due to its stong reliance on global economy through its dependance on tourism, exports and skilled as well as unskilled labour. With the high volume of foreign currency which will continue to seep out of the region in maintaing the high demand for medical supplies, commodity items and other essentials, the deficit will be further widened with the reduction of foreign remittences.

ADB has forecast regional growth to decline from 5.2% last year to 2.2% in 2020. It further stated that growth will rebound to 6.2% in 2021, assuming that the pandemic ends this year and activity promptly normalises. Yet, depending on the final closure of the aftermath of the pandemic these forecasts could really be far from materialising as the outbreaks could worsen in many Asian countries based on the lifestyle and social practices in the region.

In the midst of such unprecedented economic disruption, innovative thinking is vital to overcome the current difficulties and rebound quickly. The ability to think up new solutions is necessary to restore developing Asia to its impressive growth path over the past decade. The last decade witnessed a dedicated focus on fostering innovation in the Asian region to attract foreign investment as well as to achieve sustainable growth. Those business intitatives will unquestionably pose opportunities for M&A in the current economic recess.

Innovating for inclusive and sustainable growth is essential and this requires a paradigm shift in the mindset of the Asian worker and the emplyoyers. Innovations, including social innovations such as work-from-home arrangements, can help better cope with the large economic repercussions of COVID-19, a new ‘normal’ for this part of the world. But, the last few weeks saw the locals embrace this change with much vigour only to be functional partially. Then, the ultimate question of ‘where is the innovation we stirve for’ remains unanswered while the death toll rises dragging the economic indicators further down.

Life after COVID-19 – BDO to assist you survive the shock and ride on the wave

The pandemic has raised awareness of IT companies and accelerated the development of some online businesses, including video conferencing, distance education, medical services and fresh food delivery services. More investment opportunities in these new businesses are expected in the coming quarters. In addition, potential opportunities in the healthcare industry are expected to be highly sought after in the medium to long term. In particular, investors will focus on companies engaged in businesses related to the research and development of vaccines/antiviral drugs, development of high-end medical devices, construction of additional medical facilities, infectious disease research, online medical diagnosis, and medical information management.

Tread carefully – success is not impossible

Government invervention to save the masses from health hazards as well as from the economic upheaval has been praise worthy all over the world – yet, it can never be the only solution to the future economic crisis. Capital infusion is required from external sources with the hope of capital strenghtening because there is a limited window for Governments to drive adequate public-health responses and meet the infrastructure requirements of the country concurrently. The hardest hit sectors such as Commercial Aerospace, Air and Travel, Insurance, Oil and Gas, Automotive and Apprel may not rebound until 2021.

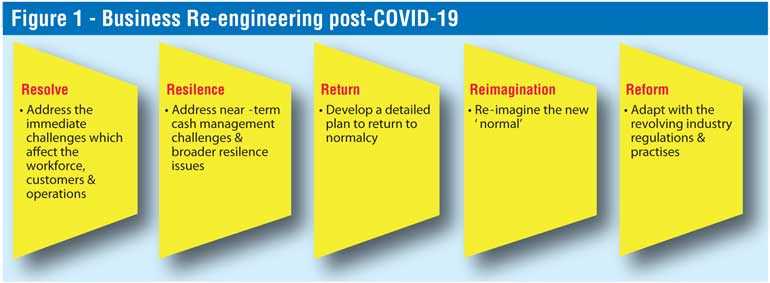

McKinsey & Company in its ‘COVID-19 – Briefing Note’ identified five definite actions for insitutions to survive post-trauma of the virus. In adapting this concept, many struggling business would resolve to identify the most resilent solution to their problem.

Setting the new benchmark on ‘normal’ is hard with no yardstick to measure upon yet, it is clear that the risk appetite for future success would entail growth for risk takers only. In identifying a detailed plan to return to normalcy (not the high debt , high risk status of high gearing but what is generally accepted to be required for a healthy business enterprise), re-imagining the new normal or reforms would result in M&A. Thus, the doors open even more widely for the mid market deals in the near future in order for the weak to survie and for the strong to thrive.

Can the Sri Lankan economy fight the unseen enemy?

The Sri Lankan Rupee depreciated against the US Dollar by approximately 9% at the start of the lockdown. As a safety measure the Central Bank of Sri Lanka (CBSL) introduced several restrictions on sovereign bond purchases by licensed banks, import restrictions and restrictions on outward investments to ease the pressure on the Sri Lankan Rupee. Despite the actions taken by regulators, given the current market conditions Sri Lankan Rupee would deteriorate further under pressure from the import of essential medical supplies to combat the pandemic. The receipt of foreign funding would ease the short term pressures on the currency.

Steps taken to control imports cannot be compared to the adverse effect the downfall of exports would have on the economy. Immediate remedial action was taken by the authorities to support the continued operations related to exports in the country, yet, many exports were suspended or cancelled by the buyers for fears of the virus. Exports are expected to weaken in 2020 due to reduced exports mainly to Europe and the US which are key markets for garments, tea and rubber products.

The current account deficit is expected to widen with the anticipated decline in exports, tourist earnings, and remittances. Larger fiscal deficits will push the Sri Lankan Government domestic and external debt ratios even higher. However, reduction in global oil prices, weak demand and restrictions on imports for vehicles and non-essential consumer items may offset some of the adverse impacts from the decline in exports.

Economic stimulus was provided by the Sri Lankan Government by allocating Rs. 50 billion to re-finance banking facilities. This is expected to support the entrepreneurs, small and medium enterprises as well as the hard hit industries. Relief in relation to individuals were also declared to uplift the livelihood of the common man. Further to the debt moratorium, permanent overdraft and trade finance facilities, working capital loans and Investment Loans were also introduced. Rs. 300 million per bank was allocated to be disbursed as Investment Purpose Loans.

Probing in the dark

The COVID-19 coronavirus pandemic is bringing the global transactions market to a near standstill with a sharp slowdown in dealmaking likely to persist until the public health crisis is brought under control. Even then, the market, and the motivations of investors, may look very different. Many investors feel that M&A as well as investing in a new buisiness venture is futile at a time the economy has come to a grinding halt. Many investors are reluctant to consider obtaining the Investment Purpose loan at present to launch a new concept. The ship will not sink if the water in the sea, which holds it up, doesn’t seep in. Similiary, many industries and the businesses within them have been adversely affected with the spread of COVID-19. However, through out the world, many opportunities were also identified which the loacl investors too can capitalise on.

Consolidating market share/positioning by integrating the target business during the downturn as competitors are busy trying to survive and then fully benefitting from synergies during recovery are possible prospects for investment. Companies forging strategic alliances or partnerships to resolve short-term supply chain issues will also provide M&A opportuntities.

Further, Banking and Financial Services (BFSI) will be vulnerable to multiple factors, including a significant slowdown in consumer, unsecured retail and auto loans, a slow rapyment of housing loans segment, tightening of credit underwriting standards, increase in delinquencies and Non Performing Loans, pressure on asset quality and collections and solvency risk. Thus, M&A would be an option for many in this sector in order to maintain legslative capital requirements in this backdrop.

Other key sectors include Business Services, Consumer and Pharma, Medical and Biotech. The new infrastructure projects including the development of 5G technology, big data and intelligence city projects with a view to enhance future investment. Reimagining business processes and re-imagining reforms are essential to be foucused on the future.

As the global workforce adapts to extraordinary levels of remote working, it will require M&A in the sector to support this online community, with particular emphasis on tech enablers for finance, education and consumer. There will be opportunities for consolidation across retail and the reinvention (or disruption) of more traditional consumer businesses, which will attract value buyers and turnaround funds.

The optimisitic expectation is for M&A to flow, but at a restrained pace, as the economic downturn presents an opportunity on the buy-side to take advantage of depressed valuations and potential industry consolidation. PE firms stand ready with ample equity and debt capital available to provide alternatives to companies that may have limited options to maximise shareholder value on their own even if the investment loans are not taken.

Many transactions in the past decade, specialy post-recession were driven by similar sized companies coming together to enhance scale and better position themselves in the global marketplace. This would be essential for our exporters to have a larger market share for the country and for one supplier. The performance of a due diligence prior to M&A would also have to be fueled via a data-room or drop-box not to mention Zoom or Microsoft Teams meetings. Many threats are also linked to the reliance on technology in our local context but we must begin to step out of our comfort zone and work with the global trends.

There is ample room for corporate finance teams to perform balance sheet restructuring, loan restructuring and obtaining financial assistance for the distressed businesses. However, the challenge is for adaptations beyong such simple measures where the business oweners will be able to utilise their avaialble assets more efficiently.

Eg: A hotelier affected by the pandemic could apply for moratorium and sit back to wait until the tourist arrivals pick up. Or, he could consider renting out space for entities distressed by lack of space to meet the current health regulations. It would not necessarily be a permanent solution, but , the best outcome for the asset.

On the other hand, online cosmetic shop could consider the manufacture of custom made masks to suit the fashion of females and the varying requirements of kids. Thus, returning to normalcy does not refer to anything that was pre-pandemic but the new ‘normalcy’ with the safety measures of the COVID-19 and the fear for one’s health. It requires the adaptation with the trends and a focus on future requirements. The value addition to the businesses would be for us to be able to assist them to return to a ‘normalcy’ which is far more profitable and dependable.

COVID-19 has transformed from a health crisis to an economic crisis, where all businesses seem to have taken the brunt of it at varying magnitudes. Micro, small and medium-sized enterprises (MSMEs), primarily in the developing countries like Sri Lanka have no pre-defined processes to assist the affected. The typical small business employs – single digit number of people, is close to home and have no defined processes. These MSMEs represent 60%-70% of jobs in developing countries and around half of economic activity.

At present, it is difficult to estimate the magnitude of the financial drawbacks but the small businesses are already facing or will soon face liquidity issues, which could wipe out whole segments of the economy. The expected four phases of the pandemic viz. shutdown, supply-chain disruption, demand depression and recovery are possible for all businesses who take corrective action immediately. But, as MSMEs move within the above four phases, there will be a combination of threats for survival including credit issues, managing the new demands of the market while reactivating business linkages and managing the work environment. Adapting technical assistance to meet the challenge is vital to ride the wave. In many cases, the MSME are succumbing to the immediate effects of COVID-19 – this is a difficult time for all.

However, MSMEs must understand that it is a difficult time for all, irrespective of size of the business. The difference is the size of the impact and the agility to adapt. It is important for MSMEs to understand that sharing the risk would ease the ultimate impact on their bottom line. Rather than trying to continue with operations with difficulty and be run over, it is time for joining hands. Merger would be the solution to gain from the synergies as well. Further, the amber alert may continue even after the merger. It maybe time for disposal.

The continued amber light may become a green immediately when another redefines the way business is handled or there is a complete turn-around of the nature of the business using the available resources. Whether it be in the manufacturing or service sector, there is always a solution for the pandemic related crisis of any business – COVID-19 has not had a cure yet – but, financial and operational distress always has various options.