Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 8 April 2019 00:00 - - {{hitsCtrl.values.hits}}

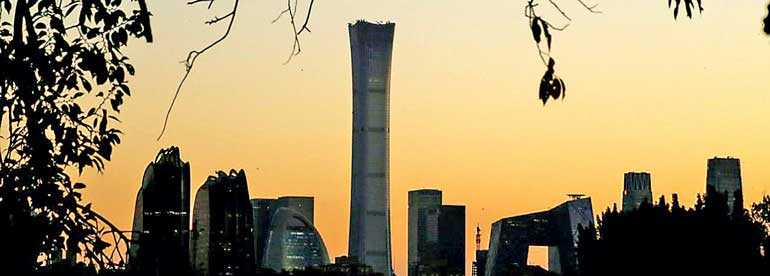

The cityscape of the Beijing Central Business District, or Beijing CBD, is silhouetted against the sky during sunset, China - REUTERS

Bengaluru (Reuters): Corporate spending in Asia is likely fall for the first time in three years, a Reuters analysis of Refinitiv data showed, as businesses conserve cash in the face of a stalling Chinese economy, an unresolved trade dispute and Brexit uncertainty.

Capital expenditure (capex) at 2,137 Asian companies is likely to slip an average 4% this year, according to the data, which is based on analyst estimates. The pace of revenue growth is likely to be flat at 3.3 percent, the data showed.

By comparison, capex - or money spent on maintenance and investment - at the same firms grew nearly 8% last year.

“We are seeing several factors working against capex growth,” said Joseph Devine, chief investment officer, global ex-US equity at Macquarie Investment Management. “Credit conditions have tightened and the US dollar is strong. In India and some other markets, the bank lending cycle may have peaked. Auto demand in China is slowing.”

Capex refers to money used to acquire or upgrade equipment, buy property or build plants, in order to aid expansion or stay competitive. Cutting capex could slow future revenue growth but is often considered prudent at times of economic uncertainty.

In Asian engine China, the world’s second-biggest economy, growth slowed to a near three-decade low last year and is widely expected to further decelerate this year as the government continues a campaign against excessive corporate debt and works to resolve a trade dispute with the United States.

Meanwhile, its tumbling imports and exports has tempered optimism toward factory output in neighbouring Japan where private-sector machinery orders - a capex barometer - fell in January at the fastest pace in four months.

“Uncertainty in trade and policy makes companies cautious while investing,” said Herald Van der Linde, head of Asia equity strategy at HSBC. Yet Asia needs more “hard infrastructure” so low investment is not sustainable in the longer term, he said.

Increased cash flow

Real estate companies and those that depend on government infrastructure spending will likely be most frugal, the data showed, while technology firms allocate less on upgrading equipment as global demand for smartphones falters.

Capex is likely to be lower than last year by 7% at industrial materials suppliers and 9% at tech firms.

“We are seeing a sharp slowdown in electronic exports over the past year and that is likely to pass through to investment growth as well,” said senior economist Gareth Leather at Capital Economics.

Some tech firms including SK Hynix Inc. and Nanya Technology Corp have already axed capex budgets.

On the flip side, falling capex is likely to raise Asian firms’ median cash flow position to its highest in at least five years, at $1.80 per share versus $1.30 last year. Companies with high cash reserves are, for instance, attractive to investors seeking steady dividends in times of economic turmoil.

A breakdown by economy showed firms in China, Hong Kong, Japan, South Korea and Taiwan are likely to cut capex by 2 to 9%.

China’s government is shoring up its economy through tax cuts and infrastructure spending, and on Friday announced steps to prevent a sharper slowdown. Analysts, however, said the measures are unlikely to lift corporate spending this year.