Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 19 March 2020 00:59 - - {{hitsCtrl.values.hits}}

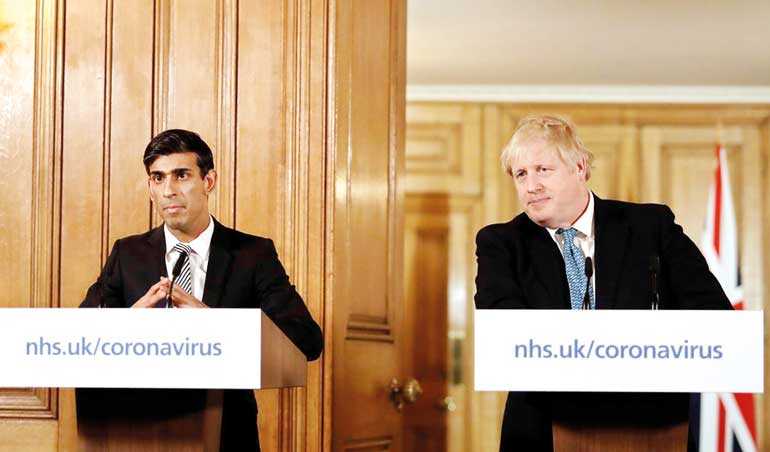

Britain's Prime Minister Boris Johnson and Chancellor of the Exchequer Rishi Sunak attend a news conference on the ongoing situation with the coronavirus disease (COVID-19) in London, Britain March 17, 2020. Matt Dunham/Pool via Reuters

LONDON (Reuters): Britain said it would launch a 330 billion-pound lifeline of loan guarantees and provide a further 20 billion pounds in tax cuts, grants and other help for businesses facing the risk of collapse from the spread of coronavirus.

Chancellor of the Exchequer Rishi Sunak again pledged to do “whatever it takes” to help retailers, bars and airports and other firms, many of which are reeling from a near-shutdown of business.

“This is not a time for ideology and orthodoxy,” Sunak said on Tuesday, speaking alongside Prime Minister Boris Johnson. “This is a time to be bold, a time for courage.”

Britain, criticised by some scientists for moving too slowly to check the spread of the virus, ramped up its response on Monday when it told people to avoid pubs, clubs, restaurants, cinemas and theatres.

On Tuesday, it announced plans to cancel routine surgery for three months to focus the health service on the coronavirus and courts in England and Wales dealing with serious crimes will not start trials likely to last for more than three days.

“We must act like any war-time Government and do whatever it takes to support our economy,” Johnson said.

The coronavirus death toll in Britain rose by 16 to 71.

Sunak described Tuesday’s package of measures as unprecedented, although Britain issued guarantees of around 1 trillion pounds during the global financial crisis.

The Institute for Fiscal Studies, a think-tank, said Sunak would need to “come back with more” and Allan Monks, a JP Morgan economist, said excluding the loan guarantees, the size of Britain’s stimulus measures for this year was “likely to look small compared to the economic shock underway.”

Sunak said he was including all retail, hospitality and leisure businesses in the suspension of a property tax, alongside the new loan guarantee program which was equivalent to 15% of British economic output.

Companies from those sectors would be offered cash grants and the Government would discuss a support package for airlines and airports.

Britain’s biggest airports including Heathrow and Gatwick have warned that they face the threat of a complete shutdown without government help.

Banks and lenders would offer a three-month mortgage holiday for people in difficulty, Sunak said.

He later told lawmakers, some of whom criticised the business focus of the plan, that the Government would soon make a statement about support for renters. He also said he would do more to support jobs and incomes.

The Bank of England said it would set up a new fund with the Finance Ministry to buy commercial debt with a term of up to one-year issued by investment-grade companies making a “material contribution” to Britain’s economy. The fund would be financed by the creation of central bank reserves, much like the BoE’s quantitative easing program.