Friday Feb 27, 2026

Friday Feb 27, 2026

Saturday, 11 May 2019 00:02 - - {{hitsCtrl.values.hits}}

LONDON (Reuters): Global stocks made gains on Friday as investors held out hopes for a trade deal between the United States and China, even as another round of U.S. tariffs on Chinese goods took effect.

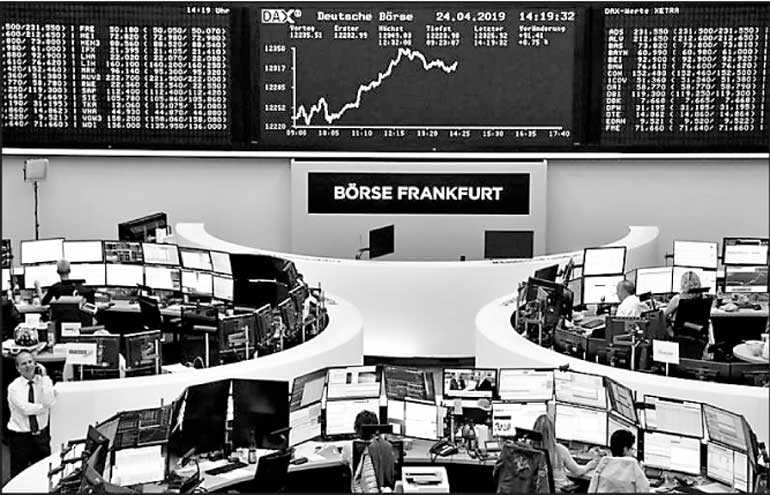

European stock markets bounced off six-week lows, with Germany’s trade-sensitive DAX index leading the charge with a 1% rise.

MSCI’s All-Country World Index, which tracks stocks across 47 countries, was up 0.2% after the start of European trading.

But the gauge was set for its worst weekly performance since late December 2018, with a loss of 2.75% as tensions on trade ratcheted up again between the U.S. and China.

U.S. President Donald Trump’s tariff increase to 25% from 10% on $200 billion of Chinese goods kicked in on Friday, and Beijing said it would strike back.

Top U.S. and Chinese negotiators are in talks to try to rescue a faltering deal aimed at ending a 10-month trade war between the world’s two largest economies.

The White House has said the two sides would resume negotiations on Friday morning in Washington after concluding the first of two days of talks on Thursday.

That has encouraged some investors to cling to hopes that the U.S. administration could revoke the new tariff hike once a deal is reached.

“In the short term, a renewed intensification of trade tensions between the United States and China could fuel further volatility and lead to temporary setbacks,” analysts at Credit Suisse.

“Still, we see recent developments as the United States strengthening its negotiating position in order to achieve a better deal, potentially later than expected.”

U.S. stock futures fell and Asian shares pared gains after the U.S. tariff hike, with investors worried that a protracted trade war could hamper global economic growth.

UBS Wealth Management cut its exposure to emerging market stocks late Thursday, changing its portfolio as the intensification of trade tensions took its toll on markets, the asset manager said in a note.

Trump also threatened on Thursday to take steps to authorize new tariffs on $325 billion in Chinese imports.

MSCI’s broadest index of Asia-Pacific shares outside Japan, which dropped more than 1% early Friday, remained where they were when tariff increase kicked in, up 0.3%.

Japan’s Nikkei was off 0.3%.

In currencies, the dollar was higher by 0.05% against a basket of peers. The Japanese yen was flat, having gained 1.2% this week. The euro was higher by 0.1% to the dollar.

Rising geopolitical tensions were also not helping markets.

North Korea fired what appeared to be two short-range missiles on Thursday in its second such test in less than a week and the United States said it had seized a North Korean cargo ship.

On Iran, Trump said he could not rule out a military confrontation after Tehran relaxed restrictions on its nuclear program in response to U.S. sanctions imposed following Trump’s withdrawal of the United States from the accord with a year ago.

The 10-year U.S. Treasuries yield stood at 2.454% near its lowest levels since late March.

Three-month bill yields stood at 2.456%.

The 10-year yield briefly fell below the shorter three-month yields on Thursday, stoking recession fears.

German 10-year government bond yields were headed for their biggest weekly fall in seven weeks in a sign that a ratcheting up in U.S./China trade tensions have exacerbated concern about the global growth outlook.

MSCI’s emerging market currency index also tumbled to a four-month low on Thursday.