Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Saturday, 8 June 2019 00:02 - - {{hitsCtrl.values.hits}}

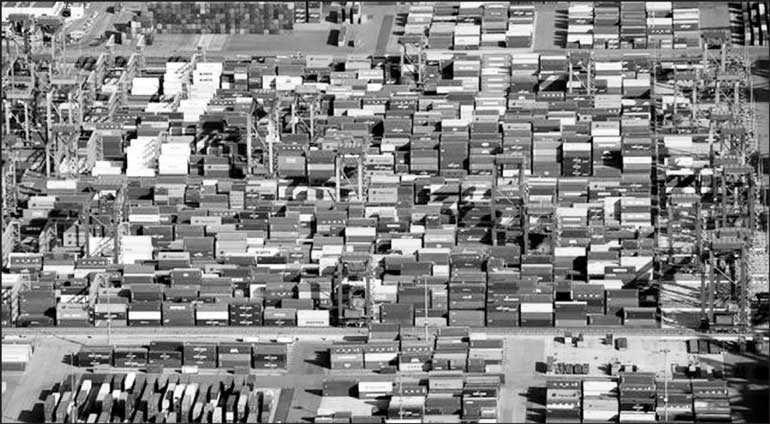

Aerial view of containers at a loading terminal in the port of Hamburg, Germany 1 August 2018 – Reuters

BERLIN (Reuters): Both German industrial output and exports fell more than expected in April, data showed on Friday, highlighting the vulnerability of Europe’s largest economy to headwinds from trade frictions and Brexit uncertainty.

Industrial output declined by 1.9% on the month, data from the Statistics Office showed. That was the sharpest drop since August 2015 and came as factories churned out fewer investment and intermediate goods. Economists had forecast a 0.4% fall.

Separate data showed exports dropping by 3.7% in April, also the biggest drop since August 2015.

The German manufacturing sector has been in recession for much of this year as unresolved trade disputes between the United States with both China and the European Union plus uncertainty linked to Britain’s expected departure from the European Union hurt the exports.

The economy is also cooling because of weaker growth in the euro zone and bottlenecks in the automotive sector resulting from stricter emissions standards.

The German economy has been relying on private consumption for growth as a solid labour market and low interest rates encourage spending. This has kept the services sector humming, providing impetus for the economy.

But the slowdown in manufacturing is starting to hurt the labour market and there are concerns this weakness could spread to the services sector. German unemployment rose for the first time in nearly two years in May.

“The fall in industrial production in April adds to the evidence that Germany has not shaken off the problems which hit it nearly a year ago, and suggests that the economy slowed sharply in the second quarter of the year,” Andrew Kenningham of Capital Economics wrote in a note to clients.

“German industry is still struggling with both domestic and external headwinds, including the weakness of global trade, slowdown in household consumption growth and regulatory confusion in the auto sector,” he added. “We don’t expect a sustained improvement anytime soon.”