Sunday Mar 01, 2026

Sunday Mar 01, 2026

Thursday, 30 April 2020 00:00 - - {{hitsCtrl.values.hits}}

Washington (Reuters): The US economy contracted in the first quarter at its sharpest pace since the Great Recession as stringent measures to slow the spread of the novel coronavirus almost shut down the country, ending the longest expansion in the nation’s history.

The decline in gross domestic product (GDP) reflected a plunge in economic activity in the last two weeks of March, which saw millions of Americans seeking unemployment benefits. The Commerce Department’s snapshot of first-quarter GDP on Wednesday reinforced analysts’ predictions that the economy was already in a deep recession.

“The economy will continue to fall until the country opens back up,” said Chris Rupkey, chief economist at MUFG in New York. “If the economy fell this hard in the first quarter, with less than a month of pandemic lockdown for most states, don’t ask how far it will crater in the second quarter.”

Gross domestic product declined at a 4.8% annualised rate last quarter, weighed down by sharp decreases in consumer spending and a drawdown of inventory at businesses. That was the steepest pace of contraction in GDP since the fourth quarter of 2008. A deepening downturn in investment by businesses was another major factor in the slump last quarter, helping to overshadow positive news from a shrinking import bill, the housing market and more spending by the government.

Economists polled by Reuters had forecast GDP falling at a 4.0% rate last quarter, though estimates were as low as a 15.0% pace. The economy grew at a 2.1% rate in the fourth quarter.

The Commerce Department’s Bureau of Economic Analysis (BEA) said that it could not quantify the full effects of the pandemic, but that the virus had partly contributed to the decline in GDP in the first quarter.

The BEA said “stay-at-home” orders in March had “led to rapid changes in demand, as businesses and schools switched to remote work or cancelled operations, and consumers cancelled, restricted, or redirected their spending.”

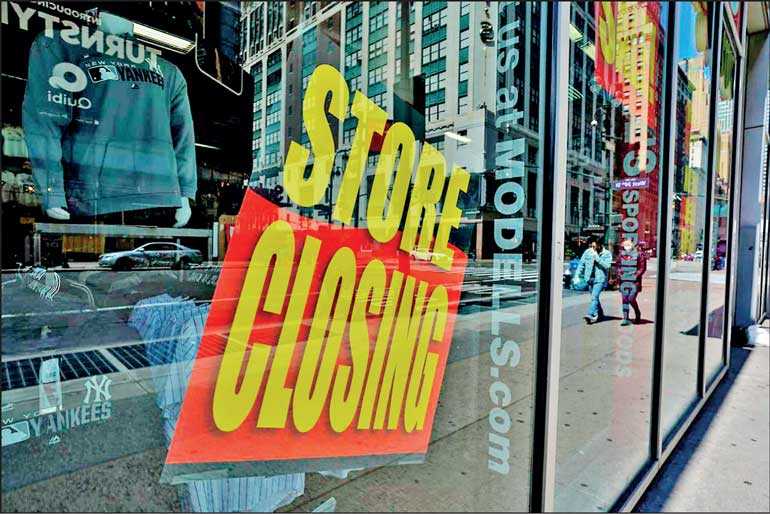

Many factories and nonessential businesses like restaurants and other social venues were shuttered or operated below capacity amid nationwide lockdowns to control the spread of COVID-19, the potentially lethal respiratory illness caused by the virus. The sharp contraction in GDP, together with record unemployment, could pile pressure on states and local governments to reopen their economies.

It could also spell more trouble for President Donald Trump following criticism of the White House’s initial slow response to the pandemic, as he seeks re-election in November. Confirmed US COVID-19 infections have topped one million, according to a Johns Hopkins University tally.

US stock index futures shrugged off the GDP report, rising after Gilead Sciences (GILD.O) said its experimental antiviral drug met the main goal of a trial testing it in COVID-19 patients. The dollar fell against a basket of currencies, while US Treasury prices were mixed.

The US Congress has approved a fiscal package of around $3 trillion and the Federal Reserve has cut interest rates to near zero and greatly expanded its role as banker of last resort, but economists say these measures are inadequate. Fed officials were wrapping up a two-day policy meeting on Wednesday.

Economists also did not believe that reopening regional economies, as some states are now doing, would quickly return the broader economy to pre-pandemic levels, which they said would take years. Reopening the economy also involves the risk of a second wave of infections and further lockdowns.

Economists expect an even sharper contraction in GDP in the second quarter and believe the economy entered recession in the second half of March when the social distancing measures took effect.

Consumer spending, which accounts for more than two-thirds of US economic activity, tumbled at a 7.6% rate in the first quarter, the sharpest decline since the fourth quarter of 1980, as demand for both goods and services plummeted. Consumer spending grew at a 1.8% pace in the October-December period.