Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 24 July 2020 00:20 - - {{hitsCtrl.values.hits}}

More than 100 days have passed since the outbreak of COVID-19 in Sri Lanka, the circumstances continue to change. Companies will require to be agile and respond to the new market conditions to stay resilient and current.

“As business leaders navigate the crisis and its aftermath, the role of employees and HR functions in shaping the organisational response to the emerging market trends cannot be overstated. People and HR functions are both critical to the organisation’s continuity, resilience and capacity to reimagine its future for the new normal,” stated Ernst & Young Sri Lanka and Maldives Partner and Consulting Leader Arjuna Herath commenting on the study on Sri Lankan Market Trends conducted by EY Sri Lanka recently.

The survey, capturing the responses of over 200 organisations – representing a workforce of over 250,000 across 12+ sectors, captured the business and HR challenges faced by organisations amidst the COVID-19 crisis, how they have responded to these challenges and the future prospects in terms of the overall business direction and management of Human Resources in the ‘new normal’, to help business leaders and Chief Human Resources Officers (CHROs) reimagine the pivotal role of HR in helping organisations transition into the ‘new normal’.

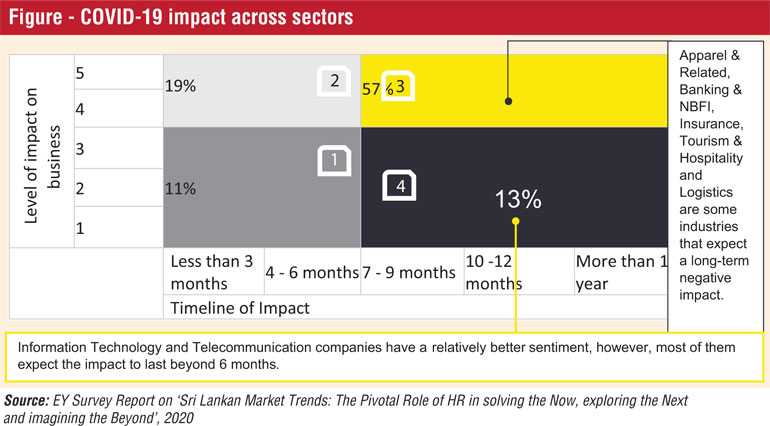

Business continuity being the most critical challenge posed by the crisis for organisations world over, 57% of the survey respondents anticipate a high negative business impact that is presumed to last for over six months whilst, the tourism and hospitality, apparel and related sectors re-affirmed the impact on their businesses to last for almost 12 months. The respondents in the automotive and construction sectors predict the impact to last for about five-six months which is the shortest period the participants believe the impact would last.

To manage and mitigate the business impact, almost all respondents indicated that they have been compelled to enforce short to medium-term changes to their HR plans in the form of controlling workforce numbers or compensation, while implementing various other cost optimisation measures across the business.

Hard decisions have been taken to reduce the size or remodel the shape of workforces and how they are remunerated, to match business and liquidity demands.

The study depicted 92% of organisations as having taken some form of measure in relation to managing staff count, whilst ‘Freezing of Recruitment’ was seen to be the most common practice adopted, representing an overall 89% of all respondents across most sectors.

While construction, telecommunications and the tourism and hospitality sectors respectively had the highest number of respondents having imposed ‘termination of contract staff’, this may also be in proportion to the number of contract staff these sectors employ. Respondents from diversified companies, logistics and the healthcare sectors had indicated retention of almost all contract staff, at the time of this study. Few respondents, predominantly those in the telecommunications sector, also signalled to opt for other ways of managing headcounts, such as reviewing post-retirement extensions and short-term staff engaged in projects.

Herath also stated, “Although organisations both global and local, have adopted numerous rigorous measures, much like salary cuts, furloughs and layoffs, to either improve current cashflows and bottom line or to protect future cashflows and bottom line, it is apparent that these actions must be imposed alongside due consideration to the overall business impact. Therefore, review of policy and regulatory guidance is of utmost importance now more than ever, to ensure just and fair practices.”

The survey revealed that 82% of respondents were compelled to impose measures around compensation and benefits, to curtail liquidity pressures during the height of the pandemic as well as to protect future cashflows. While paycuts were predominant in the apparel, tourism and hospitality, construction and diversified sectors, reduction in allowances and other forms of benefits was prevalent across all sectors.

CHROs and their teams have been at the forefront in implementing these measures, while meeting their agenda starting with crisis communication and employee safety, then quickly extending to enabling remote work and maintaining productivity. However, gaps in understanding and readiness to adapt to the almost-overnight enforced ‘Work from Home (WFH)’ guidelines, surfaced many HR challenges of its own.

Nearly 50% of organisations indicated in the survey that they found WFH unsuitable for a majority of job roles in their organisations, considering the nature of work performed and 65% of organisations had to contend with the challenge of depleting staff engagement and motivation levels.

Yet for all, to allow the practice of social distancing post-lock down, WFH is expected to continue at varying levels. Thus, the study underlines the pivotal role of HR professionals to help counterbalance both the favourable outcomes and its downsides.

Herath further stated, “Successfully returning to the physical workplace is the priority. Yet, safety of our people comes first and organisations that put people at the centre can win the trust that will define true resilience in a post-COVID world. Organisations must protect, enable and support teams as they lead through crisis, establishing resources for safety and crisis management and keeping dialogue active is critical.”

In this context, EY introduced its Remote Working Index’ (EY RWI) – a scientific tool to help organisations gain an aggregated and granular view of the remote working propensity of activities and roles, in determining who returns to work and what can continue to be done remotely to achieve sustainable benefits. The EY tool has been adopted by numerous large to medium scaled clients across regions.

As organisations navigate through the conditions of the present, what increasingly becomes apparent is that ‘the impact of the outbreak will linger’. To this effect, EY Enterprise Resilience Tool launched during the early stage of the global pandemic, with variations later launched, supports clients through today’s challenges as they adapt their operations and increase their resilience.

On a brighter note, new business opportunities are continuing to emerge post-COVID-19. The survey found 69% of organisations having identified unforeseen opportunities that they intend to explore beyond the crisis.

It was further observed that nearly all respondents in the banking and NBFI, apparel and related, logistics, consumer products and retail sectors have identified unforeseen opportunities during the crisis that they intend to explore. An overall 60% of respondents exploring future proof business avenues to identify sustainable business models, led by the Banking and NBFI sector, Information Technology sector and Diversified Groups may justify the 70% of Banking & NBFI and Insurance sector respondent’s indication to strengthen budgets on technology for business and process optimisations. Thus, the role of HR becomes even more pivotal in helping them transition into the ‘new normal’ and build the required skills among their workforce to meet their new demands.

As leaders plan for life beyond the pandemic, building a human-centred approach to improving enterprise resilience may not only drive a faster recovery but allow organisations to emerge stronger than ever. Chief human resource officers (CHROs) must integrate with the other functions to coordinate a trusted, humans-at-centre response, ensuring leadership support. To manage and mitigate the impact on workforces amidst the disruptive business trends, CHROs must take immediate action – ‘Now’ is an opportunity to actively shape a successful future, not just to protect what worked in the past – start planning now for what comes ‘Next’; and start thinking about what lies ‘Beyond’.