Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 19 December 2019 02:17 - - {{hitsCtrl.values.hits}}

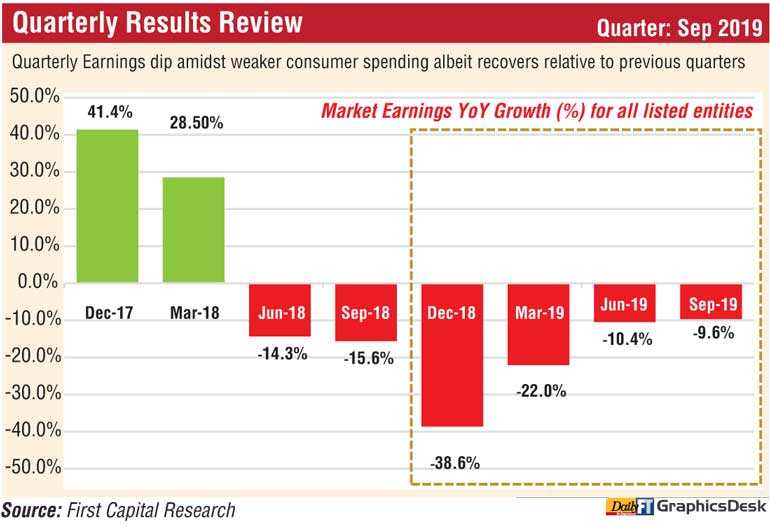

First Capital Research yesterday said September quarter earnings declined by 9.6% year-on-year (YoY) to Rs. 45.8 billion for 264 companies, but still showed better performance than previous quarters.

September quarter earnings dipped by 9.6% YoY to Rs. 45.8 billion, primarily due to sluggish performance in Insurance (-48% YoY), Consumer Services (-495% YoY), Capital Goods (-39% YoY) and Food, Beverage and Tobacco (-12% YoY) sectors, a report released by First Capital Research said. However, earnings upside was witnessed in Material (108% YoY), Consumer, Durable and Apparel (13600% YoY) and Energy (646% YoY) sectors negating the negative performance in the above-mentioned sectors.

“Lacklustre performance in Insurance, Consumer Services and Food, Beverage and Tobacco was mainly owing to the lower consumer spending stemmed from subdued economic activities.”

Insurance sector earnings recorded a substantial drop mainly due to earnings decline in AAIC (-85% YoY) from a deferred tax adjustment and UAL (-91% YoY) due to the increased transfer of insurance contract liabilities to the life fund.

Consumer Services sector earnings declined and posted a loss of Rs. 1.67 billion relatively to a profit of Rs 0.4 billion in September 2018 as a result of drop in tourist arrivals subsequent to the Easter Sunday attacks. Food, Beverage and Tobacco sector earnings dipped by 12% YoY to Rs. 7.8 billion led by BIL, MELS and tea plantation companies.

BIL posted a loss of Rs. 1.19 billion compare to loss of Rs. 0.6 billion due to higher finance and admin cost. MELS earnings dropped by 58% due to hefty taxes while the cost of sales also surged against the last year same period. Profit dip witnessed across the tea plantation counters due to weaker tea prices further dragged down the Food Beverage and Tobacco sector earnings.

Material sector saw a profit growth of 108% YoY to Rs. 1.8 billion driven by TKYO (573% YoY). TKYO profits were boosted due to operational efficiencies and increase in maximum retail price. Consumer, Durable and Apparel sector saw impressive earnings growth of 13600% YoY with TJL, MGT and GREG posting earnings growth of 84%, 83%, and 184% respectively. TJL and MGT earnings growth was supported by efficiency improvements, strong order book and stable cotton prices.

Energy sector posted a strong earnings growth of 646% YoY in profits as a result of turnaround in LGL which posted earnings of Rs. 17 million relative to Rs. 305 million loss posted in Sep 2018 and improved performance in LIOC due to higher focus on bunkering, lubricant operations and export market.