Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 1 February 2019 00:05 - - {{hitsCtrl.values.hits}}

By Uditha Jayasinghe

The 12-member Committee appointed by President Maithripala Sirisena has recommended the Government re-embark on finding a strategic partner for debt-ridden SriLankan Airlines by focusing on debt restructuring, and expand internal capital generation to improve its odds of finding an investor.

|

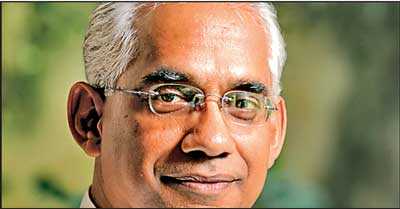

| State Minister of Finance Eran Wickramaratne |

The Committee handed over its report, which was compiled in just two weeks, to President Sirisena on Tuesday.

State Minister of Finance Eran Wickramaratne, who headed the Committee, told reporters the members had only made policy-level recommendations, as there were time limitations. He noted President Sirisena had accepted the report and indicated he would adopt it. President Sirisena had also said he would gazette the national carrier to the appropriate Ministry next week.

“If the President decides to take up the report, then it can be presented to Cabinet and the SriLankan Airlines board can adopt it for implementation,” Minister Wickramaratne said.

SriLankan Airlines accumulated operational losses of Rs. 145 billion from 2012 to 2017, which is significantly higher than the Rs. 74 billion lost by the Ceylon Electricity Board (CEB), Rs. 42 billion lost by Ceylon Petroleum Corporation, and Rs. 29 billion lost by the Sri Lanka Transport Board (SLTB) during the same period. Overall losses of SriLankan were estimated by Minister Wickramaratne to be in the range of $900 million to $1 billion, with losses for the 2017/2018 financial year alone amounting to about $185 million.

While acknowledging there is little financial basis for allowing SriLankan Airlines to operate, Minister Wickramaratne nonetheless argued that SriLankan Airlines does provide economic benefit by transporting about one-third of tourists to Sri Lanka. In 2018, over 2.08 million tourists arrived in Sri Lanka, and Wickramaratne contended that synergies could be built by linking the national carrier with the tourism industry.

“The Committee discussed three options for SriLankan Airlines. The first was closure and start-up, which the companies has done before, as it evolved from Air Ceylon to Air Lanka, and done it successfully. However, some experts have pointed out that closure in itself will be very expensive, and would need a legal framework. The Government would need to introduce a bankruptcy law or Chapter Eleven law as done in some countries for this to be possible.

“The second is having a management contract, which we believe would be positive, because it would enable the Government to retain ownership but also reduce losses. The third was debt restructuring and international capital generation, which would make the venture more attractive to a strategic partner. However, the Committee does not recommend restructuring but has left it to the Board of Directors to decide on,” Wickramaratne said.

The Committee, while recommending the third option, had also said they were open to a strategic partner who would preferably not be a competitor. Minister Wickramaratne said they were open to a Sri Lankan entity becoming an investor, and also welcomed investment into SriLankan Catering, ground handling and possibly the engineering division as well. A strategic partner would get a 49% stake in the national carrier.

“SriLankan Catering and ground handling are profit-making entities. The engineering segment also has potential to become a separate subsidiary. Investment into these segments could improve profits and allow for regional expansion. Such an increase in internal capital generation would make SriLankan Airlines a more attractive prospect for an investor, as the Government has limited space to absorb debt from the airline,” he said.

The Minister, responding to questions, said reports compiled by several consultancy firms including Skyworks and Nyras of UK, hired in 2018 to carry out a strategic options review of viability and opportunities for SriLankan Airlines, were not included in the Committee report, as they dealt with operating issues and not policy concerns.

In 2016, private equity firm TPG and fund company BlackRock were among half a dozen firms which showed preliminary interest in a 49% stake in the airline, but efforts to offload SriLankan were unsuccessful.