Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 26 August 2019 01:15 - - {{hitsCtrl.values.hits}}

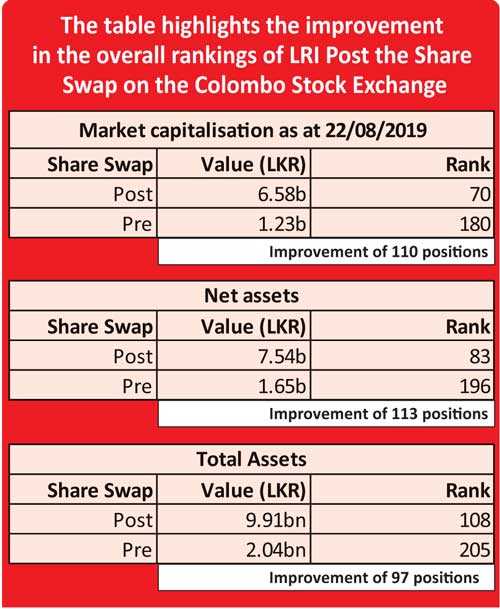

Lanka Realty Investments Plc (LRI) has recently concluded the largest-ever acquisition share swap worth Rs. 5.6 billion.

LRI boasts of commercial operations spanning over five decades. In October 2017, LRI was acquired by a consortium of British and Sri Lankan investors with the aim of becoming the largest real estate company listed on the Colombo Stock Exchange (CSE). Subsequent to the acquisition, LRI carried out a rights issue raising Rs. 632.9 million in October 2018 and recently concluded a Rs. 5.6 billion share swap for the acquisition of the entire shareholding in six privately-held companies which have exposure to the commercial property, affordable housing and tourism and leisure sectors, thus expanding the Group’s overall real estate exposure. Through the Share Swap LRI issued 149,179,853 ordinary voting shares of the Company at an issue price of Rs. 37.52 per share to the shareholders of the 6 private companies in return for their shares in these 6 companies.

Post the Share Swap, LRI Group has 11 subsidiaries and three sub-subsidiaries with business interests in commercial property, affordable residential property, real estate land banks, leisure and manufacturing. The Group holds 8.4 acres of freehold land in Colombo with planning permission for the development of 1,649 residential units, a circa 100,000 sq. ft office building in Colombo 10, three operational boutique hotels and villas in Colombo, Weligama and Ahangama with 44 rooms, two leisure sector development projects under construction for 30 rooms in Yala and 53 rooms in Ambalangoda and two companies operating in the manufacture of construction material.

The recently-concluded acquisition is expected to boost foreign investor interest in LRI due to the opportunity it provides by acting as a platform for foreign investors to participate in real estate investments in Sri Lanka which is restricted in unlisted companies as per the Land (Restrictions on Alienation) (Amendment) Act No. 21 of 2018. Furthermore, the blend in terms of operational, development and land banked assets is expected to further enhance returns to the investors in the LRIGroup.

LRI Executive Director Hardy Jamaldeen said: “These acquisitions have paved the way for LRI to embark on the next phase of growth and we are eager to execute the plans that we have to set-out at the beginning of this exercise. We are excited and optimistic about what the future has in store for this company and are relentless in the pursuit of positioning ourselves as the largest asset backed income generating real estate holding company in the country.” Acuity Partners Ltd., a leading investment bank, acted as Manager and Financial Advisor to the Share Swap/Private Placement, thereby guiding the Group through the entire process.

Its Managing Director Ray Abeywardena said: “It was a pleasure to work on this transaction with LRI which is expected to be a catalyst towards increasing investor interest on Sri Lanka as well as the Colombo Stock Exchange. This is one of the largest share swaps carried out by a listed entity in the recent past. Despite the significant size of this transaction, Acuity was able to work alongside the LRI senior management to take this transaction through to a successful conclusion.”

“Our expertise and past experience in carrying out transactions of this nature both on and off the market such as the Private Placement of Vallibel One PLC where we raised Rs. 4.9 billion within one day gave us the confidence of our ability to successfully complete this transaction. We thank the directors of LRI for the confidence placed in Acuity’s capabilities,” Abeywardena added.