Thursday Feb 26, 2026

Thursday Feb 26, 2026

Friday, 23 November 2018 00:00 - - {{hitsCtrl.values.hits}}

With the international borrowing cost likely to be higher following the downgrade by Moody’s, the Sirisena-Rajapaksa administration is looking inwards as the first option to raise much-needed cash.

National Economic Council Secretary General Prof. Lalith Samarakooon told journalists yesterday that three state banks - NSB, Bank of Ceylon and People’s Bank - will raise $ 1 billion locally and overseas via the issuance of Sri Lanka Development Bonds (SLDBs).

“The plan is to raise up to $ 1 billion by the consortium of these three banks in addition to the $ 650 million or so we have in the GST account in the Central Bank,” he added.

“Obviously when the credit rating has been downgraded it can have an impact on the cost of borrowing. The yield that the investors will demand could potentially go up, so that would lead to a higher cost of borrowing at this particular moment in time,” Prof. Samarakoon told the media.

“We have arranged certain other financing options, including the leftover money from the Hambantota Port, NSB, People’s Bank and Bank of Ceylon, raising $ 1 billion through Sri Lanka Development Bonds, China Development Bonds and swap agreements between multiple countries,” he added.

“These alternative financial sources we are trying over the next several months will enable us not to go to the global market at this point in time and if conditions actually become unfavourable,” he opined.

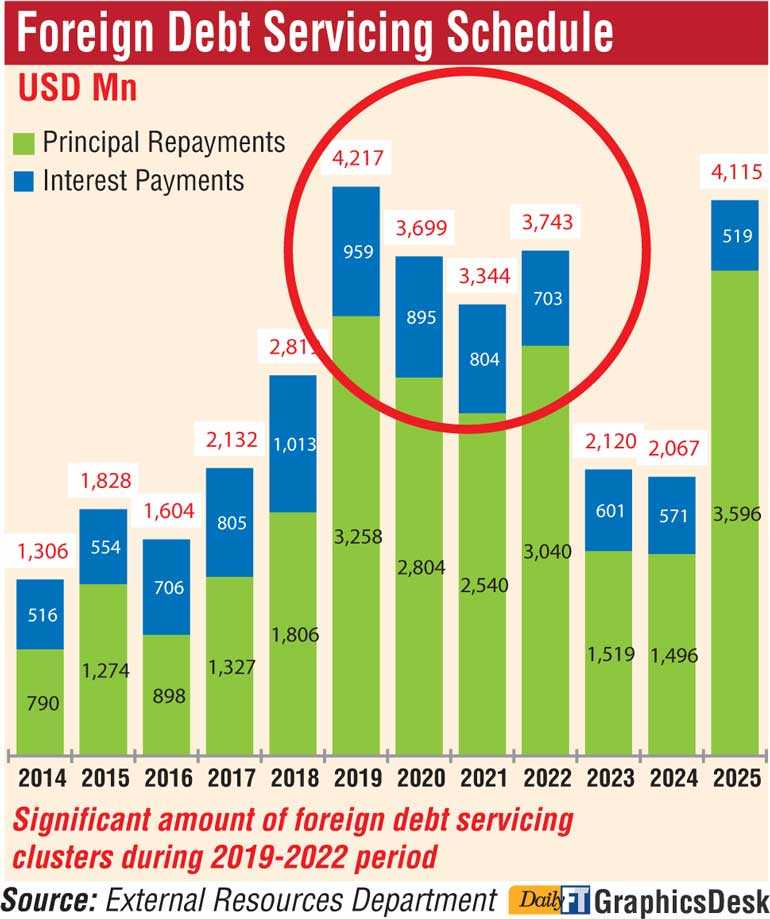

“We have sovereign bonds which are maturing in early 2019 to the tune of $ 1.5 billion and I must say that we already have $ 650 million left over from the Hambantota transaction lying in the accounts at the Central bank,” he said.

“As a responsible Government, financing is always important in terms of lower cost, therefore if the cost of financing goes up due to the political situation of the country, then the Central Bank will wait till conditions are favourable in order to raise money through international sovereign bonds, if at all,” the NCE Chief explained.

Moody’s Investors Service on Tuesday downgraded Sri Lanka’s foreign currency issuer and senior unsecured ratings to B2 from B1 and changed the outlook to stable from negative.

Prof. Samarakoon said that the changed outlook was based on two things - they think that there is a heightened refinancing risk in a period of further tightening of financial conditions worldwide.

“We are expecting the US Treasury to increase interest rates in December and further at least three times next year. Therefore there is this idea that financial conditions outside of Sri Lanka could be tighter when financial conditions become tighter. Moody’s believes Sri Lanka will have difficulty in raising funds outside of the country,” he explained.

“And secondly, the slower pace of fiscal consolidation. However, I must point out yesterday we were able to brief the Cabinet along with Secretary to the Treasury and Central Bank Governor of the conditions facing Sri Lanka,” he added.

Prof. Samarakoon also assured that all of Sri Lanka’s debt obligation will be honoured and the Government will maintain fiscal discipline in the medium term.

“We have the capacity, more than adequate capacity, to pay the debt obligations as they come to view,” he said.

“There is no intention to deviate from our fiscal discipline either, which we have agreed with the financial institutions in our medium-term framework. To the extent there are minor deviations in terms of revenue shortfalls or increase in expenditure, we will be able to maintain the targets,” he added.