Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 27 July 2020 03:15 - - {{hitsCtrl.values.hits}}

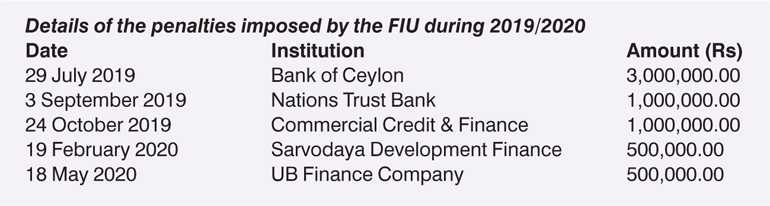

The Financial Intelligence Unit (FIU) has fined five firms for the failure of doing proper customer due diligence.

Penalties amounting to Rs. 6 million were imposed mainly on the violations of Financial Institutions (Customer Due Diligence) Rules No. 1 of 2016 in relation to third party deposits, obtaining approval for Politically Exposed Persons (PEPs), sanctions screening and financial transaction reporting under Section 6 of the FTRA.

The five financial institutions are Bank of Ceylon, Nations Trust Bank PLC, Commercial Credit & Finance PLC, Sarvodaya Development Finance Ltd., and UB Finance Company Ltd.

By virtue of the powers vested under Section 19 (1) read together with section 19 (2) of the Financial Transactions Reporting Act No. 06 of 2006 (FTRA), financial penalties can be imposed on Institutions for non-compliance with the provision of the FTRA. The penalties may be prescribed taking into consideration the nature and gravity of relevant noncompliance of the Financial Institution or the Designated Non-Finance Business (DNFBs).

As the regulator for Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) in the country, the FIU imposed penalties, as a sum total of Rs. 5 million for the year 2019 and Rs. 1 million up to 31 May to enforce compliance on Financial Institutions.

The Monetary Board of the Central Bank of Sri Lanka at its meeting dated 1 2020 decided to publish the penalties imposed on the financial institutions by the FIU in order to improve the AML/CFT compliance level in the country.