Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 16 October 2017 01:08 - - {{hitsCtrl.values.hits}}

The popular publication house Global Capital has named Dr. Indrajit Coomaraswamy the Central Bank Governor of the Year, South Asia.

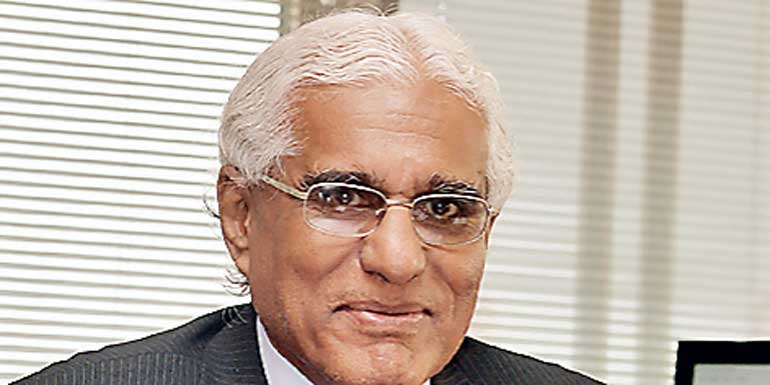

Central Bank Governor Dr. Indrajit Coomaraswamy

D r. C o o m a r a sw a m y was felicitated at Global Capital Markets Awards ceremony in Washington DC over the weekend on the sidelines of the World Bank-IMF Annual meetings.

The article dedicated to the award on the global capital website has been titled ‘Cool, calm and collected approach to central banking’. In the article the Central Bank Governor has said: “We are… creating the robust macroeconomic fundamentals necessary for accelerating growth and employment generation.”

The 30-year-old Global Capital is a leading news, opinion and data service for people institutions using and working in the international capital markets.

Following are excerpts of the article in global capital written by Elliot Wilson.

South Asia is awash with highly capable central bank chiefs, yet Indrajit Coomaraswamy fully deserves this award for his unstinting professionalism and for ushering his country through some choppy waters over the past year.

Sri Lanka is in a strange position. On the one hand, foreign investment is flooding in as are tourists, with inward arrival numbers at a record high in 2016. Yet on the other hand, this is a highly friable economy struggling to deal with rising national liabilities (its public debt-to-GDP ratio is the highest in the region), a fragile currency and a narrow tax base — though a recently passed bill aimed at simplifying the tax structure and widening the tax base should help to tackle the last of those issues

In light of all of such challenges, the central bank’s ability to keep calm and carry on has been admirable. In an interview with GlobalMarkets, Coomaraswamy says establishing a flexible inflation targeting regime has successfully kept a lid on prices over the past year, with consumer inflation up 6% year-on-year in August but tipped by the central bank to settle at around 5% by the end of the yearEscaping the past

Improved modelling and better accountability and legal frameworks, he says, have created the conditions for a proactive monetary policy, ensuring that “interest rates will be insulated from the fiscal forbearance of the past, which made Sri Lanka a classic stop-go economy with recurring balance of payments crises and bouts of high inflation”.

A data-driven approach to policy meanwhile has enabled the central bank to “keep interest rates fairly stable while containing pressure on prices and the current account of the balance of payments”.

At a meeting on September 26, the central bank kept its key rates steady, saying inflation and private growth were under control. Coomaraswamy hopes that having got the basics right the central bank can begin to lay the foundations for a stronger economy capable of supporting an ambitious and growing middle class. “We are… creating the robust macroeconomic fundamentals necessary for accelerating growth and employment generation,” the central bank chief says, adding that keeping the nation’s public finances in order will “provide the space for credit creation to support private sector activity”.

But there remains much to do. Coomaraswamy admits the debt situation remains “challenging” but is confident it can be handled “in a manner that does not disrupt” the creation of fresh growth and new jobs.

A fiscal consolidation programme aimed at cutting the budget deficit to 3.5% of GDP by 2020 will, he adds, generate primary surpluses in fiscal assets from the start of 2018. Sri Lanka has many problems but also many positive assets and attributes. Its cool, calm and collected central bank chief is certainly one of them.