Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 20 March 2019 00:20 - - {{hitsCtrl.values.hits}}

The Central Bank yesterday insisted that it has followed transparency procedures and due process when issuing International Sovereign Bonds (ISBs) and that the interest rates were according to market standards.

With reference to the recent paper articles on the governance process and issuing yields relating to the 5-year and 10-year International Sovereign Bonds (ISBs) issued by the Central Bank of Sri Lanka (CBSL) on behalf of the Government of Sri Lanka (GOSL), the CBSL wishes to make the following clarifications:

nThere has been a clear operational procedure adopted by CBSL for the issuances of ISBs since 2007, involving the Office of the President, the Ministry of Finance (MOF), the Monetary Board of the Central Bank of Sri Lanka, the Cabinet of Ministers, and the Attorney General’s Department.

nISB issuance process is led by a Cabinet appointed Steering Committee (SC) consisting of officials from the MOF and CBSL, supported by a Cabinet appointed Technical Evaluation Committee (TEC) consisting of officials from the MOF and CBSL, and a lead manager or joint lead managers selected based on a competitive evaluation process and duly approved by the Monetary Board and the Cabinet of Ministers. Discussions at SC and TEC are properly minuted and all decisions of SC are subject to the approval of the Monetary Board and the Cabinet of Ministers.

nISBs are issued under the law of the State of New York. In addition to the Attorney General’s Office, there are two international legal counsels and two local legal counsels appointed with the prior approval of the Cabinet of Ministers in relation to the issuance process. All the documents relating to the issuance of ISB are subject to the prior approval of the said legal counsels and final approval of the Attorney General’s Office.

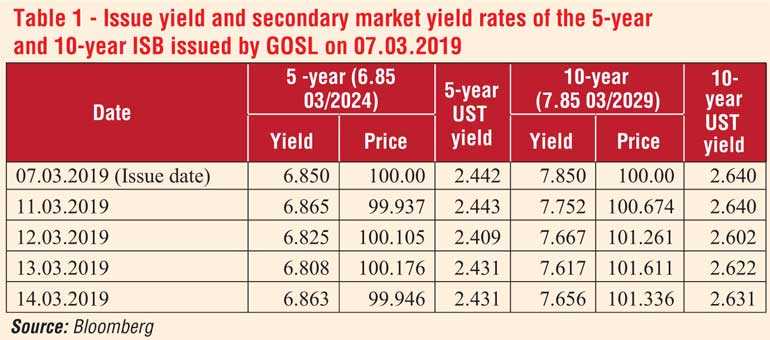

nISBs are issued at a fixed yield (coupon) rate and at par value. Target yield of the ISB on the issue is arrived by looking at the benchmark risk free rate, the secondary market fair value, new issue premium, prevailing international capital market conditions, other sovereign issuances by emerging and frontier market economies and the yield rates of bonds with similar tenure issued by GOSL, at the time of the issuance of the new ISB. At the announcement of the issuance of a new ISB, an initial yield rate guidance, also known as initial price guidance, is made to the market. The initial yield guidance is made marginally higher than the target yield of the ISB being issued in order to attract investors for the bond being issued and order book building. However, towards the pricing of the ISB, the final yield guidance, usually the targeted yield, is announced and some of the bidders usually withdraw their bids owing to the lower final yield guidance.

nThe secondary market transactions of a new ISB commence on the next available trading day, just after the ISB pricing day. If there were no substantial post issue developments affecting the secondary market yield rates in the international bond market, secondary market trading yield would be an indication whether the final yield guidance was fair for both the issuer and the investors.