Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 6 August 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

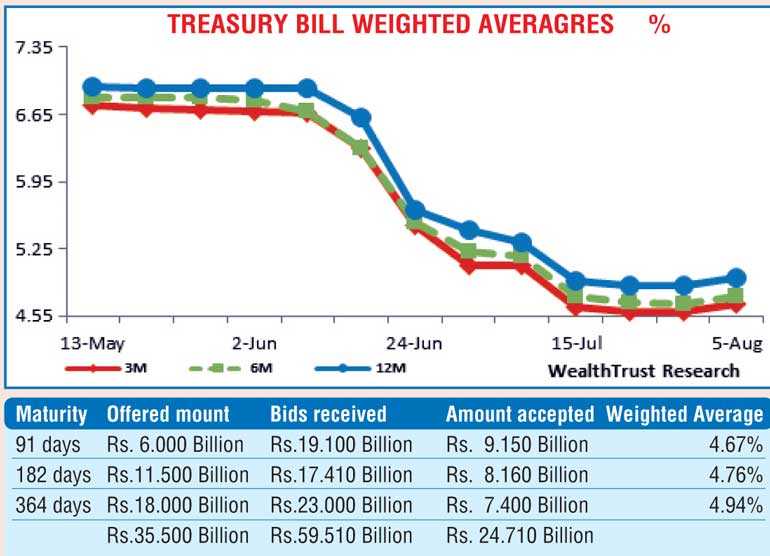

The weighted average yields at the weekly T-bill auction conducted yesterday were seen increasing, with the market favourite 364 day maturity rising by 08 basis points to 4.94%, for the first time in 21 weeks. The 91 day bill and 182 day bill weighted average rates increased by 08 basis points as well to 4.67% and 4.76%. Once again, the total accepted amount of Rs.24.71 billion fell short of the total offered amount of Rs.35.5 billion, with the bids to offer ratio increasing to 1.68:1.

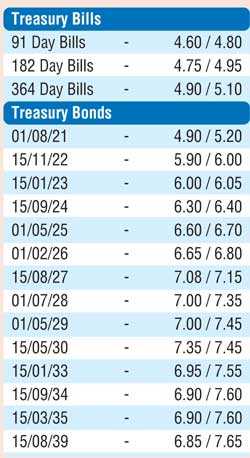

Activity in the secondary bond market moderated yesterday, with limited volumes of the 01.09.23 and 01.08.25 changing hands at 6.20%and 6.68%. In the secondary bill market September 2020, November  2020 and January 2021 bills were traded at levels of 4.70% each and 4.80% respectively prior to the auction.

2020 and January 2021 bills were traded at levels of 4.70% each and 4.80% respectively prior to the auction.

The total secondary market Treasury bond/bill transacted volumes for 4 August was Rs. 4.15 billion.

In money markets, the weighted average rates of overnight call money and repo’s stood at 4.53% and 4.55% respectively, with the liquidity surplus increasing further to Rs. 157.94 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day at Rs. 185.46/54 against its previous day’s closing level of Rs. 185.50/55 subsequent to trading at levels of Rs. 185.50 to Rs. 185.51.

The total USD/LKR traded volume for 4 August was $ 77.04 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)