Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 19 July 2019 00:00 - - {{hitsCtrl.values.hits}}

By Thanushka Jayasundera

If you’re a retail client, SME, a large conglomerate, or even a multinational and if you have attempted to raise funds from a bank, chances are you have heard the term AWPR, as the relationship manager will always undoubtedly say ‘AWPR is “x%” hence we’re lending to you at this rate’.

AWPR provides information on the rate most top-end clients can raise funds in Sri Lanka. However, it is important to remember that AWPR is not a benchmark like SLIBOR, but only a reference rate such as CCPI.

How is it calculated?

Each bank submits their AWPR rate every Friday by 12 noon to the Central Bank. To do this, each bank looks at all clients who have borrowed more than Rs. 10 million from the previous week’s Friday morning to the current week’s Thursday end of day.

Then this set of data is filtered for the lowest rate granted to sort the 10 clients who enjoyed the lowest interest rate during the week for their short-term (less than 3 months) funding. A weighted average is arrived at based on the amount borrowed and this weighted rate is submitted to Central Bank as AWPR.

What does AWPR say?

The lowest interest rates are offered to the best clients of the bank. These are the clients who enjoy an edge over the bank when it comes bargaining for funding. These are the clients who have very high credit ratings and a very stable business model. Hence the credit profile of lending to such clients is not very different to lending in the interbank market.As such, the margin between the AWPR rate and the Standing Lending Facility Rate (SLFR) of Central Bank, inflation rate, 3 month T-bill rate, Average weighted deposit rate are good indicators on the perceived risk of the real sector economy or the risk appetite of the banking system. For sustained economic acceleration, the AWPR rate should be within at least 100 basis points or 1% of the 3 month SLIBOR or 3 month T-bill yield. This is assuming that the bank funded the short-term lending by either borrowing in the interbank market or selling one of its short-term bills.

Further, it also reflects the ability of the Monetary Board to ensure that credit is available to the real sector of the economy at a reasonable rate which can fuel economic growth. If the margin on AWPR is high, it becomes difficult for the real sector to be competitive.

Cost of Funds (COF) Rate

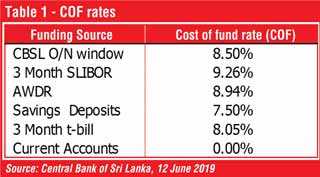

The weighted average rate at which the short- and long-term capital markets in the country can raise funds is the COF rate of the economy. When it comes to short-term funding, COF rates are as shown in Table 1.

The monetary sector can either borrow from CBSL at SLFR, or borrow from the interbank market or liquidate T-bills if they are short of funds to facilitate short term lending. In such an event, the rate charged from the real sector would be the applicable COF rate in the above table + the bank’s margin.

Similarly, the monetary sector can fund short term lending via their behaviouralised savings deposits, Current A/C balances or from weighted average cost of all deposits (AWDR). In such an event, the rate would be the applicable COF rate in the above table + the bank’s margin.

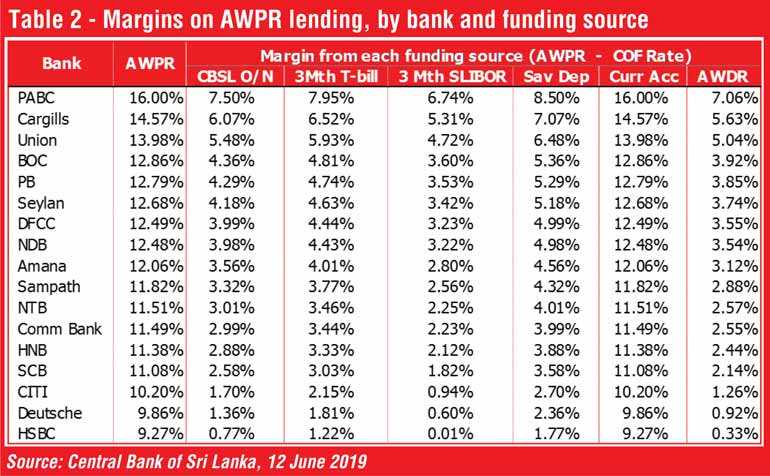

Each bank’s margin on AWPR

Table 2 shows the margin each bank enjoyed on their AWPR lending, from the respective funding source. As per the table, PABC enjoys the highest margins over AWPR lending. While HSBC and Deutsche Bank accommodate the lowest. This is either as a result of PABC having a high-risk appetite, hence even their top-end clients being very high-risk clients, who cannot source funds at a lower rate, or PABC’s internal structures being cost inefficient, hence they’re forced to keep a large margin on their lending.

While HSBC and Deutsche have a very low-risk appetite, hence service to a set of clients who have very low credit risk.

No bank accommodated a margin less than 1% from their top end clients as at 12 June 2019, except the foreign banks. Banks lend among themselves on an overnight basis within the boundaries of 7.5% - 8.5%. Which means in an ideal scenario, the most creditworthy clients should be able to borrow at least within the boundaries of 8.5% - 9.5%.

However, the minimum margin maintained was by HNB, that of 212 basis over 3 month SLIBOR, which is a very high margin.

Benefits of low AWPR

Economic growth is the increase of production in goods & services. For this increase in production to be possible, entrepreneurs, inventors, and investors need to be able to raise funds at a rate lower than their expected return rate.

E.g. - Let’s assume that an entrepreneur wants to establish a solar panel factory in Sri Lanka. He believes that by selling solar panels to local clients will earn him a return of 15%.

However the AWPR is 10.97% (12 July 2019). Which means it is not worthwhile to undertake this project, as the funding cost is more than 2/3 of the return rate. Once operational costs and risk of the project is taken into account, the project is not worthwhile.

Same applies for inventors who wish to commercially sell their inventions, or an investor who wishes to invest in the stock market. Hence it is very important that the real sector is given an opportunity to borrow at a rate that is reflective of the risk of the economy, and the returns the economy can generate. When you have very high margins in lending rates, only investments which enjoy an inelastic demand or economic bubbles will succeed. However if you have reasonable real rates, such rates will lubricate credit flow to projects that will create sustainable economic growth.

Further, low lending rates will reduce the non-performing loan ratios for the banking industry. Provided the monetary sectors credit assessment mechanisms are robust, low interest rates will increase the credit servicing capability of the borrowers. This will lead to low NPL ratios in the long run for the banking industry, increasing the stability of the monetary sector.

AWPR is only a reflection of probably the top 100 clients in the country. Everyone else in the country has to borrow at much higher rates. Such higher rates become unbearable over a period of time and create a significant portfolio of bad debts. This can be seen in the monthly AWLR rates.

The AWLR is calculated based on interest rates of all outstanding loans and advances extended by commercial banks to the private sector. AWLR was 14.48% as at end May 2019, creating variance of at least 300 – 400 basis points between the prime borrowers and the rest of the economy, and also, creating a margin of 900 basis points between the inflation rate and the borrowing rate available to the average borrower.

It would only be a surprise, if NPL ratios of banks did not increase dramatically, as we’re seeing at the moment.

Is the AWPR competitive?

As at end of May, Sri Lanka had a NCPI (National Consumer Price Index) annual average of 2% and a year-on-year rate of 3.5%. While CCPI had an Annual average of 4.2% and a year-on-year rate of 5%. (Source = Central Bank of Sri Lanka, 12 June 2019) When the country has an inflation rate of 5%, for the real sector to borrow at 11.38% (HNB AWPR rate, lowest as at 12 June 2019) and invest in a project, that project has to yield at least 15%.

In simple terms, when the prices of goods and services in the domestic economy increase at a speed of 5% per annum, you’re borrowing at 11.38%, hoping that your project will yield more than 11.38%. Which means even to break-even, your project needs to yield a real return in excess of 100% of the domestic price growth rate. Chances are such returns do not materialise. Hence the current margins on AWPR are not only uncompetitive, but they also lead to higher NPL ratios, price bubbles, and instability in the financial sector.

Role of the monetary board and borrowers

For short term lending, we expect a bank to utilise either short-term borrowing or short-term client deposits. As such, the time lag between a rate reduction and reduction in COF rates are minimal. It is the responsibility of the monetary board to understand such phenomena, and direct the interest rate environment accordingly. By restricting the deposit rates of banks, regulators have only increased the margins for banks, further allowing space for inefficient pricing mechanisms, especially since all short-term deposits should’ve been behaviouralised by now and transfer-priced accordingly.

It would not be prudent to implement interest rate caps or direct lending. Different banks have different risk appetites and serve different market segments. Hence, margins may differ based on the risk appetite and the risk profile of the client.

However, given that the BASEL III mechanism is in place, and as a result, each bank is required to develop their own internal rating model to evaluate credit risk, the Monetary Board has the opportunity to cap interest margins based on the credit rating of the client.

Since margins are capped based on the credit rating, and the credit rating is based on each bank’s internal model, the pricing will be a direct reflection of the credit risk of the client and the respective bank’s risk appetite. This will require a certain amount of statistical modelling, and also will increase the workload of CFOs.

However, given that the Sri Lankan economy and its demography is in a transition period and we must move towards high-yielding industries, it is a must that the credit flow is efficient and accurate. Further, borrowers also have a responsible role to play in this space. Whenever a short term price is offered they need ask what I am priced against.

What is the transfer pricing rate used? Is it 3 month SLIBOR? Is it 3-month T-bill rate? What is the weighted average COF rate? The increased financial literacy rate will force more transparent pricing in the economy and will also lead to efficient financial intermediation.

The writer is a senior finance professional, with 15 years of experience in financial intermediaries. He is a member of Sri Lanka Economic Association (SL), Chartered Institute of Management Accountants (UK) and Association of Chartered Certified Accountants (UK). He also hold a Master of Arts degree in Financial Economics, Master of Science degree in Finance and a Bachelor’s degree in Business Administration.