Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 9 July 2020 00:59 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

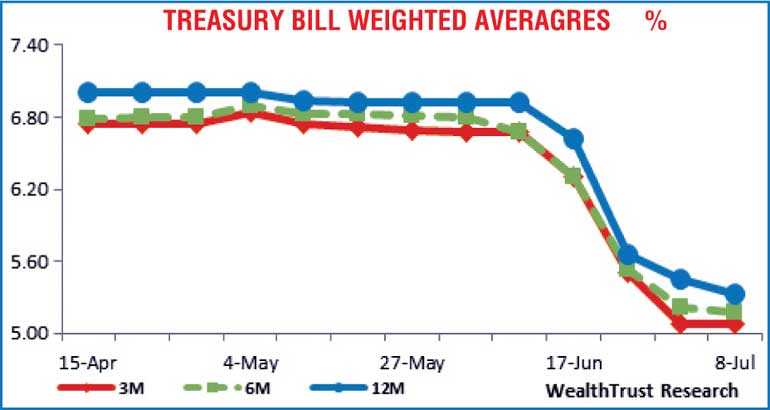

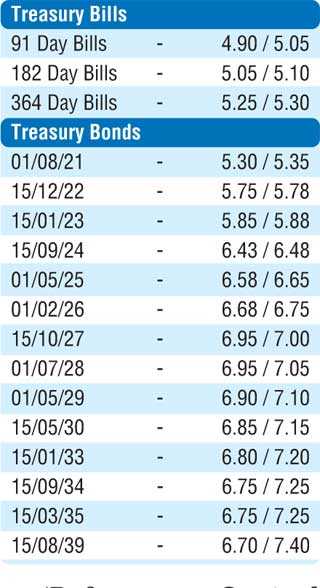

The degree of decline on the 364 day bill weighted average (W.A) was seen slowing at its weekly auction conducted yesterday, recording its fifth consecutive week of declines. It registered a drop of 13 basis points to 5.32% while the 182 day bill dipped by 04 basis points to 5.18%. The weighted average rate on the 91 day bill remained steady at 5.08% for the first time in nine weeks. The total offered amount of Rs. 28.5 billion was fully met at the auction as the bid to offer ratio was recorded at 2.14:1.

Activity in the secondary bond market picked up yesterday as the liquid maturities of 15.12.22, 15.01.23, 15.09.24, 01.05.25 and 15.10.27 were seen changing hands from opening highs of 5.82%, 5.90%, 6.52%, 6.70% and 6.995% respectively to closing lows of 5.75%, 5.85%, 6.45%, 6.62% and 6.97%. In addition maturities of 01.05.21, 01.07.22, 01.09.23, 2024s (i.e. 01.01.24 & 15.03.24), 2026s (i.e. 01.02.26 & 01.08.26) and 01.07.28 were traded at levels of 5.00% to 5.22%, 5.70% to 5.90%, 6.14% to 6.15%, 6.35% to 6.50%, 6.72% to 6.74% and 7.00% respectively. This was ahead of today’s monitory policy announcement due at 7.30 a.m., the fifth for the year 2020. The monetary board of the Central Bank of Sri Lanka, at its meeting held on 16 June reduced its SRR (Statutory Reserve Requirement) rate applicable for all Rupee deposit in Licensed Commercial Banks by 200 basis points while at its meeting held on 6 May, cut its policy rates by 50 basis points to 5.50% and 6.50% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively.

The total secondary market Treasury bond/bill transacted volume for 7 July was Rs. 3.49 billion.

In money markets, the high net liquidity surplus of Rs. 172.50 saw the overnight call money and repo rates remaining steady to average 5.51% and 5.54% respectively yesterday.

Rupee appreciates marginally

In Forex markets, the USD/LKR on spot contracts appreciated marginally once again to close the day at Rs. 185.75/85 yesterday in comparison to its previous day’s closing of Rs. 185.85/95 on the back of selling interest by Banks.

The total USD/LKR traded volume for 7 July was $ 92.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)