Monday Feb 09, 2026

Monday Feb 09, 2026

Thursday, 16 August 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

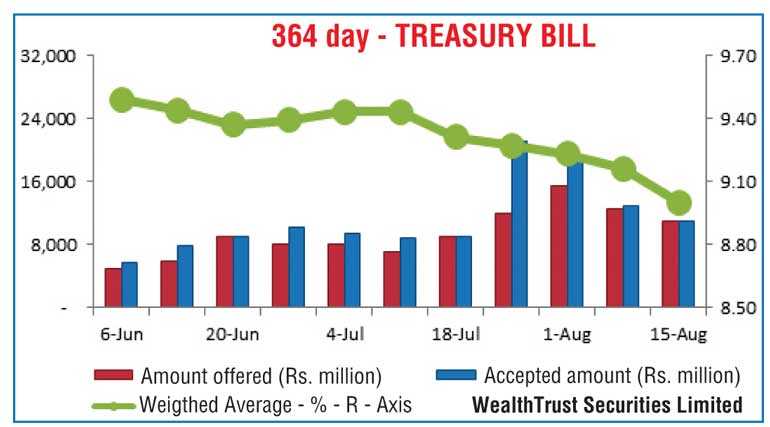

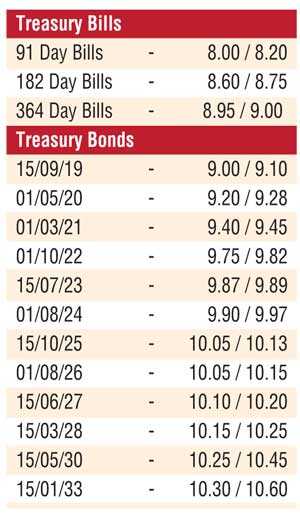

The declining trend in the weekly Treasury bill weighted average yields continued for a fifth consecutive week, with the 364-day bill dipping to the 9% psychological level for the first time since 14 February. The 364-day bill recorded a decline of 16 basis points, closely followed by the 182-day maturity by eight basis points to 8.62%, and the 91-day maturity by six basis points to 8.10%. The exact offered amount of Rs. 20 billion was accepted at the auction as the bid-to-offer ratio increased to 4.21: 1.

In the secondary bond market, the liquid maturities of 01.03.21 and 15.07.23 were seen changing hands within the range of 9.42% to 9.45% and 9.87% to 9.88%, respectively. Furthermore, the maturities of 15.09.19, 2020’s (i.e. 01.05.20 and 15.12.20) and 2021’s (i.e. 01.05.21, 01.08.21, 15.10.21 and 15.12.21) were also traded at levels of 9.05% to 9.10%, 9.25% to 9.35% and 9.46% to 9.65%, while in the secondary bill market, July and August 2019 bills were traded at levels of 8.92% and 8.95%, respectively, subsequent to the auction.

The total secondary market Treasury bond/bill transacted volumes for 14 August was Rs. 11.07 billion.

In money markets, the Open Market Operations (OMO) Department of the Central Bank was seen mopping up an amount of Rs. 24.4 billion on an overnight basis at a weighted average of 7.52% as the net surplus liquidity stood at Rs. 40.71 billion. The Overnight call money and repo rates averaged 7.92% and 7.93%, respectively.

Rupee closes mostly unchanged

The USD/LKR rate on spot contracts closed mostly unchanged at Rs. 160.15/25.

The total USD/LKR traded volume for 14 August was $ 44.75 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 161.00/20, 3 months - 162.55/85, and 6 months - 165.05/35.