Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 8 November 2018 00:00 - - {{hitsCtrl.values.hits}}

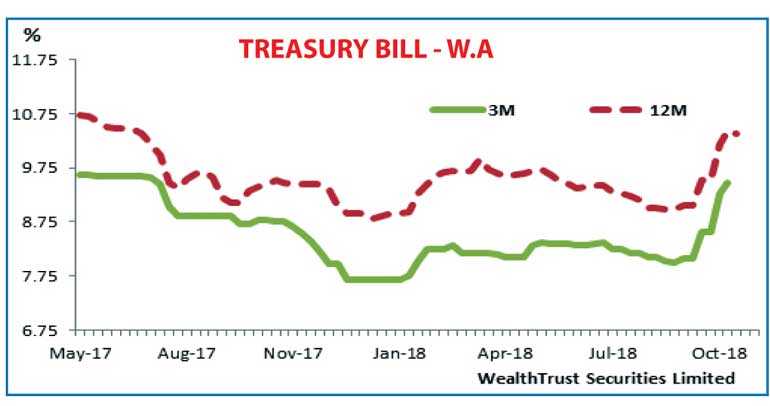

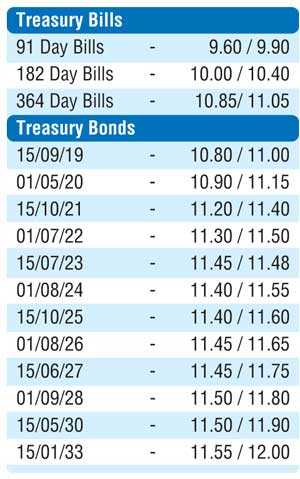

By Wealth Trust Securities

The weekly Treasury bill weighted averages were seen increasing across the board yesterday, following the rejection of all bids the previous week, with the 364-day bill recording a sharp increase of 50 basis points to a 77-week high of 10.89%. The 91-day bill which was accepted after a lapse of two week’s saw its weighted average increase by 17 basis points to 9.65% while the 182-day bill which was offered after two weeks recorded a weighted average of 9.99% against its previous of 9.75%. The total offered amount of Rs. 16 billion was almost fully accepted across all three maturities with a total bids to offer ratio of 1.66:1. The secondary market bond yields were seen increasing yesterday with moderate volumes being traded. The 15.07.23 maturity hit an intraday high of 11.50% in comparison to its previous day’s closing levels of 11.38/45. Furthermore, trades on the 01.05.19, 15.09.19, 01.11.19, 01.03.21 and 01.10.22 maturities were witnessed at levels of 10.25%, 10.80% each, 11.10% to 11.20% and 11.50%, respectively, as well.

The total secondary market Treasury bond/bill transacted volumes for 5 November was Rs. 2.2 billion.

In the money market, the OMO department of Central Bank was seen infusing liquidity by way of an overnight and a seven day term repo auction for successful amounts of Rs.44.65 billion and Rs.15.00 billion respectively at weighted averages of 8.47% and 8.50% as the net liquidity shortage in the system stood at a high of Rs.70.30 billion yesterday. The overnight call money and repo rates remained mostly unchanged to average 8.47% and 8.50% respectively.

Rupee loses further

The rupee rate on spot contracts were seen losing further yesterday to close at Rs. 174.85/00 against its previous day’s closing level of Rs. 174.45/55 on the back of continued buying interest from banks.

The total USD/LKR traded volume for 5 November was $ 51.70 million.

Some forward USD/LKR rates that prevailed in the market are 1 month – 175.80/10, 3 months – 177.75/15, and 6 months – 180.75/50.