Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 17 April 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

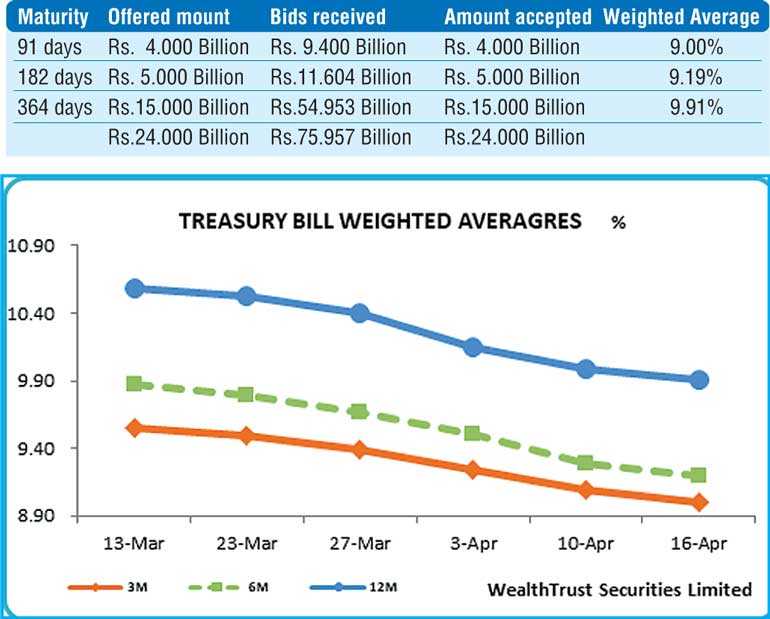

The weekly Treasury bill weighted averages were seen continuing its downward rally at its auctions held yesterday as the total offered amount of Rs. 24 billion was successfully met with the bid to offer ratio registering at 3.16:1. The 182 day bill reflected the highest decline of 10 basis points to 9.19% closely followed by the 91 day and the 364 day bills by 09 and 08 basis points respectively to 9.00% and 9.91%.

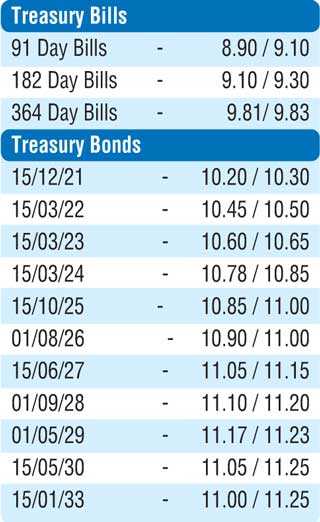

In the secondary bond market yesterday, yields were seen increasing marginally during morning hours of trading, mainly on the 15.03.22, 15.12.23, 15.03.24, two 2027’s (i.e. 15.01.27 and 15.06.27) and 01.05.29 maturities to intraday high of 10.55%, 10.80%, 10.85%, 11.10%, 11.15% and 11.20% respectively against its previous day’s closing levels of 10.43/50, 10.70/75,10.75/78, 10.95/05, 11.05/10 and 11.15/20, on the back of moderate volumes. However, buying interest at these levels subsequent to the auction results curtailed any further upward movement with yields dipping from its day’s highs on the maturities of 15.03.22, two 2023’s (i.e. 15.03.23 and 15.12.23), 15.03.24 and 15.01.27 to levels of 10.50%, 10.60%, 10.75%, 10.82% and 11.07% respectively.

The total secondary market Treasury bond/bill transacted volumes for 12 April was Rs. 1.15 billion.

In the money market, the Central Bank was seen injecting liquidity by way of an overnight and seven day repo auction for amounts of Rs. 10.00 billion and Rs. 5.00 billion respectively at a weighted average of 8.53% and 8.55% as the net liquidity shortfall in the system stood at Rs. 16.77 billion yesterday. The OMO Department also infused a further amount of Rs. 4.70 billion by way of a 13 day term repo auction at a weighted average rate of 8.59%, valued today. The call money and repo rates averaged 8.54% and 8.57% respectively.

Rupee loses marginally

The USD/LKR rate on spot contracts was seen depreciating marginally yesterday to close the day at Rs. 174.60/70 against its previous day’s closing levels of Rs. 174.55/65, on the back of buying interest by Banks.

The total USD/LKR traded volume for 12 April was $ 26.50 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 175.60/80; 3 months - 177.45/65 and 6 months - 180.30/60.