Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 19 November 2020 01:59 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

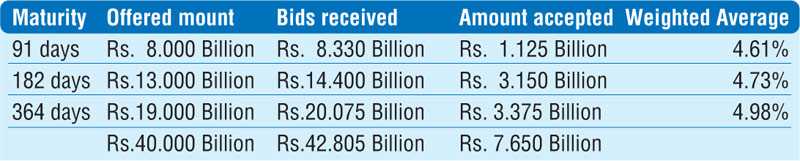

The demand for Treasury bills at the weekly auction decreased further yesterday, as only an amount of Rs. 7.65 billion was accepted in comparison to its previous week’s total accepted amount of Rs. 9.19 billion and against a total offered amount of Rs.40 billion.

The demand for Treasury bills at the weekly auction decreased further yesterday, as only an amount of Rs. 7.65 billion was accepted in comparison to its previous week’s total accepted amount of Rs. 9.19 billion and against a total offered amount of Rs.40 billion.

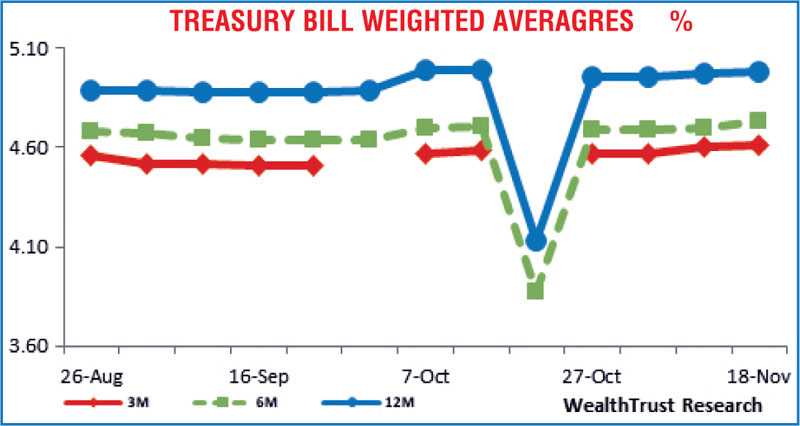

The weighted average rates on the 182 day and 364 day maturities were recorded at its stipulated cut off rates of 4.73% and 4.98% respectively. However, the weighted average rate of the 91 day maturity was registered at 4.61% against its stipulated cut off rate of 4.62%. The auction was undersubscribed for a fourth consecutive week as the bids to offer ratio decreased further to 1.07:1.

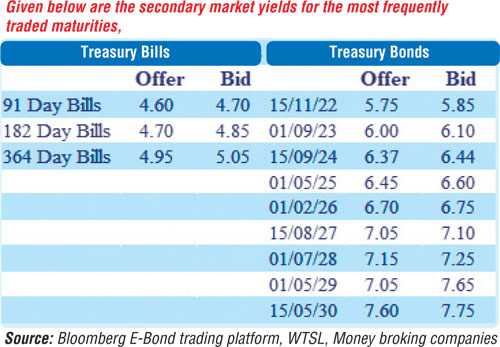

The upward momentum in the secondary bond market continued yesterday as well with yields on the maturities of 15.12.22, 15.12.23, 15.08.27 and 01.07.28 hitting highs of 5.87%, 6.10%, 7.08% and 7.22% respectively against its previous day’s closing levels of 5.75/85, 6.05/10, 7.02/10 and 7.15/30. In addition maturities of 01.08.21, 01.07.22 and 2024s (i.e. 01.01.24 and 15.09.24) traded at levels of 4.84% to 4.85%, 5.65%, 6.20% and 6.38% respectively as well. In secondary bills, 26 February 2021 maturity traded at level of 4.72%, pre-auction.

The total secondary market Treasury bond/bill transacted volumes for 17 November 2020 was Rs. 2.4 billion.

In money market, weighted average rates on overnight call money and repo were recorded at 4.54% and 4.61% respectively yesterday while the overnight surplus liquidity decreased to Rs. 167.79 billion.

Rupee appreciates further

In Forex markets, the LKR were seen appreciating further yesterday as its spot contracts were seen closing the day at Rs. 184.60/70, subsequent to trading within the range of Rs. 184.55 to Rs. 184.80.

The total USD/LKR traded volume for 17 November was $ 15.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)