Friday Feb 27, 2026

Friday Feb 27, 2026

Friday, 26 October 2018 00:00 - - {{hitsCtrl.values.hits}}

Core banking growth and profitability

Core banking growth and profitability

Union Bank posted consistent and strong growth in core banking operations excluding the results from capital gains and newly launched credit card operations by 79% during the period under review, amidst the challenging macroeconomic backdrop.

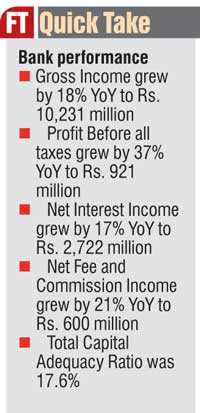

Group profit before all taxes crossed the Rs. 1 billion mark, whilst the bank recorded an impressive profit before all taxes of Rs. 921 million, a 37% growth YoY for the period ended September 2018; highlighting the bank’s robust performance and progress towards achieving its growth objectives for the year.

Focused revenue management using portfolio re-alignment within and across business units resulted in 17% YoY growth in Net Interest Income (NII) which was Rs. 2,722 million during the period ended 30 September despite the narrowing margins due to market fluctuations.

The fee and commission income of the bank continued to improve through the key enablers articulated in the business strategy. Net fee and commission income grew by 21% YoY to Rs. 600 million during the period under review. The growth is mainly attributed to fees on loans and deposits.

Capital gains from Government securities for the period is Rs. 207 million, which is an 8% reduction YoY. Income from investment in units for the period is Rs. 198 million.

Capital gains from Government securities for the period is Rs. 207 million, which is an 8% reduction YoY. Income from investment in units for the period is Rs. 198 million.

The growth in other operating income was primarily a result of foreign exchange income which was Rs. 209 million for the period and is a 61% increase YoY. This is mainly the result of increased customer transactions.

Total Operating Income of the bank rose to Rs. 3,931 million and represented a growth of 19% YoY. Total Operating Expenses were prudently managed and grew by only 16% YoY to Rs. 2,843 million during the period. As a result, operating margin (pre-impairment profit) improved by 29% YoY.

The impairment charge for the period was Rs. 214 million and the profit share from subsidiaries was Rs. 48 million.

Profit after Tax (PAT) for the period was Rs. 390 million and represented a 14% growth YoY. The bank’s PAT continued to be impacted due to higher effective tax rates as a result of the implementation of the new Inland Revenue Act. Overall taxes have increased by 62% YoY.

Total assets of the bank stood at Rs. 122,375 million as at 30 September. The bank’s loans and receivables stood at Rs. 71,647 million while the deposits base was Rs. 76,143 million as at the balance sheet date. Loan to Deposit ratio significantly improved to 94% from 100% a year ago. The bank continued to focus on asset quality with prudent risk management practices. The net NPL ratio of the bank was 2.4% at the end of the reporting period.

Total CASA grew to Rs. 17,363 million which translated to growth of 14% YoY. Maintaining a healthy CASA inflow was supported through focused acquisition strategies driven by the Retail and SME banking segments.

The bank continued to maintain its robust Capital Adequacy, reporting a Total Capital Ratio of 17.6% as at the balance sheet date.

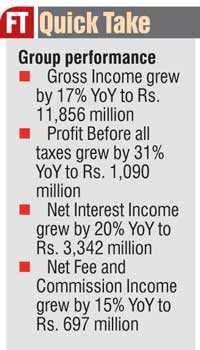

The group, consisting of the bank and its two subsidiaries UB Finance Company Ltd. and National Asset Management Ltd., reported a profit before all taxes of Rs. 1,090 million for the period, which was a growth of 31% YoY. Total assets of the group amounted to Rs. 131,174 million, of which 93% was represented by the bank. The group maintained a healthy Core Capital Ratio of 17.5% as at the balance sheet date.

Business performance and strategic enablers

The bank’s Corporate Banking portfolio grew by 10% YoY. CASA and fee income was supported with the cash management solution whilst end-to-end relationship management enhanced strengthening of customer portfolios during the period under review.

The SME Banking portfolio stood at Rs. 23,317 million as at 30 September amidst a slowdown in credit growth. The bank continued to focus on growth segments in the SME sector supported by a customised strategy for key market segments. Focus on transactional banking services continued to support CASA and deposits sourcing for the sector.

The Retail Banking portfolio continued to expand during the period under review, with the retail deposits base growing to Rs. 48,710 million, which is a 15% YoY growth. The bank’s focus on relationship management and higher average balance savings accounts highlighted YoY growth of 14% in CASA. An enhanced focus on mortgaged backed lending highlighted growth in the retail loans portfolio with growth of 19% YoY of same.

The Retail Banking portfolio continued to expand during the period under review, with the retail deposits base growing to Rs. 48,710 million, which is a 15% YoY growth. The bank’s focus on relationship management and higher average balance savings accounts highlighted YoY growth of 14% in CASA. An enhanced focus on mortgaged backed lending highlighted growth in the retail loans portfolio with growth of 19% YoY of same.

Adding to the versatility of the retail banking product offering, the bank also launched credit cards, powered with VISA Paywave. Three credit card variants were launched, namely Gold, Platinum and Signature propositions. The cards offer a competitive range of interest rates and include payment plans, rewards and year-round offers.

The Treasury made notable contributions to the bank’s bottom line during the period under review. In a backdrop where financial markets experienced liquidity shortages and extreme volatility, resulting in fluctuations in dollar/rupee premiums, the Treasury generated higher FX Revenues by timely exploitation of market opportunities in Swap, outright and customer positions. In addition, the Treasury also recorded higher capital gains through bond trading.

During the quarter, the bank also secured the award for the best bank in seamless back-end operations at the LankaPay Technnovation Awards 2018 and two main awards at the National Sales Congress Awards (NASCO) organised by the Sri Lanka Institute of Marketing (SLIM).

Commenting on the performance of the bank as at end of 3Q 2018, Union Bank’s Director/Chief Executive Officer Indrajit Wickramasinghe said: “This consistent growth trajectory is an affirmation of the success of the bank’s midterm strategic initiatives for accelerated growth. A clear focus, strategic realignment and commitment have enabled the bank to record an impressive performance amidst a challenging business environment. We will continue to enhance operational efficiencies in all key areas and align our subsidiaries to support the overall growth momentum.”