Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 7 August 2019 00:00 - - {{hitsCtrl.values.hits}}

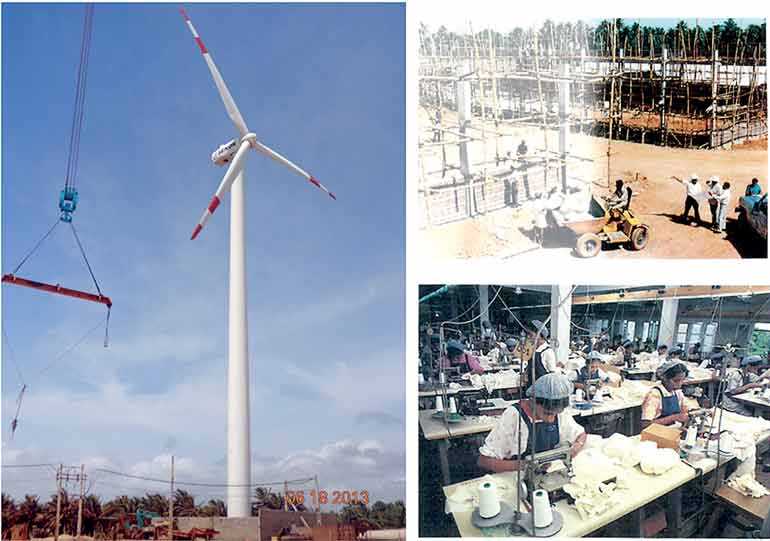

For four decades, NDB Bank’s Project Finance unit has been its forte since its inception as a development bank. In addition to the bank’s various project financing endeavours, NDB is also strong in financing renewable energy generation projects in Sri Lanka as well as in overseas jurisdictions, while also being one of the first banks to fund wind power and waste-to-energy projects in Sri Lanka.

Project financing is an integral part of development banking and is a key contributor towards the development of key sectors of any developing economy. Therefore, it is considered as of strategic importance to the overall socio-economic development of a developing country. With the objective of this need being fulfilled, National Development Bank PLC, then known as the National Development Bank of Sri Lanka, was established in 1979. Since then, NDB has been active in all areas of national development funding over 200,000 successful projects.

Since the beginning, NDB has been one of the largest providers of financing for the development of strategic economic sectors in Sri Lanka. Initiatives taken towards achieving these objectives include financing for the structural reforms of the plantation sector in the 1990s, financing a large number of start-up hotels and garment factories, securing credit lines on concessionary terms from foreign funding agencies in order to support low interest financing for growth sectors such as plantations and renewable energy as well as enhancing operational efficiency through professional approach in performing the mandated role.

Accordingly, NDB has been having a strong presence in renewable energy generation project undertaken by Sri Lankan corporates in Sri Lanka and in the African country Uganda. NDB also spearheaded two thermal power projects in Bangladesh and four mini hydro projects in Uganda, all of which were promoted by local corporates and provided long-term facilities to two financial institutions in Cambodia. Additionally, the bank has also funded many projects for the Government of Sri Lanka, assisting in Road Development Authority (RDA) and National Water Supply & Drainage Board.

NDB possesses the competence to assist its corporate clients in complex transactions, whether they are within Sri Lanka or across foreign jurisdictions and propel them towards the next phase of development in their businesses. Throughout the years, the bank has shown competence in handling complex transactions such as structuring mergers and acquisitions, balance sheet restructurings, securitisations, stock market related transactions, etc., through special skills and expertise possessed by NDB PF team and the bank’s Legal team.

All these accomplishments have been endorsed by the Asian Banking & Finance Magazine of Singapore by awarding NDB’s Project Finance unit the coveted title of ‘Domestic Project Finance Bank of the Year Sri Lanka 2018’ for the fifth consecutive year. Moreover, NDB Project Finance unit won the Merit award for ‘Best Innovation in Sustainable Financial Products and Services’ at the Global Sustainable Finance Conference held in Karlsruhe, Germany in 2019.

NDB Bank, which is the first and to date the only corporate in Sri Lanka to officially be certified with EDGE Certification, is a premier retail bank with over 111 branches across the island, serving millions of Sri Lankans through a host of financial services. From its inception, the NDB Group which includes NDB Bank, NDB Capital, NDB Investment Banking, NDB Wealth and NDB Securities, has been a catalyst in the development of the nation, strengthening and empowering entrepreneurs, corporates and individuals from all strata of the economy. Customers across all Group companies have benefited from the product and service offerings of the NDB Group.