Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 28 May 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

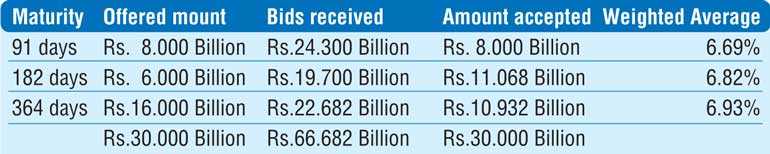

The weekly Treasury bill auctions conducted yesterday broadly reflected steady outcomes as the total offered amount of Rs. 30 billion was fully subscribed for a third consecutive week. The weighted  average yield on the market favourite 364-day bill remained steady at 6.93% while weighted average yields on the 91-day and 182-day bill decreased by 2 and 1 basis points, respectively, to 6.69% and 6.82%. The bids to offer ratio stood at 2.22:1.

average yield on the market favourite 364-day bill remained steady at 6.93% while weighted average yields on the 91-day and 182-day bill decreased by 2 and 1 basis points, respectively, to 6.69% and 6.82%. The bids to offer ratio stood at 2.22:1.

The positive momentum in the secondary bond market continued yesterday with yields declining further during morning hours of trading. Yields on the market favourite maturities of 01.10.22, 15.01.23, two 2024’s (i.e. 15.06.24 & 15.09.24) and 01.05.25 were seen hitting lows of 7.38%, 7.75%, 8.35% each and 8.48%, respectively, against its previous day’s closing levels of 7.42/46, 7.77/82, 8.35/40 each and 8.52/55 while activity moderated towards the latter part of the day. In addition, maturities of 15.10.21, 01.07.22, (i.e. 15.03.23 & 15.12.23), 01.08.24 and 15.10.27 changed hands at levels of 7.16%, 7.40%, 7.85%, 8%, 8.40% to 8.42% and 8.80%, respectively.

The total secondary market Treasury bond/bill transacted volume for 26 May was Rs. 9.74 billion.

In money markets, the weighted average rates on overnight call money and repo was recorded at 5.87% and 5.91%, respectively, as the overnight net liquidity surplus in the system increased further to Rs. 99.35 billion. The Domestic Operations Department (DOD) of the Central Bank refrained from conducting any auctions for a second consecutive day.

Rupee remains mostly unchanged

In the Forex market, the USD/LKR rate on spot contracts was seen closing the day mostly unchanged at level of Rs. 186.15/35 yesterday, subsequent to changing hands within the range of Rs. 186.10 to Rs. 186.20.

The total USD/LKR traded volume for 26 May was $ 59.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)