Monday Jan 19, 2026

Monday Jan 19, 2026

Friday, 22 March 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

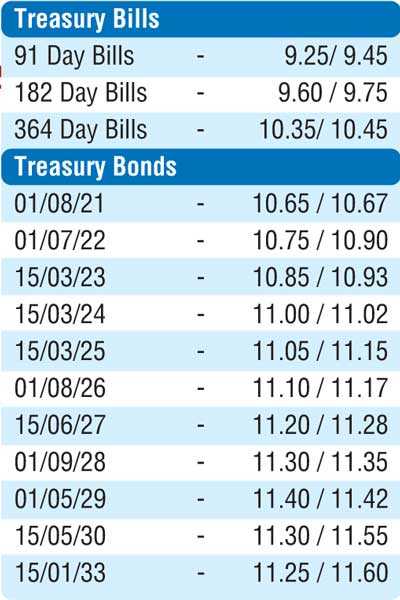

The secondary bond market rallied yesterday as yields retreated across the yield curve on the back of fresh  foreign and local buying interest. Demand mainly for the 15.03.24 and 01.05.29 maturities saw its yields dip to intraday lows of 11.00% and 11.35% respectively against its days opening highs of 11.05% and 11.45%. In addition, the two 2021’s (i.e. 01.08.21 and 15.12.21), 15.05.23 and 01.08.26 maturities were seen changing hands within the range of 10.66% to 10.73%, 10.70% to 10.73%, 10.96% to 11.02% and 11.12% to 11.16% respectively. On the very short end of the yield curve, February 2020 bills and 01.05.20 were seen changing hands at levels of 10.38% and 10.40% to 10.45% as well.

foreign and local buying interest. Demand mainly for the 15.03.24 and 01.05.29 maturities saw its yields dip to intraday lows of 11.00% and 11.35% respectively against its days opening highs of 11.05% and 11.45%. In addition, the two 2021’s (i.e. 01.08.21 and 15.12.21), 15.05.23 and 01.08.26 maturities were seen changing hands within the range of 10.66% to 10.73%, 10.70% to 10.73%, 10.96% to 11.02% and 11.12% to 11.16% respectively. On the very short end of the yield curve, February 2020 bills and 01.05.20 were seen changing hands at levels of 10.38% and 10.40% to 10.45% as well.

The total secondary market Treasury bond/bill transacted volumes for 19 March was Rs. 8.31 billion.

In money markets, the overnight call money and repo rates averaged 8.85% each as the Open Market Operations (OMO) department of the Central Bank of Sri Lanka injected amounts of Rs. 10.00 billion, Rs. 6 billion and Rs. 12.6 billion on an overnight, seven days and fourteen days basis at weighted averages of 8.77%, 8.74% and 8.80% respectively yesterday. The net liquidity shortfall in the system decreased to Rs. 18.73 billion yesterday.

Rupee appreciates

In the Forex market, the USD/LKR rates on spot contracts were seen appreciating yesterday to close the day at Rs. 177.90/05 against its previous day’s closing levels of Rs. 178.40/45 on the back of selling interest by Banks.

The total USD/LKR traded volume for 19 March was $ 78.38 million.

Some forward USD/LKR rates that prevailed in the market were: 1 month - 178.85/05; 3 months - 180.70/00; 6 months - 183.65/95.