Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 31 March 2020 00:55 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The commencement of a fresh trading week saw secondary market bond yields increasing marginally yesterday on the back of selling interest as activity moderated towards the latter part of the day.

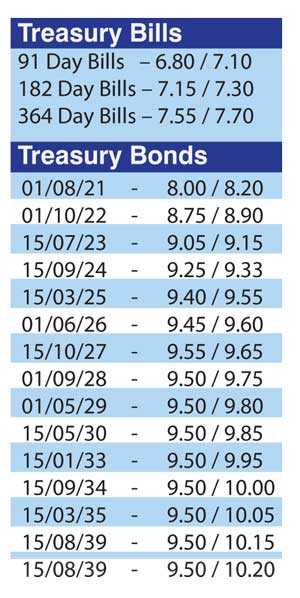

The liquid maturities of 15.07.23, 15.09.24 and 15.10.27 saw its yields hit intraday highs of 9.08%, 9.30% and 9.55% respectively against its previous day’s closing levels of 8.90/00, 9.12/17 and 9.40/50.

In secondary bills, maturities of August 2020 to January 2021 changed hands at levels of 7.25% to 7.65%.

Meanwhile in money markets, the weighted average yield on the overnight call money and repo rates stood at 6.75% and 6.81% respectively as the Domestic Operations Department (DOD) of Central Bank of Sri Lanka was seen injecting an amount of Rs. 12.60 billion on an overnight basis by way of a Reverse Repo auction at a weighted average rate of 6.76%.

A further injection of Rs. 16.95 billion was made by way of a 15-day reverse repo auction at a weighted average of 6.90% while an amount of Rs. 15 billion was injected for Standalone Primary Dealers by way of 15-day reverse repo auction as well, at a weighted average rate of 7.16%. The overnight net liquidity surplus in the system stood at Rs. 44.50 billion yesterday.

Rupee trades on spot contracts

In the Forex market, the USD/LKR rate on spot contracts was traded within the range of Rs. 188.50 to Rs. 190 yesterday.

The total USD/LKR traded volume for 27 March was $ 110.05 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)