Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 8 October 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

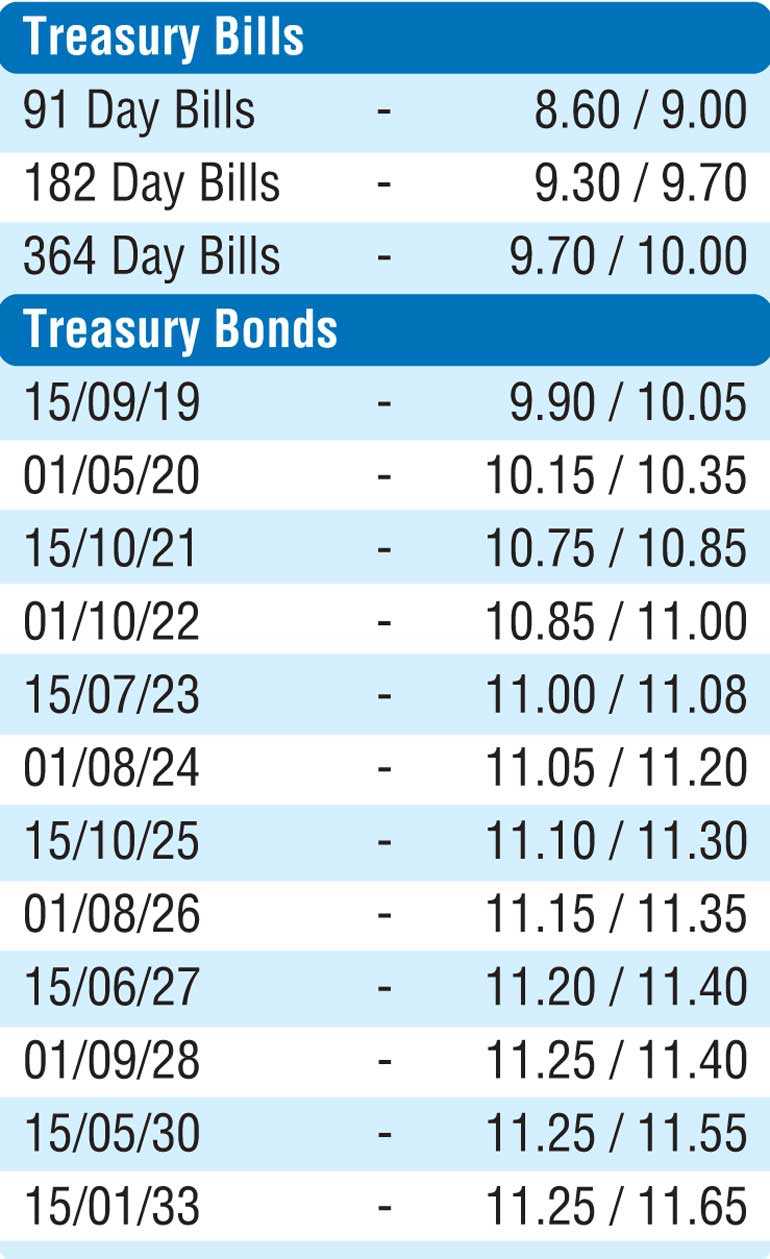

The secondary bond market witnessed a round of fresh buying interest during the week ending 5 October subsequent to the monetary policy announcement at where policy rates were kept unchanged against market expectations. The rejection of all bids received for the weekly Treasury bill auction due to market participants seeking higher yields added further imputes to the downward momentum.

Trades were mainly seen on the market favourite two maturities of 15.10.21 and 15.07.23 as its yields were seen dipping from its weeks opening highs of 11.10% and 11.28% respectively to weekly lows of 10.60% and 10.85%. In addition, buying interest along the rest of the yield curve during mid-week saw the maturities of the two 2020’s (i.e. 01.05.20 and 15.12.20), four 2021’s (i.e. 01.03.21, 01.05.21, 01.08.21 and 15.12.21), 15.03.23, two 2025’s (i.e. 15.03.25 and 15.10.25), two 2026’s (i.e. 01.06.26 and 01.08.26) and two 2028’s (i.e. 15.03.28 and 01.09.28) dip to weekly lows of 10.10%, 10.50%, 10.87%, 11.10%, 11.18% and 11.28% respectively within the ranges it traded against its weekly highs of 10.34%, 11.00%, 11.02%, 11.55%, 11.35% and 11.40%.

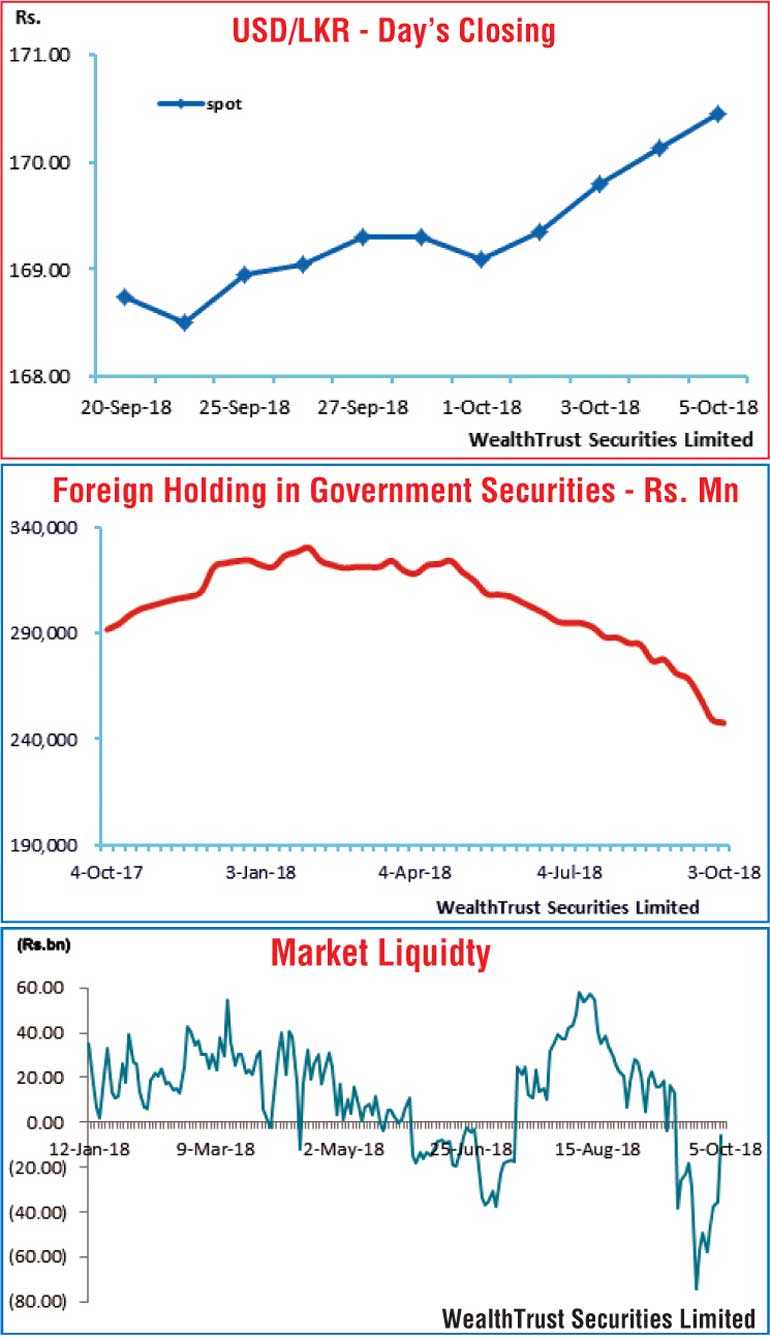

Furthermore, the foreign holding in rupee bonds continued to decline for a fifth consecutive week, recording an outflow of Rs. 1.80 billion for the week ending 3 October.

The daily secondary market Treasury bond/bill transacted volume through the first four days of the week averaged Rs. 6.08 billion.

In money markets, the call money and repo rates averaged 8.43% and 8.31% respectively for the week as net liquidity shortfall in the system fluctuated from a high of Rs. 46.24 billion to a low of Rs. 5.83 billion. The Open Market Operations (OMO) Department of Central Bank was seen injecting liquidity throughout the week by way of overnight and 7 to 14 days reverse repo auctions at weighted averages ranging from 8.14% to 8.29%. Liquidity was further injected by way of outright purchases of Treasury bills for durations ranging from 127 days to 155 days at weighted averages of 8.63% to 8.84%.

Dollar strengthens further

In the Forex market, a globally strengthening dollar and foreign outflows from the local capital markets (i.e. government security market and stock market) coupled with continued importer demand saw the rupee on its spot contracts losing further to hit a new low of Rs. 170.42 and close the week at Rs. 170.35/55 against its previous weeks closing levels of Rs. 169.20/40.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 60.00 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 171.40/80; 3 Months - 173.40/80 and 6 Months - 176.10/60.