Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 6 May 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

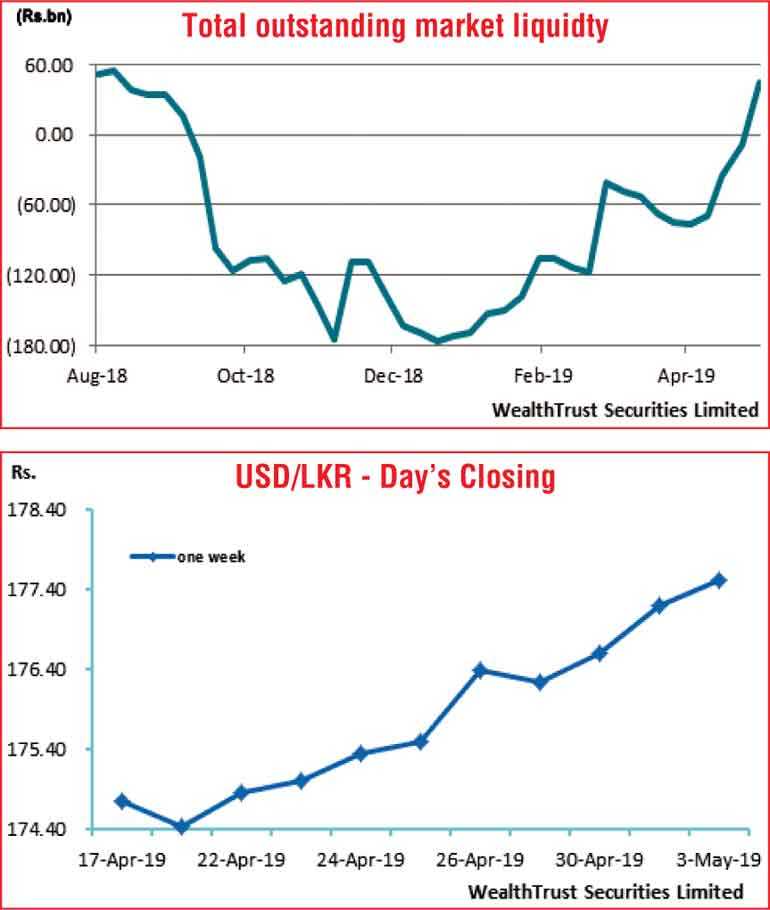

The secondary bond market commenced the week ending 3 May 2019 on a positive note reversing its negative sentiment which prevailed the previous week, driven by the robust outcomes at the two Treasury bond auctions at the start of the week and a continuous increase in the money market liquidity during the week, despite foreign selling of Rupee bonds.

The overall net liquidity position in the system was seen turning positive for the first time in over seven months as it was seen hitting a high of Rs. 44.6 billion by the end of the week, a level last seen in August 2018. This led to the overnight Repo and Call money rates easing to average 8.50% and 8.64% respectively for the week.

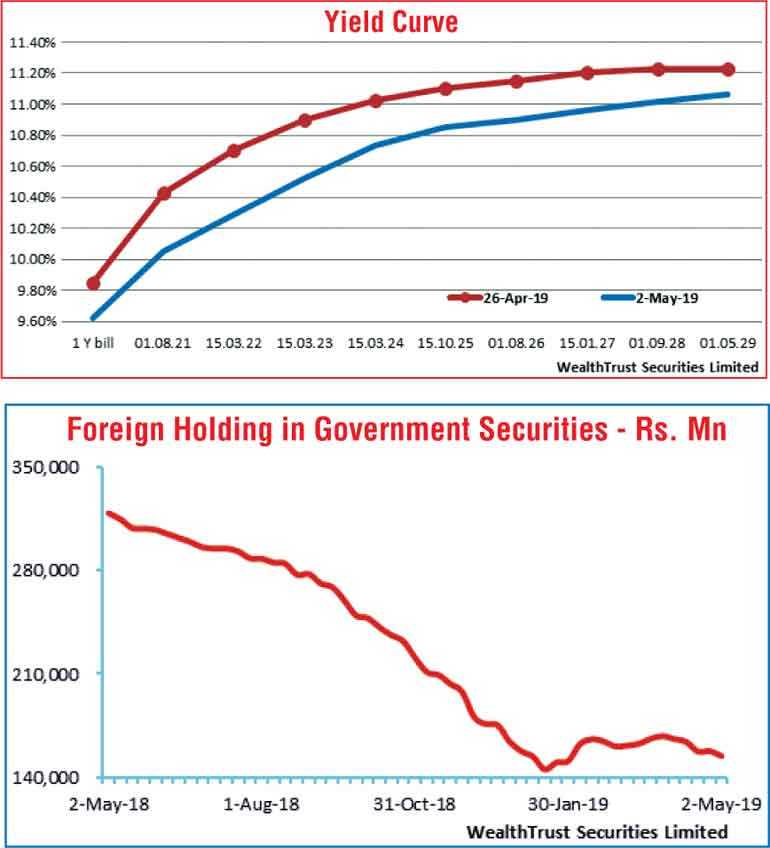

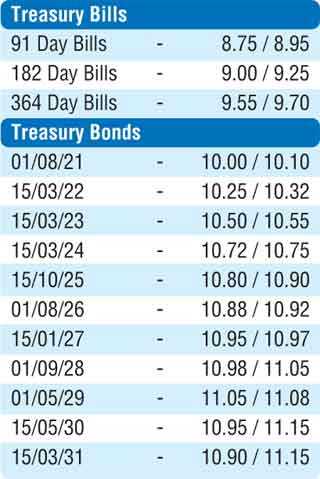

The bull run in the secondary bond market was further supported by the outcome at the weekly Treasury bill auction, where weighted averages declined across the board with the benchmark 364 day bill dipping by 10 basis points to 9.81%.

The overall yield curve witnessed a parallel shift downward with yields on the liquid maturities of 01.08.21, 15.03.22, 15.03.23, 15.03.24, 01.08.26, 15.01.27, 01.09.28 and 01.05.29 decreasing to hit intraweek lows of 10.05%, 10.30%, 10.52%, 10.71%, 10.88%, 10.95%, 11.05%, 11.03% respectively against its previous weeks closing levels of 10.35/50, 10.65/75, 10.85/95, 10.98/05, 11.05/25, 11.15/25, 11.15/30 and 11.20/25. Furthermore, the latest one year bill was seen changing hands at 9.65% in the secondary bill market.

The foreign holding in Rupee bonds was seen recording an outflow after a lapse of one week to the tune of Rs. 3.28 billion for the week ending 30 April 2019.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 25.55 billion.

Rupee loses further

The Rupee on its one week forward contracts in the absence of Spot contracts during most part of the week was seen depreciating to close the week at Rs. 177.45/60 against its previous weeks closing of Rs. 176.30/50 on the back of continued buying interest by banks.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 83.47 million.

Some of the forward dollar rates that prevailed in the market were one month – 178.20/50; three months – 179.95/25 and six months – 182.55/85.