Monday Mar 09, 2026

Monday Mar 09, 2026

Monday, 10 September 2018 00:52 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The positive momentum in the secondary bond markets witnessed towards the latter part of the previous week came to halt during the week ending 7 September on the back of renewed foreign and continued local selling interest coupled with a fluctuating money market liquidity.

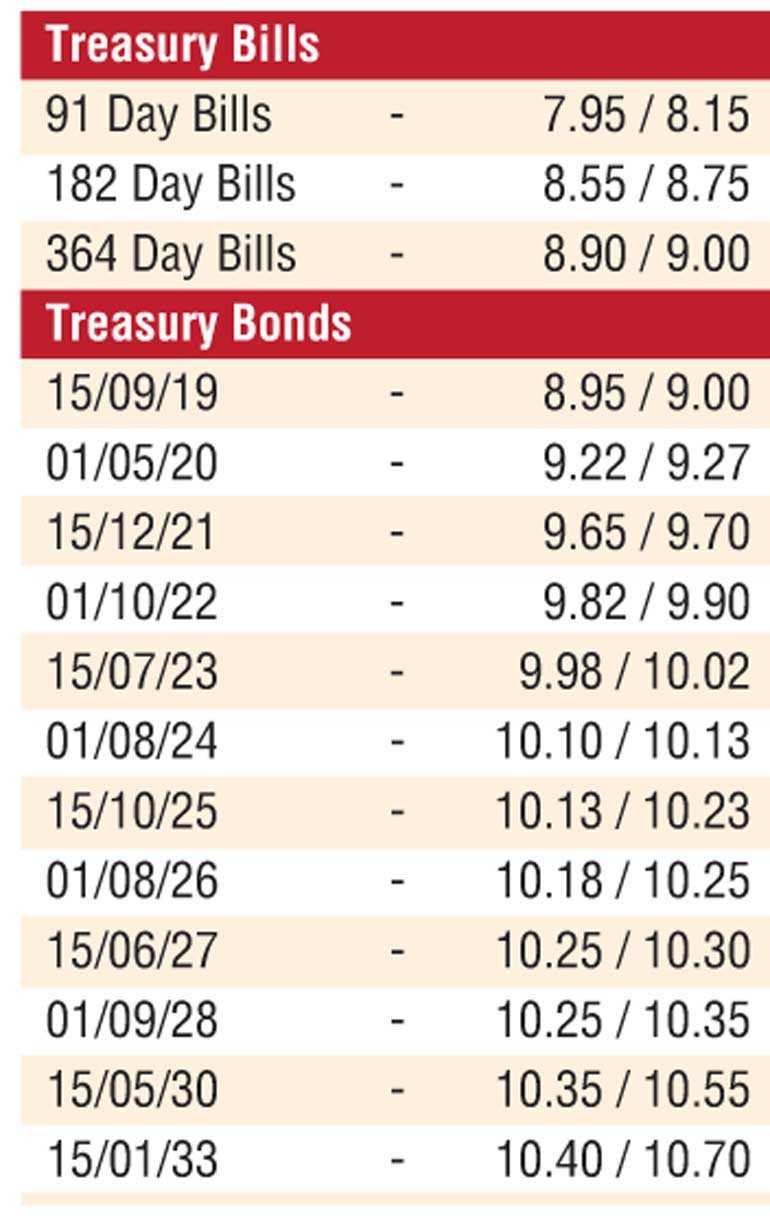

The overall yield curve reflected a marginal shift upward with the liquid maturities of 01.03.21, 01.10.22, 15.07.23 and 01.08.24 hitting intraweek highs of 9.53%, 9.85%, 10.00% and 10.15%, respectively, against its previous weeks closing levels of 9.45/50, 9.81/85, 9.90/93 and 10.00/02. In addition, the maturities of 2019’s (i.e. 01.07.19 and 15.09.19), 2020’s (i.e. 01.05.20 and 15.12.20), 2021’s (i.e. 01.05.21, 01.08.21, 15.10.21 and 15.12.21) 01.08.26, 15.06.27 and 01.09.28 changed hands at levels of 8.93% to 9.00%, 9.23% to 9.38%, 9.50% to 9.65% 10.20% to 10.22%, 10.26% to 10.32% and 10.24% to 10.27%, respectively, as well.

The increase in yields was driven by renewed foreign selling in rupee bonds after a lapse of one week to record an outflow of Rs. 6.435 billion for the week ending 5 September, despite weighted averages at the weekly Treasury bill auction reducing by 3 and 2 basis points to 8% and 8.97% on the 91-day and 364-day maturities, respectively.

The daily secondary market Treasury bond/bill transacted volume through the first four days of the week averaged Rs. 4.82 billion.

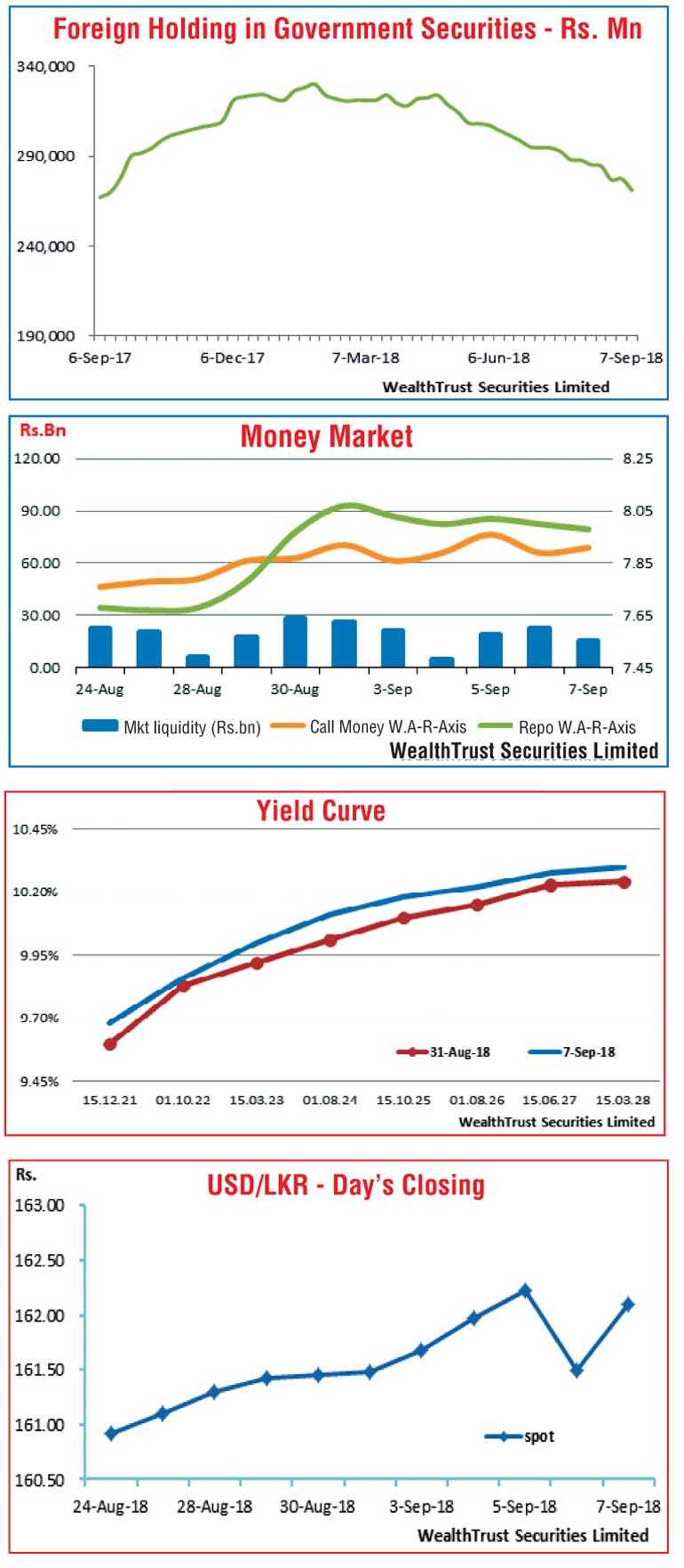

In money markets, the net surplus liquidity was seen fluctuating from a one-and-a-half-month low of Rs. 4.98 billion to a high of Rs. 22.76 billion during the week which saw the average overnight call money and repo rates increase marginally during the week to 7.90% and 8.01%, respectively, against its previous week of 7.84% and 7.83%. The Open Market Operations (OMO) Department drained out liquidity during the week on an overnight basis at weighted averages ranging from 7.82% to 7.87%.

Rupee fluctuates

In the Forex market, the downward trend on the rupee continued during the early part of the week as the USD/LKR rate on spot contracts was seen dipping to a new low of Rs. 162.50 against its previous weeks closing levels of Rs. 161.45/50. However, it was seen gaining grounds towards the latter part of the week to close the week at Rs. 162.00/20 on the back of selling interest by banks.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 62.32 million.

Some of the forward dollar rates that prevailed in the market were 1 month - 162.75/05; 3 months - 164.50/80, and 6 months - 166.80/20.