Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 28 March 2018 00:00 - - {{hitsCtrl.values.hits}}

The story

Sampath Bank, the third largest private sector commercial bank in terms of assets (Rs. 827 billion), has outperformed the rest in its league by posting the best above industry average results in 2017, an achievement not by accident but by well-crafted and innovative measures put in place.

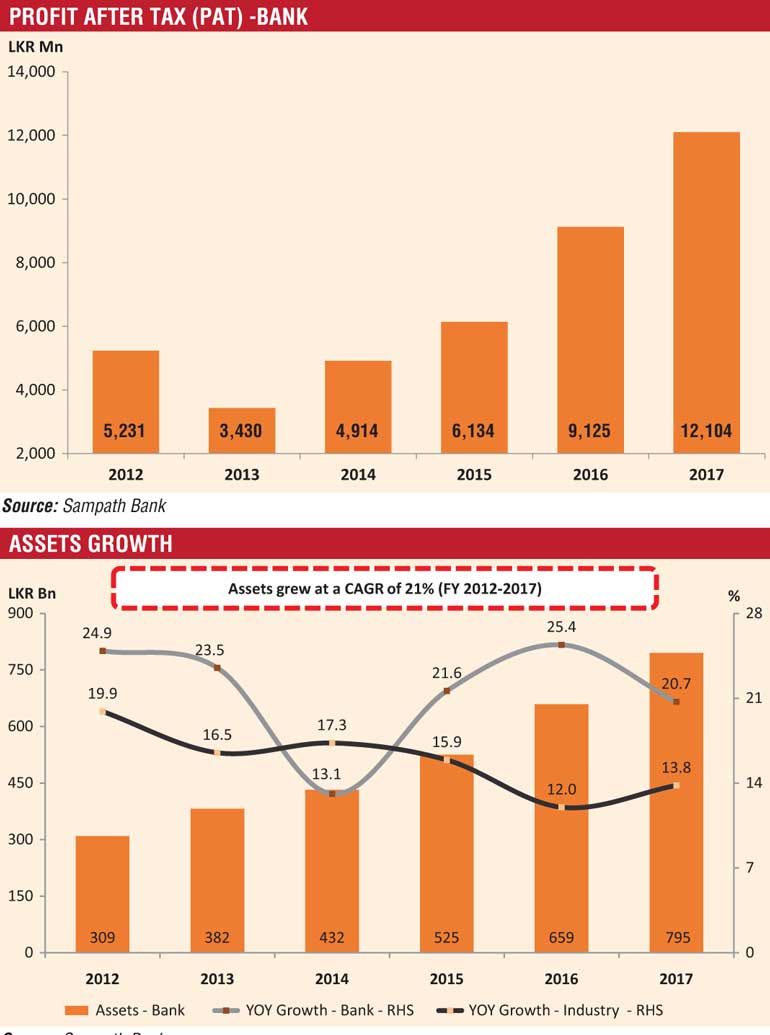

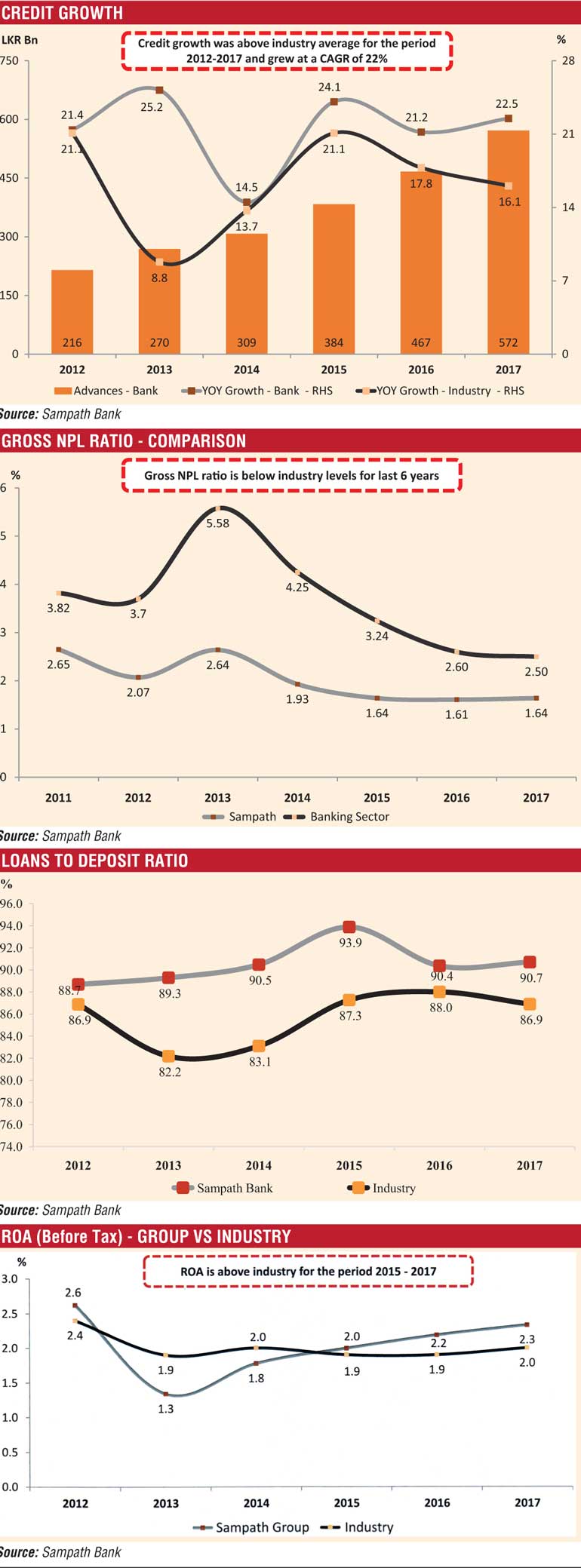

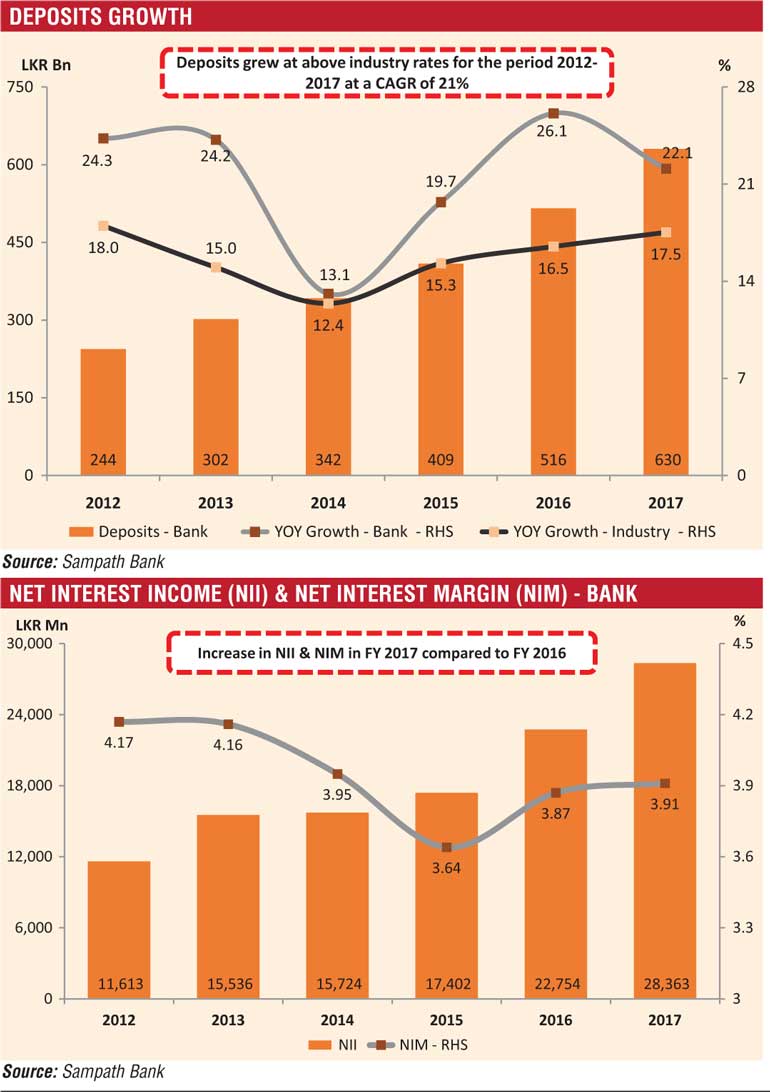

Having posted its best-ever financial results in 2017, Sampath’s deposit growth was 22.1% above the industry average of 17.5%. Sampath’s growth dwarfed that of 14.9% by Commercial Bank, 12.5% HNB and 12.3% Seylan. On lending, Sampath’s growth was 22.5% way above industry growth of 16.1% and fared better that 19.2% of Commercial, 9.1% HNB and 18.3% Seylan.

Sampath’s loans to deposit ratio was 90.7% in 2017, up from the industry average of 86.9%. The bank’s gross NPL ratio at 1.64 is also below industry average of 2.50, and this achievement Sampath has successfully maintained for the past six years. For the past three years Sampath’s assets growth has been above the industry. In 2015 it was 21.6% as against the industry average of 15.9%, in 2016 it was 25.4% versus 12% and last year 20.7% versus 13.8% of the industry.

Gross income rose 37% to Rs. 92.6 billion thanks to a strong 86% contribution from Fund Based Income (FBI). Net Interest Income (NII), the bank’s main source of revenue grew by 24.7% to Rs. 28.4 billion supported by a strong increase in loans and advances. Timely re-pricing of the asset and the liability portfolios helped to relieve the pressure on Net Interest Margins (NIMs), resulting in a slight increase in NIMs to 3.91% in 2017 from 3.87% in 2016.

Whilst it took three years for Sampath Bank to double its after tax profit to Rs. 6 billion in 2015, it has succeeded to double from that figure to Rs. 12 billion in 2017 within two years.

“There was a concerted and a reinvigorated effort to improve performance in 2017,” stresses Sampath Bank Managing Director Nanda Fernando, who took over the helm at the Bank in September 2016 after the appointment was announced in February that year.

Nanda, who has been at Sampath since its inception, counts over three decades of experience in banking and finance industry, driving multiple aspects of banking business, transactional banking in retail and corporate banking, amongst many other key growth areas.

‘Paradigm Shift’

“The Board and the senior management looked at where the bank would like to be in five or 10 years and how the desired future journey could be sustained. We strategised accordingly and 2017 marked the first year of transformation and we are encouraged by the results though the full benefit of the changes made will be more pronounced in the next few years,” Nanda told Daily FT in an interview.

The flagship futuristic initiative launched last year at Sampath Bank was ‘Paradigm Shift,’ which articulated and began rolling out 30 key changes for improved efficiency and effectiveness.

Described as perhaps the single-largest internal restructuring effort undertaken to-date, the purpose of ‘Paradigm Shift’ is threefold; firstly to fuel growth of corporate business through sector-specialisation; secondly to raise the standards of consumer banking and reach out to as many individuals and SMEs as possible across Sri Lanka and finally, to position Sampath Bank as the market-leading financial technology (fintech) solutions provider in the country.

The ‘Paradigm Shift’ initiative aims is to reorient the business and put customers at the centre of the bank’s focus. It saw a major structural revamp of Sampath Bank’s business activities to bring greater clarity between the corporate and consumer banking models.

Widespread changes were made to the Corporate Segment to augment its advisory capacity and maintain industry leadership in fast-growth sectors of the economy. Sector specialisation was introduced as a means of expanding the exposure to priority sectors such as agriculture, apparel, manufacturing and leisure. In parallel, the Consumer Banking operational architecture was streamlined to generate synergies for greater efficiency and improved returns. Branches were appointed as the sole custodians of driving the Consumer Banking proposition, with the key strategic growth levers being channel diversification and increased market penetration to the SME segment. In addition the bank was able to keep pace with the ‘Paradigm Shift’ program by expediting process integration and automation.

One initiative was restructuring the 21 Regional Offices to be a network of 14 within five zonal offices and setting up a Central Processing Unit where a loan is processed and approved internally within a maximum of 48 hours. Another is outsourcing some of the non-core banking functions such as cash loading on its network of 398 ATMs and cash sorting.

This and the restructuring of the regional offices network empowered the 4,000 staff of Sampath to focus on driving credit and deposit mobilisation. The 2017 performance was a testimony of early wins via the “Paradigm Shift’ initiative. The pace of achieving desired goals have become faster. In terms of efficiency, the cost to income ratio at Sampath was down at 42.3% from a high of 54.8% in 2014.

Invests nearly

Rs. 800 m in IT

In 2017, Sampath Bank invested nearly Rs. 800 million to replace its core banking system with a modern version. The roll out of the new Finacle 10 core banking system began to replace the Legacy systems that was in place for past 11 years. With its agility and added functionality, the bank will expedite the way in which it respond to customer needs and strengthen ability to deliver cutting-edge digital banking solutions.

Last year the bank introduced the ’10 digital products’ in a single day and this is showcased as a testament to the agility of its core banking system. The introduction of online legal registers, the banking robot console, were all made possible thanks to the functionality of the new core-banking platform. One of the products was the innovative slip-less banking, which has been a big draw improving convenience for customers and also reducing cost for the bank. It is also part of the broader goal at Sampath to go paper-less by 2020.

Sampath’s unique Agency Banking concept is revolutionising the way banking is delivered. With the approval of the Central Bank, Sampath now has a base of 400 banking agents who are trustworthy and operate their own successful business such as a retail or wholesale shop. They are initially allowed to carry out four activities on behalf of Sampath – opening an account, depositing or withdrawing cash, pay utility bill or check balances. The value limit is Rs. 5,000 per transaction and Rs. 100,000 per day.

“We are carefully expanding the agency banking initiative in tandem with its popularity. We hope to have around 1,000 agents by end of this year,” Nanda added.

“Rapidly-advancing technology such as fintech and blockchain and ecommerce are key challenges for the banking sector. This requires banks to be agile, smarter and faster via constant innovation in the way we serve customers conveniently and affordably,” points out Nanda.

The spirit of innovation has been a hallmark at Sampath Bank. In its 30 years of existence, Sampath Bank has been a pioneer of innovative solutions and technology. Among them are first to launch 365-day banking, foreign currency exchange at ATMs, one-day clearing and cheque imaging and truncating, uni-banking concept, ATMs and credit cards, debit cards (also in South Asia), Card-less Cash ATM and missed call banking concept and more recently, the ‘Robot Banking’ concept.

People key differentiator

For Sampath Bank, while the ‘Paradigm Shift’ and the core banking system roll out were bold steps aimed at taking its business forward, the true measure of the success is contingent on the people – Team Sampath. Given the broader scope of these changes, change agents were appointed to manage the behavioural challenges, while a series of special on-boarding initiatives were rolled out to assist employees to understand and cope with the change. The goal was to ensure that employees feel vested in the performance and the future of the bank.

Nanda has launched the ‘MD’s blog,’ which provides the opportunity for any staff member to contribute with their ideas, suggestions and opinions. He is also happy that these efforts were 100% successful. For example, in the ‘Paradigm Shift’ program alone the bank managed all 307 staff reassignments without a single incident or complaint being reported.

The bank also continues to invest in building the capacity of its team. In 2017 it invested Rs. 70 million in training, where the focus was on improving soft skills through local and overseas training. In a world where all banks largely have the same products and the same access to similar technology, Sampath firmly believes that the investment to build staff capacity will differentiate it from competitors.

A new Board-approved structure was also introduced to ensure that the bank has a robust continuity plan to move forward in the growth journey. This exposes employees to leadership development programs through cross-functional roles that allow interaction in different parts of the business, while re-skilling and up-skilling tactics are used to redeploy capable people in line with changes in the business environment and business needs.

Robust funding pipeline

Under the aegis of the Board Capital Planning Committee, a new capital plan was formulated in 2017 with actionable objectives.

To fuel its growth, Sampath Bank got support from shareholders and debt markets for capital enhancement. Last year Rs. 7.6 billion was added by way of a Rights Issue, first in 12 years, and a further Rs. 6 billion via Sri Lanka’s first BASEL III compliant debenture in December 2017. The bank also succeeded in securing a $ 100 million senior debt from China Development Bank in a landmark offshore deal with a five-year tenure.

Recently it announced a fresh Rights Issue worth Rs. 12.5 billion and concluded a Rs. 7.5 billion BASELIII-compliant debenture issue totalling Rs. 20 billion so far this year.

Nanda says Sampath Bank is likely to see healthy credit growth in 2018 as well. For the first time in 2017, the bank’s annual gross loans growth exceeded Rs. 100 billion, driven by a 26.8% increase in corporate lending, mainly to high-growth sectors, while the SME and Retail books grew by 19.0%.

With funding base firmly in place, Sampath is also stepping up offshore lending, an area in which it had not been aggressive in the past. In 2017, it undertook the first official lending transaction to Myanmar through the bank’s offshore banking unit. Efforts are underway to pursue offshore lending opportunities in other regions saw the bank venture into project financing activities in a number of East African countries, a hitherto untapped market for the bank.

“We are committed to grow as a national bank serving current and future needs of Sri Lanka and customers efficiently and affordably. In this journey we are keen to especially help the under-banked and un-banked communities. We will also step up our support to the SMEs, which is a key priority area championed by the Central Bank and the Government,” emphasised the Managing Director, adding that Sampath Bank would continue to add value to all its stakeholders in a dynamic way using new technology to be smarter and faster. “For this it will be collective effort at the bank,” he said.

Sampath Bank Plc Board of Directors comprise C.P. Palansuriya (Chairman), K.M.A.K. Ranasinghe (Deputy Chairman), M.N.R. Fernando (Managing Director), D. Sooriyaarachchi, D.S. Wijayatillake, S.K.G. Senanayake, A.H.W. Senanayake, R.P. Pathirana, S. Amarasekera and Y.S.H.R.S. Silva.