Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 6 December 2018 00:45 - - {{hitsCtrl.values.hits}}

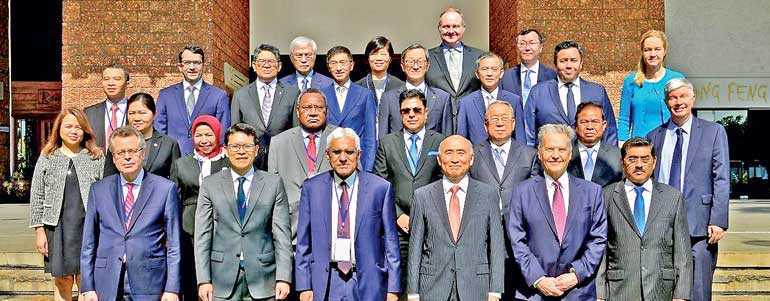

The Central Bank of Sri Lanka hosted the 54th SEACEN Governors’ Conference/High-Level Seminar and the 38th Meeting of the SEACEN Board of Governors in Colombo from 29 November to 2 December.

These events were attended by Governors and delegates of SEACEN member central banks and monetary authorities.

International Monetary Fund (IMF) Deputy Managing Director Mitsuhiro Furusawa attended the Conference as the Keynote Speaker.

SEACEN comprises 19 member central banks and monetary authorities of Brunei Darussalam, Cambodia, China, India, Indonesia, Hong Kong SAR, Korea, Lao PDR, Malaysia, Mongolia, Myanmar, Nepal, Papua New Guinea, Philippines, Singapore, Sri Lanka, Chinese Taipei, Thailand, and Vietnam, as well as eight associate members and eight observers.

The SEACEN Centre plays a leading role in promoting greater understanding in financial, monetary and banking matters in the Asia-Pacific region. Established in 1982, the SEACEN Centre serves central banks and monetary authorities in Asia-Pacific through learning programs, research work, and networking.

The theme of this year’s Conference was ‘Monetary Policy in a Rapidly Evolving Environment’. Delivering opening remarks, Furusawa provided an overview of IMF’s view of current economic policies and prospects for Asia, focusing on the need to strengthen macroeconomic building blocks. Overall, Asian economies are well-positioned to weather future monetary and financial challenges, although there is a need for continuous vigilance and encouraging structural reforms, prudent fiscal policies, safeguarding the credibility of central banks, and ensuring strong financial institutions through a mixture of both micro- and macro-prudential policies.

The Conference/High-Level Seminar consisted of three sessions. In the first session, Governors discussed rapid technological changes and their implications on the issuance of currency in the future.

Keynote Speaker Sveriges Riksbank Deputy Governor Cecilia Skingsley shared the Swedish experience of substantially declining usage of cash, the rise of alternative electronic means of payments, and the prospects of a central bank-issued digital currency during this session.

World Bank Development Prospects Group Director Dr. Ayhan Kose delivered the Keynote Speech of the second session on the stylised facts about inflation and inflation dynamics in emerging and developing economies, with a special focus on the implications for monetary policy frameworks. Governors deliberated on the implications of the changing determinants of inflation, with a much greater influence of international – rather than domestic – drivers. Another topic of discussion was how emerging market central banks should react if the economic recovery underway in advanced economies led to heightened global price pressures.

In the third session, Central Bank of Iceland Governor Már Guðmundsson shared policy challenges in Iceland as a small, open, financially integrated economy. Governors discussed the regional experience of conducting monetary policy in a rapidly evolving environment and its lessons in light of broader developments in the world economy, such as geopolitical risks, uneven growth, accumulating financial imbalances, the more politically-charged context in which monetary policy is conducted, and capital flow volatility. Governors agreed that complications from political uncertainty and threats to central bank independence have made for a more challenging assessment of threats to both monetary and financial stability.

At the 38th Meeting of the SEACEN Board of Governors, Sri Lanka Central Bank Governor Dr. Indrajit Coomaraswamy was elected as the new Chair of the SEACEN Board of Governors.