Thursday Feb 26, 2026

Thursday Feb 26, 2026

Tuesday, 14 August 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

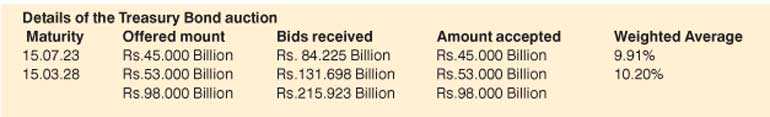

The weighted average yields at yesterday’s Treasury bond auction were seen decreasing considerably, in comparison to previously recorded average yields of similar maturities. The four-year and 11-month maturity of 15.07.23 recorded the sharpest decrease of 60 basis points to 9.91% (in comparison to the 15.03.23 on 28 May) closely followed by the 9-year and 7-month maturity of 15.03.28 by 52 basis points to 10.20%.

The auction had on offer a total amount of Rs.98 billion, which was successfully subscribed.

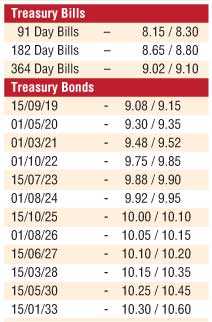

Meanwhile, subsequent to the auction, the new maturity of 15.07.23 was seen changing hands within the range of 9.90% to 9.93% while the 15.03.23 and 01.03.21 maturities were traded at levels of 9.85% and 9.50%, respectively. During trading sessions prior to the auction, maturities consisting of the 01.07.19, 01.05.20, 01.05.21 and 01.08.24 were traded at levels of 9.04%, 9.35%, 9.53% and 9.92%, respectively.

The total secondary market Treasury bond/bill transacted volumes for 10 2018 was Rs.5.92 billion.

In money markets, the overnight call money and repo rates decreased further to average 8.12% and 8%, respectively, as the OMO (Open Market Operations) Department of the Central Bank was seen draining an amount of Rs.20billion on an overnight basis by way of a repo auction at a weighted average of 7.62%. The net liquidity in the system increased further to Rs.57.50 billion.

Rupee remains steady

The USD/LKR rate on spot contracts remained mostly unchanged to close the day at Rs.160/10.

The total USD/LKR traded volume for 10 August was $ 43million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 160.80/00; 3 Months - 162.35/55 and 6 Months - 164.70/00.

The closing, secondary market yields of the most frequently traded T – bills and bonds.