Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 6 August 2019 01:06 - - {{hitsCtrl.values.hits}}

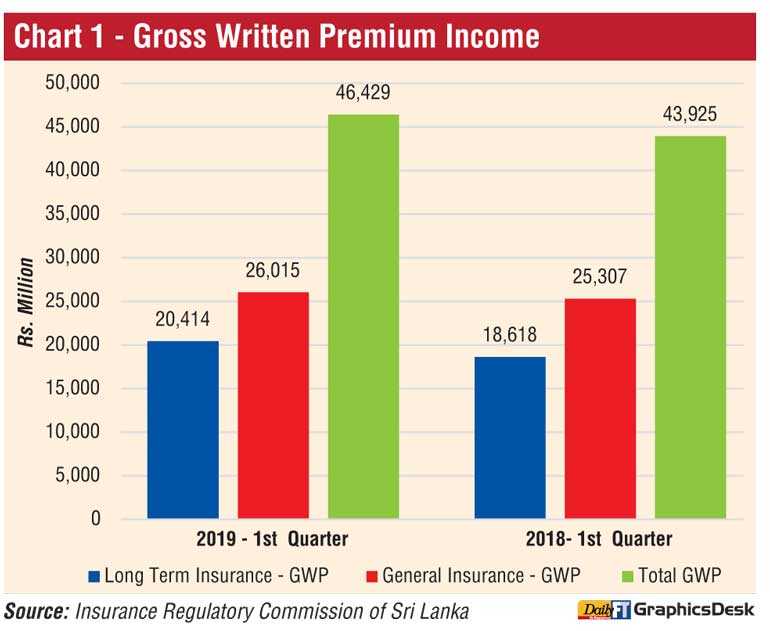

Gross Written Premium

The insurance industry was able to achieve a growth of 5.70% in terms of overall Gross Written Premium (GWP), during the first quarter of 2019, recording an increase of Rs. 2,504 million when compared to the same period in the year 2018.

The GWP for Long Term Insurance and General Insurance Businesses for the period ending 31 March 2019 was Rs. 46,429 million compared with the same period in 2018 amounting to Rs. 43,925 million. The GWP of Long Term Insurance Business amounted to Rs. 20,414 million (Q1, 2018: Rs. 18,618 million) while the GWP of General Insurance Business amounted to Rs. 26,015 million (Q1, 2018: Rs. 25,307 million). Thus, Long Term Insurance Business and General Insurance Business witnessed a GWP growth of 9.64% and 2.80% respectively, when compared to the corresponding period of year 2018.

(Refer chart 1)

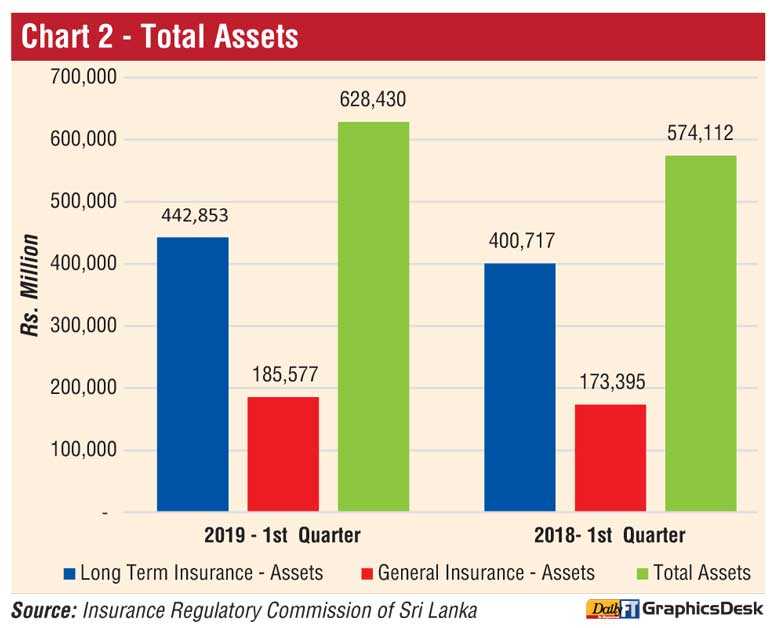

Total assets

The value of total assets of insurance companies has increased to Rs. 628,430 million as at 31 March 2019, when compared to Rs. 574,112 million recorded as at 31 March 2018, reflecting a growth of 9.46% mainly due to increase in corporate debts, deposits and reinsurance receivables. The assets of Long Term Insurance Business amounted to Rs. 442,853 million (Q1, 2018: Rs. 400,717 million) indicating a growth rate of 10.52% year-on-year. The assets of General Insurance Business amounted to Rs. 185,577 million (Q1, 2018: Rs. 173,395 million) depicting a growth rate of 7.03 %.

(Refer chart 2)

Investment in Government Securities

At the end of first quarter of 2019, investment in Government Debt Securities amounted to Rs. 178,624 million representing 45.25% (Q1, 2018: Rs. 180,469 million; 48.85%) of the total assets of Long Term Insurance Business, while such investment of the total assets of General Insurance Business amounted to Rs. 42,010 million representing 37.07% (Q1, 2018: Rs. 39,521 million; 35.99%). Accordingly, the total investment of both Long Term Insurance Business and General Insurance Business in Government Debt Securities amounted to Rs. 220,634 million (Q1, 2018: Rs. 219,990 million) as at 31 March 2019.Thus, the investment in Government Debt Securities of Long Term Insurance Business has decreased by 1.02% and such investment of General Insurance Business has increased by 6.30%.

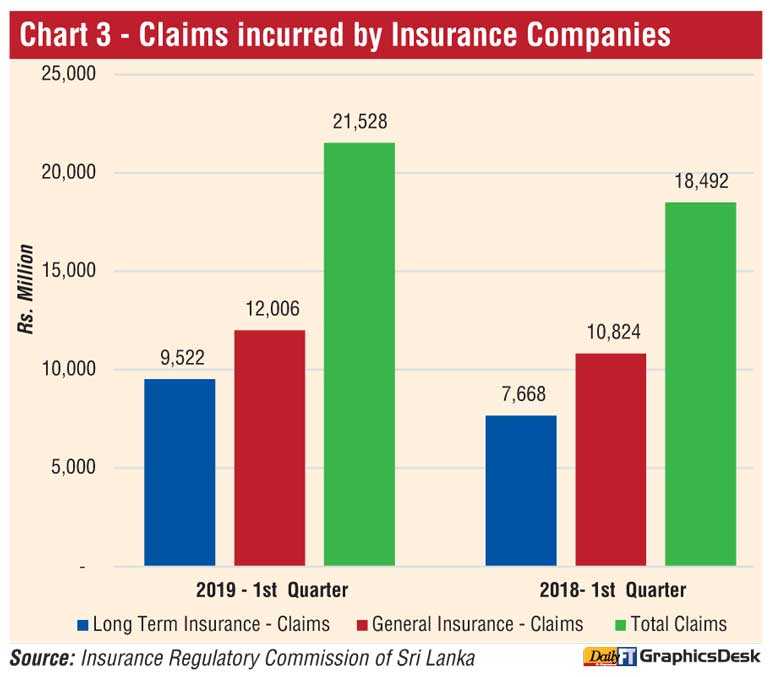

Claims incurred by insurance companies

Claims incurred by insurance companies in both Long Term Insurance Business and General Insurance Business was Rs. 21,528 million (Q1, 2018: Rs. 18,492 million) showing an increase in total claims amount by 16.41% year-on-year. The Long Term Insurance claims, including maturity and death benefits, amounted to Rs. 9,522 million (Q1 2018: Rs. 7,668 million). The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 12,006 million (Q1 2018: Rs. 10,824 million). Hence, during the first quarter of 2019, there had been an increase in claims incurred by 24.17% and 10.92% for Long Term Insurance and General Insurance Businesses respectively, when compared to the same period in 2018.

(Refer chart 3)

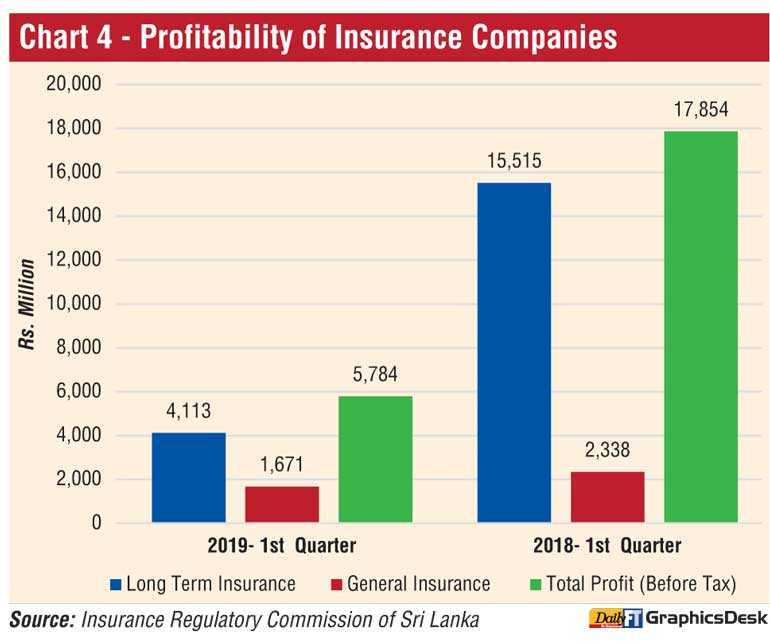

Profit (Before Tax) of Insurance Companies

The profit (before tax) of Long Term Insurance Business amounted to Rs. 4,113 million (Q1, 2018: Rs. 15,515 million) while the profit (before tax) of General Insurance Business amounted to Rs. 1,671 million (Q1, 2018: Rs. 2,338 million) at the end of first quarter of 2019. Thus, profit (before tax) of Long Term Insurance Business and General Insurance Business has decreased by73.49% and 28.53% respectively. The Profit before tax of Life Insurance Business shows a significant decrease (Rs. 11,402 million) in the first quarter of 2019. This is mainly due to profit recorded by an insurer from a sale of its subsidiary in the first quarter of 2018. Further, two life insurers showed a considerable drop in profits due to decrease in other operating revenue. (Refer chart 4)

Insurers

25 Insurance Companies (Insurers) in operation as at 31 March 2019, 12 are engaged in Long Term (Life) Insurance Business, 11 companies engaged in General Insurance Business and two are composite companies (dealing in both Long Term and General Insurance Businesses).

Insurance brokers

63 insurance brokering companies, registered with the Commission as at 31 March 2019, mainly concentrate in General Insurance Business. Total Assets of insurance brokering companies have increased to Rs. 4,849 million as at the end of first quarter of 2019 when compared to Rs. 4,092 million recorded as at 31 March 2018, indicating a growth of 18.49%.

Notes:

Above analysis does not include information of National Insurance Trust Fund (NITF,) MBSL Insurance Co. Ltd. and Life Insurance Corporation (Lanka) Ltd. for the quarter ended 31 March 2019.

Above analysis does not include information in respect of NITF for the quarter ended 31 March 2018.

Total Assets of the Insurance Brokering Companies represent all insurance brokering companies excluding three insurance brokering companies.