Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 10 June 2019 00:30 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

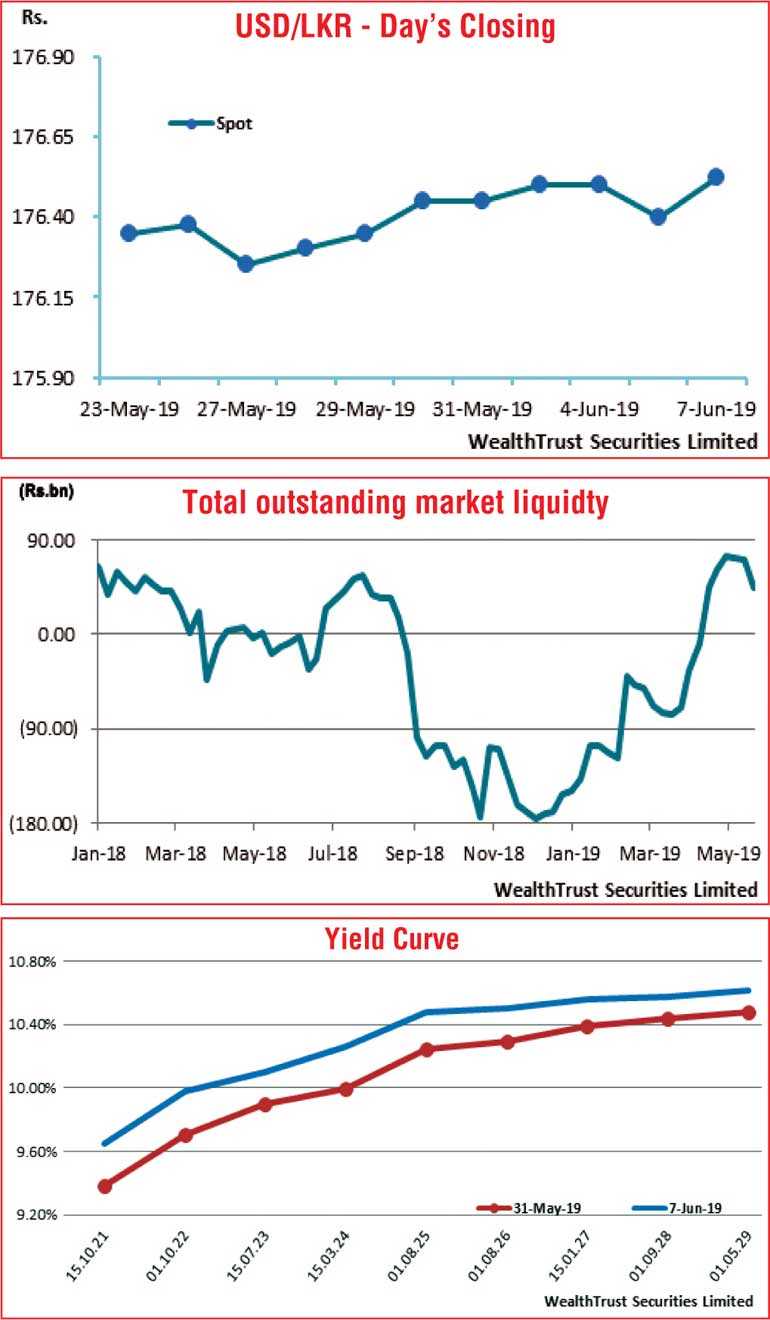

The secondary market bond yields increased across the yield curve during the shortened trading week ending 7 June, reversing a downward momentum witnessed over the previous five weeks.

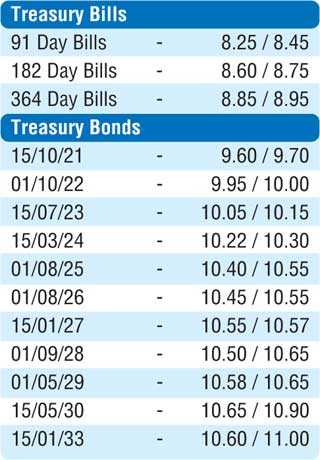

Yields of the 15.10.21, 01.10.22, 15.07.23, 15.03.24, 01.08.25, 01.08.26 and 15.01.27 maturities were seen increasing week on week by 27, 40, 25, 36, 26, 26 and 21 basis points respectively to intra week highs of 9.65%, 10.10%, 10.15%, 10.35%, 10.50%, 10.55% and 10.60%.

Furthermore, on the long end of the yield curve, the 15.05.30 increased to a high of 10.90% with two way quotes on the rest of the yield curve edging up as well, reflecting a parallel upward shift. In the meantime the market also witnessed some foreign selling of rupee bonds to the tune of Rs. 3.48 billion.

However, buying interest at these levels curtailed any further upward movement as activity moderated towards the end of the week. At the weekly Treasury bill auction the weighted average yield of the 364-day maturity held steady subsequent to five weeks of declines.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 8.93 billion.

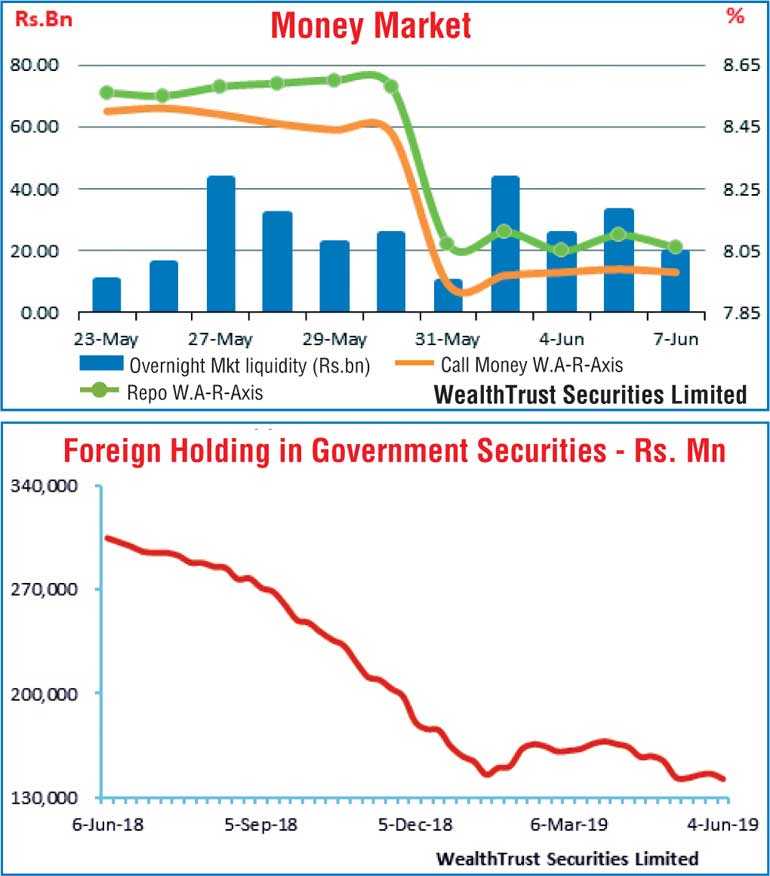

Meanwhile in the money market, the overnight call money and repo rates averaged 7.98% and 8.08% respectively during the week with the average net overnight liquidity surplus in the system standing at Rs. 30.15 billion. The Open Market Operation (OMO) Department of the Central Bank drained out liquidity during the week on an overnight and eight days basis at weighted averages ranging from 7.88% to 8.04%. The total money market liquidity decreased to Rs. 44.49 billion.

Rupee loses further

The USD/LKR rate on spot contracts depreciated further during the week to close the week at Rs. 176.50/55 against its previous weeks closing levels of Rs. 176.40/50 on the back of bank buying interest.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 85.40 million.

Given are some forward dollar rates that prevailed in the market: one month – 177.20/35; three months – 178.75/00; six months – 181.00/30.