Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 19 February 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

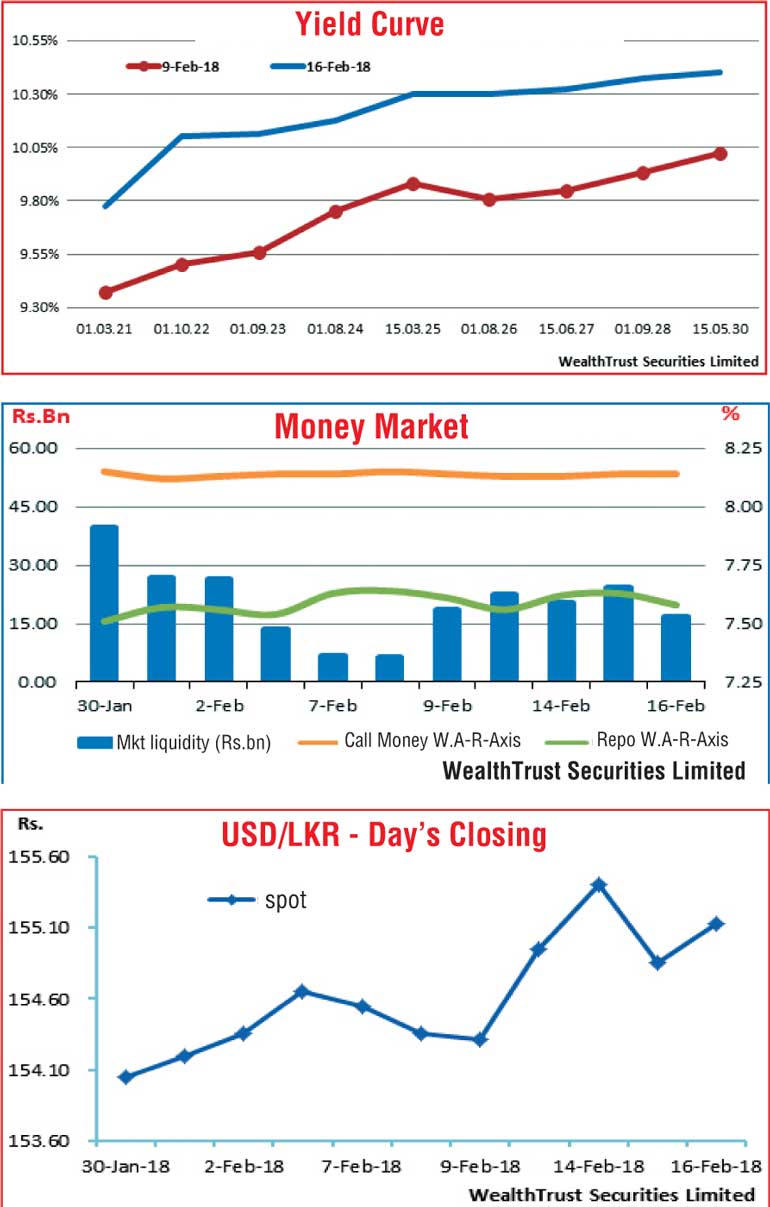

Secondary market bond yields increased across the boards during the week ending 16 February, driven by the outcome of the Provincial Council elections.

Yields of the three liquid maturities, consisting of 01.03.21, 01.08.21 and 15.12.21 along with the 01.09.23 and the two 2026’s (i.e. 01.06.26 and 01.08.26) and the 15.05.30 increased by 63, 50 each, 75, 57, 54 and 50 basis points respectively to intra week highs of 10.00% each, 10.30%, 10.40%, 10.35% and 10.50% in comparison to last week’s yields.

The weekly Treasury bill auction reflected the same sentiment, with the weighted averages of the 91 day, 182 day and 364 day maturities increasing considerably by 27, 30 and 34 basis points respectively to 8.02%, 8.29% and 9.28%.

However, buying interest at these levels drove yields down again to 9.60%, 9.65%, 9.75%, 10.07%, 10.05%, 10.07% and 10.15% respectively on the above mentioned maturities before closing at levels of 9.75/80, 9.80/90, 9.85/95, 10.08/15, 10.25/35, 10.30/35 and 10.35/45.

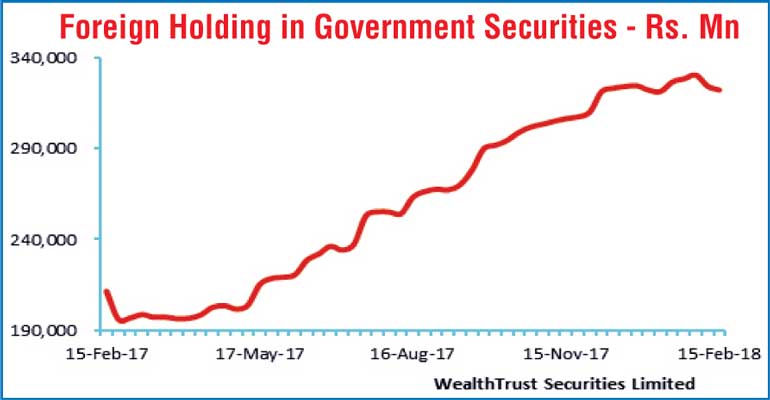

Foreign selling of Rupee bonds continued for a second consecutive week, recording an outflow of Rs.2.1 billion for the week ending 14th February.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged Rs. 7.48 billion.

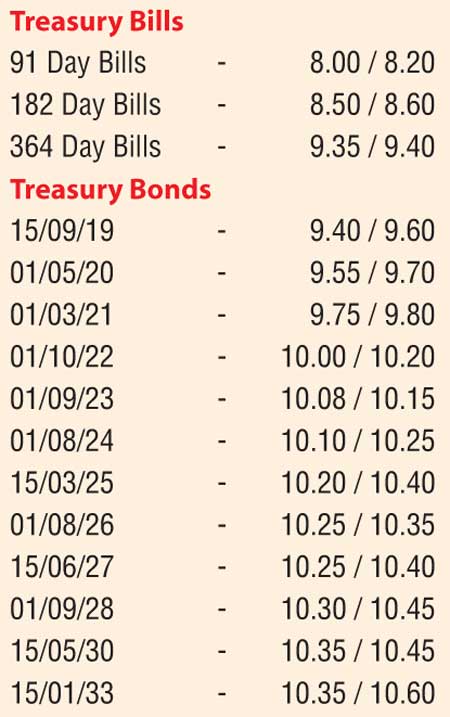

In money markets, the Open Market Operations (OMO) Department continued to drain out liquidity by way of the outright sale of Treasury bills and repos at weighted averages ranging from 7.25% to 7.62% for durations ranging from overnight to 58 days, while the average net surplus liquidity in the system stood at Rs. 21.01 billion for the week. The overnight call money and repo rates remained mostly unchanged to average 8.14% and 7.60% respectively.

Rupee loses

during the week

The USD/LKR rate on spot contracts depreciated to an intraweek low of Rs. 155.90 during the early part of the week against its previous weeks closing levels of Rs. 154.28/35 before closing the week at Rs. 155.10/15, on the back of heavy importer demand and reluctant exporter sales.

The daily USD/LKR average traded volume for the three days of the week stood at $ 104.62 million.

Some of the forward dollar rates that prevailed in the market were one month – 155.87/97; three months – 157.55/65 and six months – 159.90/00.