Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 5 August 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

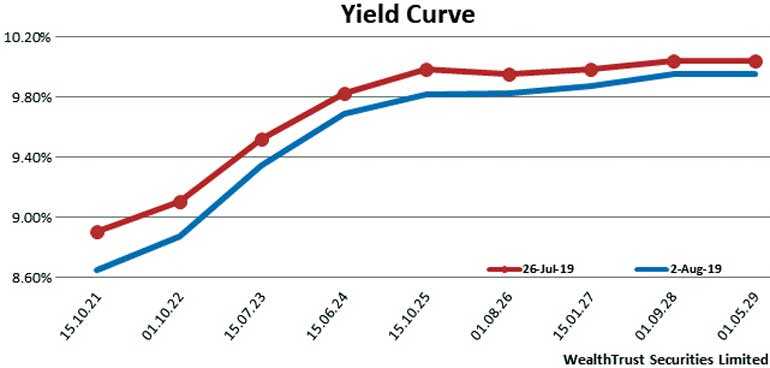

The sharp reduction on the 364 day bill weighted average, reduction in CCPI inflation numbers for the month of July coupled with the Fed policy rate reduction along with the drop in US Treasury yields led to secondary market bond yields dipping during the week, reflecting a parallel shift downwards of the overall yield curve on a week on week basis.

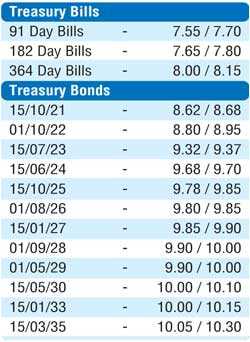

Buying interest on the liquid maturities of 2021’s (i.e. 01.03.21, 01.05.21, 01.08.21, 15.10.21 and 15.12.21), the two 2023’s (i.e.15.03.23 and 15.07.23) and three 2024’s (i.e. 15.03.24, 15.06.24 and 01.08.24), 01.08.26 and 15.01.27 saw its yields dip to weekly lows of 8.47%, 8.55%, 8.60%, 8.65%, 8.70%, 9.30%, 9.35%, 9.65%, 9.67%, 9.75%, 9.85% and 9.87% respectively against its previous week closing levels of 8.65/75, 8.71/78, 8.75/85, 8.87/92, 8.91/95, 9.47/52, 9.50/53, 9.75/80, 9.80/83, 9.85/95, 9.92/98 and 9.95/00. In addition, February and July 2020 bill maturities were traded at lows of 7.70% and 8.02% respectively.

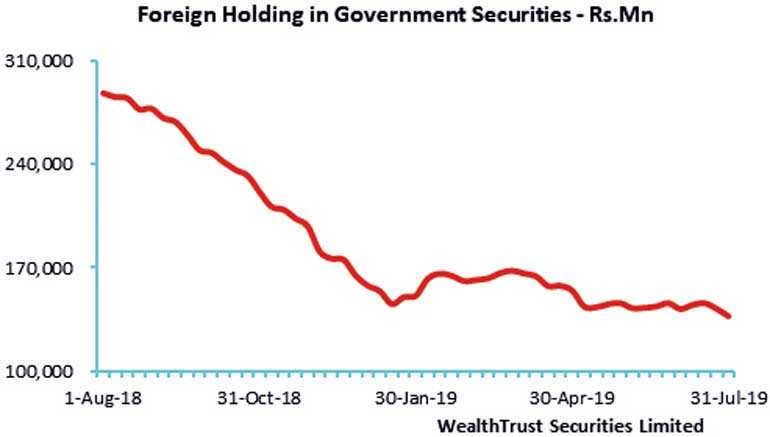

The foreign holding in Rupee bonds decreased for a second consecutive week recording an outflow of Rs. 5.1 billion for the week ending 31 July 2019.

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 8.32 billion.

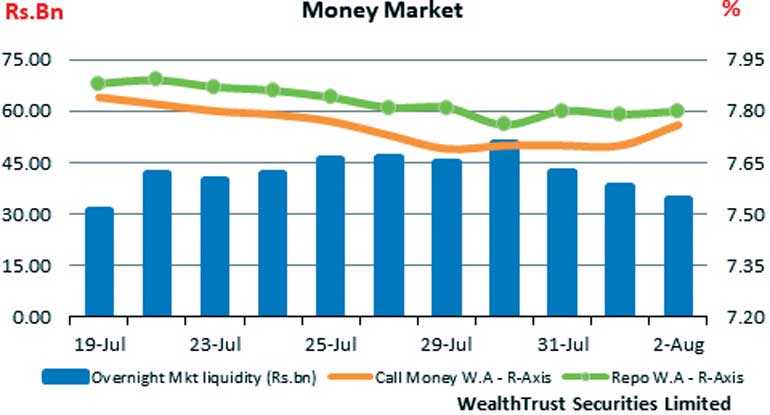

In money markets, the Overnight call money and repo rates averaged 7.71% and 7.79% respectively for the week as the average net overnight liquidity surplus stood at a high Rs. 42.14 billion for the week. The OMO (Open Market Operation) Department of the Central Bank of Sri Lanka was seen refraining from conducting any auctions to drain out liquidity towards the latter part of the week. It drained out liquidity during the early part of the week on an overnight basis at weighted average yields ranging from 7.67% to 7.68%.

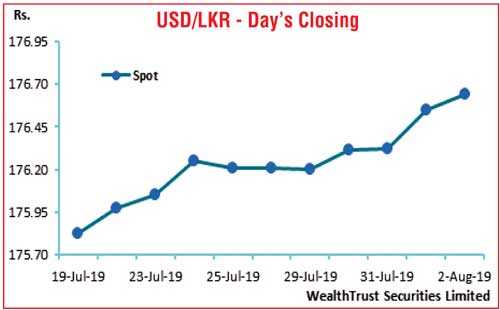

Downward trend in rupee continues

In the Forex market, The USD/LKR rate on spot contracts was seen losing further during the week to close the week at a level of Rs. 176.60/68 against its previous week’s closing level of Rs. 176.18/25 on the back of a globally strengthening dollar, importer demand and continued buying interest by banks.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 76.65 million.

Some of the forward dollar rates that prevailed in the market were one month – 177.10/25; three months – 178.30/50 and six months – 180.00/30.