Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 27 May 2019 00:41 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

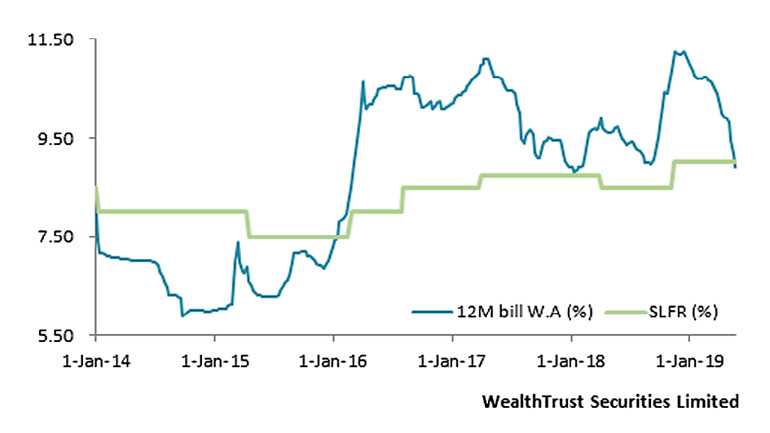

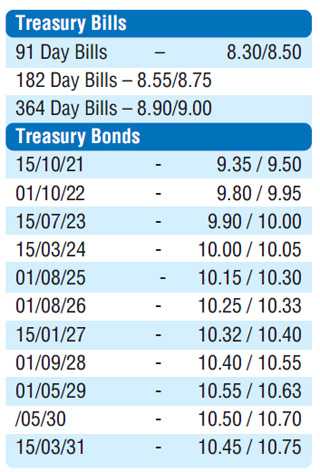

The shortened trading week ending 24 May 2019 saw the weighted average on the benchmark 364 day bill falling below Central Banks Standing Lending Facility Rate (SLFR) for the first time in over three years, an occurrence which was last witnessed in January 2016. A third consecutive week of steep declines saw the benchmark bill record a weighted average of 8.90% against Central Banks SLFR of 9.00%, bringing the accumulated drop over the past four weeks to 101 basis point.

The secondary bond market opened the week by continuing its bullish momentum from the previous week which was given further impetus by comments of a possible policy rate deduction at the upcoming monitory policy announcement on 31 May 2019.

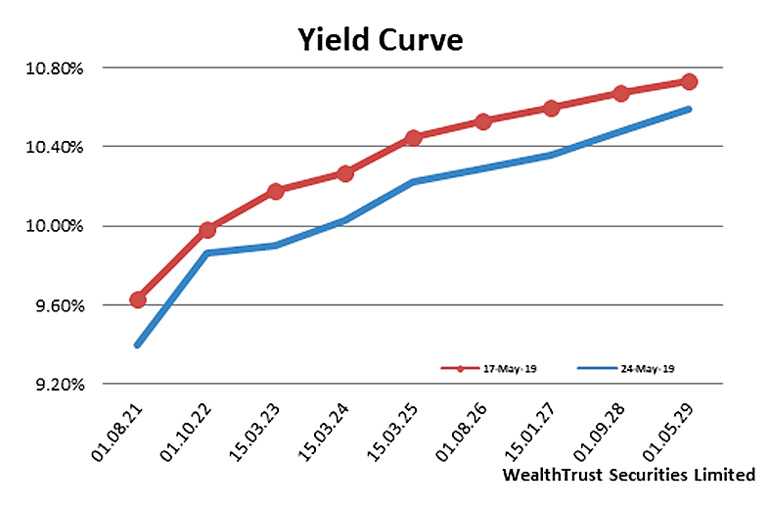

The yields on the liquid maturities of 15.07.23, 15.03.24, 01.08.26, 15.01.27 and 01.05.29 were seen declining to weekly lows 9.85%, 9.90%, 10.20%, 10.25%, 10.50% respectively against its previous weeks closing levels of 10.25/33, 10.25/28, 10.50/55, 10.57/62 and 10.70/75 leading to the outcome of the weekly bill auction. However, yields were seen picking up from this point onwards and towards the latter part of the week to highs of 9.95%, 10.05%, 10.32%, 10.45% and 10.65% respectively once again. Nevertheless, the overall yield curve recorded a parallel shift downward week on week for a fourth consecutive week.

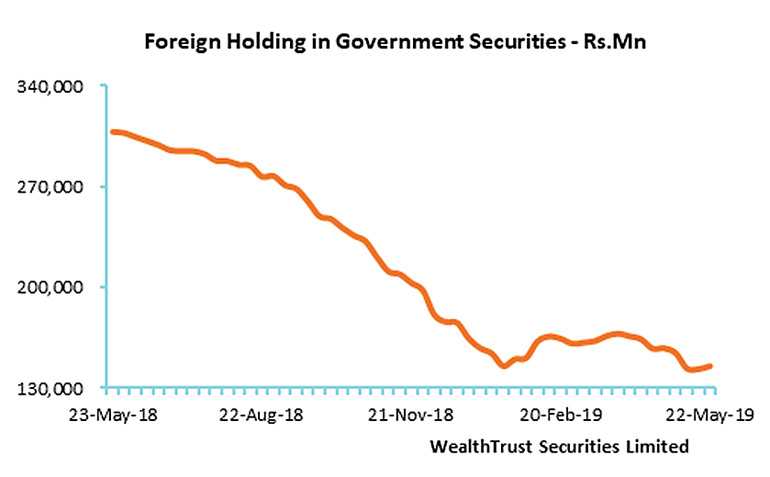

In the meantime, the foreign holding in Sri Lankan Rupee bonds recorded an inflow for the first-time in four weeks to the tune of Rs. 2.10 billion for the week ending 22 May 2019.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 13.52 billion.

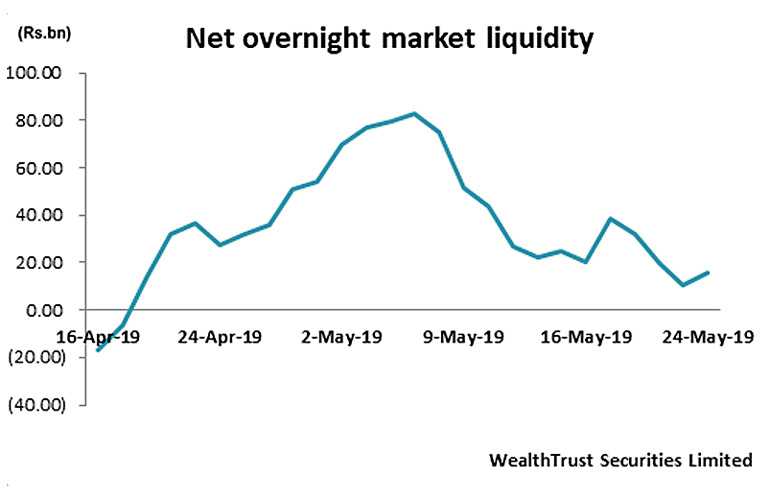

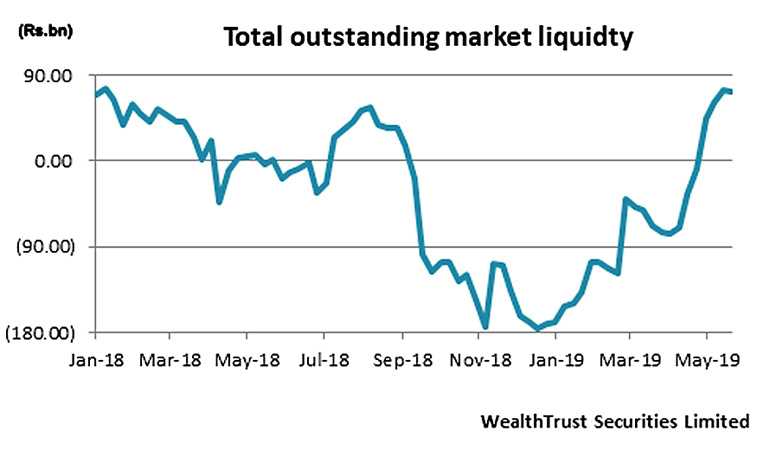

In the money market, the overnight net surplus liquidity in the system reduced to Rs.19.59 billion for the week as the Open Market Operations (OMO) Department of the Central Bank continued to drain out liquidity during the week by way of overnight, three day, four day, five day, seven day, eight day and ten day repo auctions at weighted averages ranging from 8.51% to 8.67%. The overnight call money and repo rates increased marginally to average 8.48% and 8.54% respectively for the week. However, the total money market liquidity remained high at Rs. 72.78 billion by the end of the week.

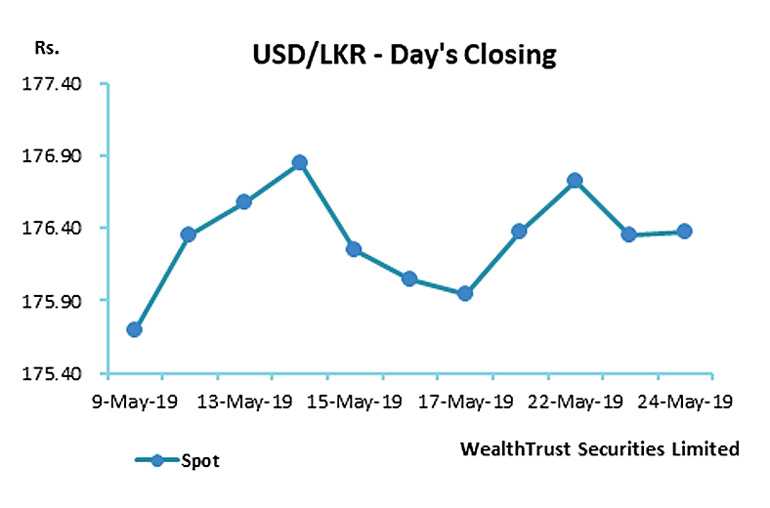

Rupee weakens

In the Forex market, The USD/LKR rate on spot contracts were seen losing ground during the early part of the week to an intraweek low of Rs. 176.85 against its previous weeks closing level of Rs. 175.90/00. However, it was seen recovering somewhat during the later-part of week to close the week at Rs. 176.30/45.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 81.00 million.

Some of the forward dollar rates that prevailed in the market were one month – 177.15/30; three months – 178.80/00 and six months – 181.25/50.