Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 19 August 2019 00:36 - - {{hitsCtrl.values.hits}}

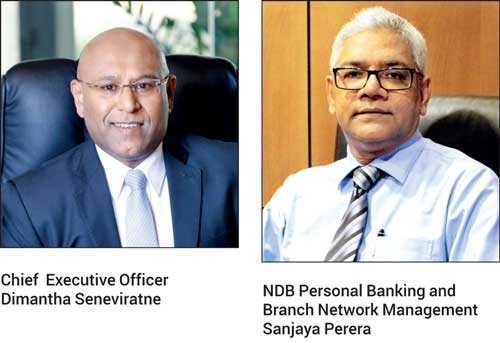

NDB has taken considerable strides in a bid to support and encourage the businesses and entrepreneurial efforts of its people through a network of 111 branches around the island through four decades of excellence.

With customised SME financing facilities, advisory services as well as a host of Retail Banking services, such as Current and Savings Accounts, Children’s Savings Accounts, NRFC/RFC Accounts, Fixed Deposits, Housing Loans, Education Loans, Leasing facilities, Credit and Debit Cards, Pawning services coupled with the convenience of Internet Banking, Mobile Banking and a Call Centre that operates 24 hours, the bank’s customers have access to a wide array of banking solutions to help them meet their unique financial needs.

With its expertise and knowledge in SME financing, the bank offers many solutions; including short term working capital loans, supplier and distributor finance and long term funding which will be beneficial to the business community, traders, distributors and other proprietors in the area. NDB pioneers in providing exceptional Micro finance solutions for small scale entrepreneurs and gives constant empowerment to women and propel financial guidance to grow in their life.

Meanwhile, NDB has been strenuously expanding its Digital Footprint throughout the years and the bank’s ATM network has grown significantly to count over 150 ATM/CRM machines today. Additionally, the bank’s first Physical proposition, NDB NEOS was introduced with the launch of the branch in Fort, with a view to provide customers a new paradigm in banking convenience, where the physical presence of bank staff is coupled with a truly digitised experience.

The NDB Digital Banking Platform includes the famed NDB Mobile Banking App, NDB Online Banking, and Branchless Banking services.

Delivering customer convenience is a key driver at NDB. The bank is currently in the process of carrying out branch transformations to simplify processes while saving time and cost for customers. Accordingly, NDB has installed Self Service machines at several of its branch locations, with which customers are given the convenience of 24x7 deposits and withdrawals. This service eliminates the need to spend time waiting in queues, and encourages customers to embrace efficient digital banking.

In the time to come the bank will enhance the range of services provided to their customers to further ease their banking activities, progressing into new solutions, providing additional value.a